|

Forum Report: Otelco Shareholder Survey

2018 Survey of Otelco Inc. Shareholders

Investment

Objectives

Business

Strategies

Financial

Policies

Shareholder

Comments and Questions

The shareholders of Otelco Inc. were invited

to report views during the week prior to the company’s scheduled reports of

third quarter performance results.[1] The survey

requested rankings of investment objectives, business strategies and

financial policies, with a participant’s anonymity assured by independent

moderation and secure data administration.[2]

The request for this survey was initiated by

Tim Bergin,[3] as a shareholder who has no other

relationship with Otelco or its management, for the purpose of determining

whether there is sufficient shareholder support of the current management

policies that he considers essential to long term investment in the company.

Two other investment professionals, each like Mr. Bergin owning over 5,000

shares of Otelco, were invited to participate in a workshop to guide the

Shareholder Forum’s definition of issues to be addressed in the survey.[4]

In addition to questions developed to

address the issues defined in the project workshop, the survey asked

participants to volunteer information that might be useful in analyzing

anonymous responses, about what kind of portfolio(s) they managed, how many

shares they owned, how long they had owned shares, and whether they had

recently increased or decreased their Otelco investment. Participants were

also offered an opportunity to present questions or comments anonymously for

the Forum to report for consideration by Otelco’s management or other

shareholders.

Investment

Objectives

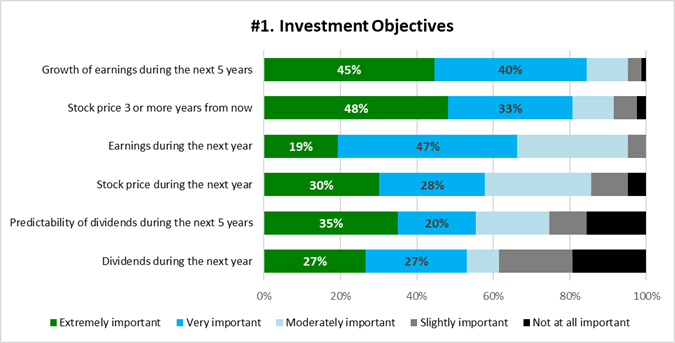

The first of three survey subjects asked

participants “how you would rank the importance of each of the following

investment objectives” which are shown in the graph below, but re-sorted

here in order of the highest combined responses of “extremely important” and

“very important” rankings.

Notably, an analysis of responses by the

numbers of shares owned showed unusual consistency, with more than

two-thirds of all three categories of investors (shares under 1,000, between

1,000 and 5,000, and more than 5,000) providing “extremely important” or

“very important” rankings to both of the top categories above, “Growth of

earnings during the next 5 years” and “Stock price 3 or more years from

now.” Similarly, each category gave the lowest ranking of importance to

“Dividends during the next year.”

Participants were able to offer their

comments on other investment objectives. Responses generally addressed

refinements of the listed objectives or means of achieving them, rather than

the identification of other objectives, and were reinforced by subsequent

responses to rankings of business strategies and financial policies. The

largest number of these comments focused on a long term view of value, with

a variety of perspectives illustrated by the following examples:

■

I'm interested in long term growth with a growing dividend. Not

concerned with short term fluctuations of stock price or earnings as long as

business looks solid going forward.

■

Long term return on investment is always my

objective.

■

I

think the main objective should be de-risking the company. The investment

goals should be to secure the highest level of dividends 3 to 5 years in the

future, ie. by reducing debt now.

■

I

believe that this company's share price is very undervalued and that a

merger of some sort will be the likely key to unlocking value. That said, if

a dividend is structured to unlock that value over time I would continue to

be a holder of the [XX],000 shares currently owned in our several accounts.

Comments addressing other objectives were

generally not inconsistent with this more broadly expressed support of long

term investment perspectives, as illustrated in these examples of the range:

■

Very low debt and grow the company

■

Pay

down the debt as quickly as possible.

■

Is

it too much to ask for you to get the stock price back to where it was 10

years ago?

■

You have no scale and a non contiguous

footprint. Either get a lot larger or sell the company.

Business

Strategies

The second survey section asked participants

to rank the importance of listed “business strategies,” with the following

results re-sorted here in order of the highest combined responses of

“extremely important” and “very important” rankings.

As in the first section, responses to the

option for suggestions of other business strategies generally presented

observations relating to the listed business strategies or means of

achieving them. Most, like these examples, supported the current

management’s continuation of current policies:

■

The company is doing a good job of

optimising the cost structure and expanding under ACAM. I would encourage

them to keep doing that.

■

Go for the sure win of reducing debt. Reduce

leverage below 1.5 before considering new strategies.

■

The company should continue to focus on its

existing business.

Financial

Policies

The third survey section asked participants

to consider whether various listed “financial policies” were appropriate or

inappropriate for Otelco. The listed policies have been re-sorted here in

order of their combined responses of “extremely appropriate” and “somewhat

appropriate” rankings.

Responses to the invited suggestion of other

financial policies, as in previous sections, presented observations relating

to the listed alternatives. Most of these comments addressed either debt

management or a possible sale of the company, and often both, as illustrated

in these examples:

■

Restart dividends, even if a very modest

amount. Avoid adding debt, continue lowering debt.

■

keep an investment grade rating

■

I would like to see future dividends

secured, by lowering debt to a very low amount (1x to 1.5x). Any additional

capital, not needed to expand, should be used to repurchase shares. I think

a sale should only be done at an EV/EBITDA multiple north of 9x.

■

If selling the company is to the benefit of

shareholders long term I would be for that.

■

Consolidation is inevitable. Otelco is an

attractive target. The Board should be working to maximize sales price.

Stock buybacks (once permitted) at current to 50% higher prices would be

higher ROI than new projects. Company's largest shareholders understand

value of reducing share count over a taxable dividend.

■

Need to do what is best for the investors

but also make every attempt to make sure current employees are taken care of

if the company is sold.

Shareholder

Comments and Questions

In a section following the survey questions

for rankings, participants were offered an opportunity to present comments

or questions anonymously for the Shareholder Forum to report to Otelco’s

management, and also for consideration by other shareholders. All of the

comments presented prior to the survey’s conclusion are presented in this

report:

Comments submitted for Forum reporting to Otelco management and shareholders

(4 pages, 164 KB, in PDF

format)

All of the comments and questions submitted

by survey participants for reporting to Otelco’s management were

presented to the company, without editing, on November 13, the day after the

survey closed. The Forum will present Otelco’s responses to all survey

participants who provided an email address for reports of the survey

results.

Mr. Bergin

has responded as follows to a request for

his observations, as the initiator of the survey and also as an Otelco

shareholder:

This survey was initiated to answer a

simple question I had: what do the shareholders of Otelco want the company

to do?

This question is a necessary one to ask

now because Otelco is transitioning. It was a company with too much debt

and limited discretionary income. Management has successfully turned the

company around and it is now a company that is generating a large amount of

discretionary income. What should the company do with this cash? It is

often assumed that shareholders want dividends. I wanted to ask the

shareholders directly to see if this was true.

The responses were very interesting. It

is clear that the shareholders of Otelco have a long-term approach and a

more nuanced view of cash uses than dividends. Shareholders state a

preference for reinvestment in the business, followed by share buybacks and

the payment of dividends. The other consistent theme is debt reduction.

Shareholders like the idea of de-risking the balance sheet now to allow for

a more secure stream of dividends in the future. This approach makes sense

to me, and I am encouraged by the long-term perspective of my fellow

shareholders.

The Forum thanks Mr. Bergin as well as the

other workshop participants who helped define the issues to be considered,

and of course all of the shareholders who offered their views, for their

efforts to support the progress of Otelco’s management.

GL

– November 19, 2018

Gary

Lutin

Chairman, The Shareholder Forum

575

Madison Avenue, New York, New York 10022

Tel:

212-605-0335

Email:

gl@shareholderforum.com

©The Shareholder Forum, Inc. |