When the Federal Reserve cuts interest rates, making it cheaper to

borrow, it’s supposed to deliver a direct boost to the economy. But

one key part of that machinery has broken down.

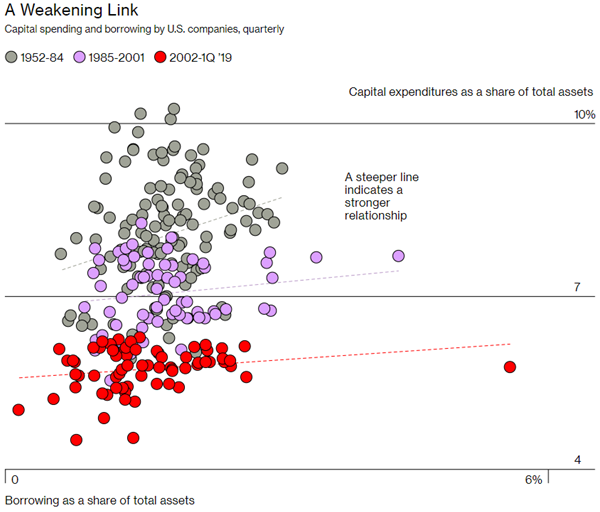

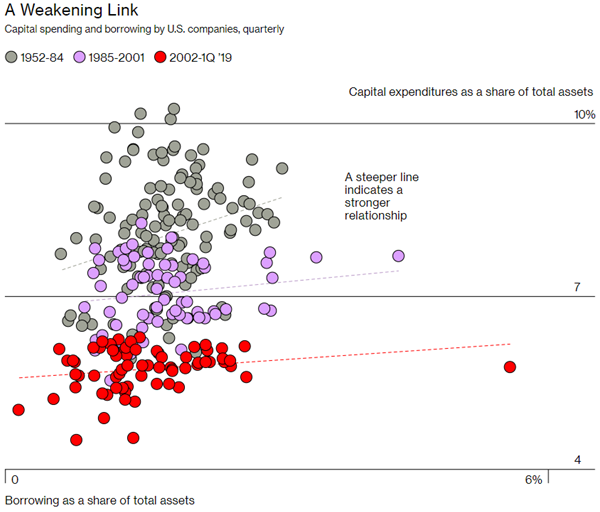

Business investment used to rise when U.S. companies took on more

debt—because most companies borrowed to add capacity. Nowadays,

they’re likelier to funnel the money to shareholders.

Investment is stuck at low levels by historical standards. President

Donald Trump’s reduction in corporate taxes hasn’t changed the

pattern. Neither has a decade of low interest rates, even before the

Fed’s quarter-point cut on July 31.

It’s not that business stopped borrowing. As a share of gross domestic

product, corporate debt has climbed to a record. What’s all but

vanished is the correlation between how much companies borrow and how

much they invest.

|

Data: Bloomberg

calculations from Federal Reserve data, based on work by the

Roosevelt Institute’s J.W. Mason

|

That long-standing relationship endured, albeit weakened, through the

1980s and ’90s as companies focused increasingly on driving

shareholder value, says J.W. Mason, a fellow at the Roosevelt

Institute in New York who’s been researching the topic. Now it’s gone,

and Mason says the data suggest a different link. “If you can borrow

on more favorable terms, you don’t necessarily invest more,” he says.

“You might think this is an opportunity to give bigger payouts to

shareholders. This is a big reason why monetary policy isn’t as

effective as it used to be.”

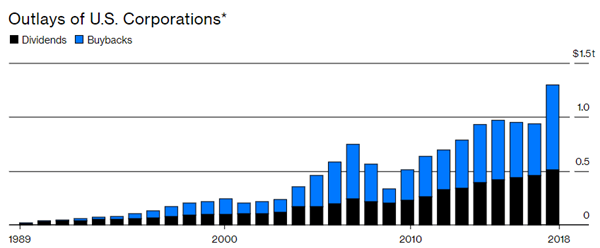

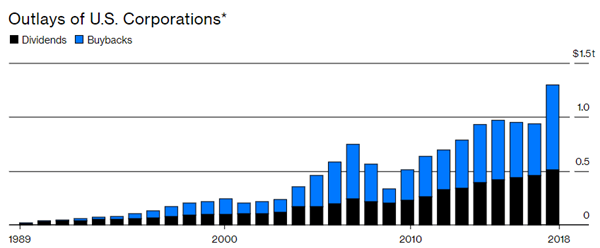

Companies can return money to investors through share buybacks and

dividends. Cash payments for acquisitions fit the category too—at

least for an economist looking at the macro picture rather than at

individual companies—because they’re another transaction where money

goes to holders of already-existing assets.

Buybacks, in particular, have become a controversial way for

businesses to spend. They took off in the U.S. after 1982, when a U.S.

Securities and Exchange Commission ruling reduced the risk that they’d

trigger charges of market manipulation. Buybacks are likely to

approach $1 trillion this year, according to a

Goldman Sachs Group Inc.

forecast, rising from 2018 levels that were already a record.

|

*2,902 nonfinancial U.S.-based

companies that represent more than 98% of the U.S. public equity

market

Data: Capital Group

|

The finance industry defends the practice, arguing that outsiders

shouldn’t be second-guessing corporate managers who have the best

handle on where they can usefully channel funds. If those managers

can’t see opportunities for profitable investment, in other words,

maybe there aren’t any.

Still, buybacks are in the political spotlight. On the Democratic

side, Senators Chuck Schumer and Bernie Sanders have called for curbs.

Republican Senator Marco Rubio has criticized the tax code for

encouraging buybacks over investment.

Dan Ivascyn, group chief investment officer at Pacific Investment

Management Co., says the economy can benefit in “indirect ways” when

companies borrow at low rates to finance buybacks and dividends, as

those activities typically boost the price of a stock. For owners of

those shares, there’s a wealth effect—which may induce them to spend

more. There’s also a dynamic in which “higher stock markets improve

business confidence,” because they’re widely viewed as a gauge on the

outlook for the economy, says Ivascyn.

That’s pretty much the line Fed Chair Jerome Powell took at a July 31

press conference, after the Fed’s first interest-rate cut in a decade.

Asked how cheaper borrowing can help the real economy when the cost of

capital doesn’t appear to be an issue for business, he said the policy

“seems to work through confidence channels, as well as the mechanical

channels.” That confidence has lifted asset prices to record

highs—though it doesn’t seem the kind that gets business to invest.

When economists search the horizon for the next source of trouble,

they often alight on corporate debt. It’s true that American companies

aren’t the biggest borrowers in the low-rates era that began in 2008.

That would be the federal government. But the government controls the

dollar printing press, so it can’t really go bust. Plus, there hasn’t

been a sovereign debt default in a rich country for decades.

Analysts at

Capital Group, a Los

Angeles-based investment firm, have concerns about debt-financed

buybacks and dividends. That kind of spending has jumped above a key

cash flow measure, they found. “We’re trying to identify those

companies that, in this late cycle, might not have used debt for the

primary purpose of growing the business,” says David Bradin, a

fixed-income investment specialist at Capital Group.

Companies that borrow to increase capital spending or for acquisitions

will have more options to pay off debt in a downturn. It’ll be easier

for them to pare back operations or “potentially sell noncore assets

to pay off some of the debt,” Bradin says. Companies that borrow to

fund buybacks and dividends may not have those resources to draw on.

While bond pickers like Bradin look at the risks for individual

businesses, economists such as William Lazonick, a professor at the

University of Massachusetts at Lowell, worry that buybacks,

debt-financed or otherwise, are bad for the whole economy. Lazonick

has campaigned against the practice for decades. It’s often been a

lonely fight—but less so lately. He advised Hillary Clinton when she

was running for president in 2015 and has been consulted by Sanders.

Rubio cited his work this year in a report on America’s failure to

invest.

Lazonick says buybacks are a

driver of high inequality and low investment. They’re also a reason

U.S. companies have fallen behind their Chinese competitors in the

race to dominate 5G telecommunications. (He’s working on a paper

comparing Huawei Technologies Co. with

Cisco Systems Inc., which has

spent more than $100 billion this century buying its own stock,)

Most economists, blinded by faith in financial markets as the most

efficient allocators of resources, have missed the whole problem,

according to Lazonick. “They just say, ‘Oh, the investment ends up

somewhere,’ ” he says. “That’s an argument with no evidence.” Lazonick

says the label favored by corporate bosses to describe their

buybacks—“capital return program”—is misleading. “Capital is

something that gets invested,” he says. “It’s not capital. It’s just

money.” —With Alex Tanzi

BOTTOM LINE - U.S. corporate borrowing is on track to exceed last

year’s record. But the debt binge is financing stock buybacks instead

of productive investment.

©2019 Bloomberg L.P. All Rights Reserved