|

Elliott Urges

Cognizant Debt Hike for M&A and Share Buybacks

■

Activist Paul Singer urged Cognizant to take on more leverage to help

fund research and acquisitions and to set up a $2.5 billion share

buyback program.

IT services company

Cognizant Technology Solutions Corp. ((CTSH)) shares jumped 10% early Monday after billionaire Paul Singer and his

activist investment fund

Elliott Management launched a campaign urging the

company to take on more leverage to help fund research and M&A at the

same time that it initiated a $2.5 billion share buyback program.

"Despite growing into a scale market leader with stable and

significant cash flows, Cognizant has remained unwilling to establish

a capital return program," said Elliott portfolio manager Jesse Cohn

in a 16-page-letter.

The activist fund pointed out that Cognizant has $4 billion in net

cash, including $1.1 billion in onshore cash following a recent

repatriation and "virtually no debt." Cognizant, which has a $36

billion market capitalization, had $896 million in debt as of Sept.

30, according to its most recent quarterly report.

The activist fund said that Cognizant is trading at its lowest

valuation since the financial crisis, which makes it a good candidate

for buying back shares to boost its undervalued share price. It also

is urging Cognizant to move substantially beyond its existing buyback

approach, which only "repurchases shares to offset dilution." The fund

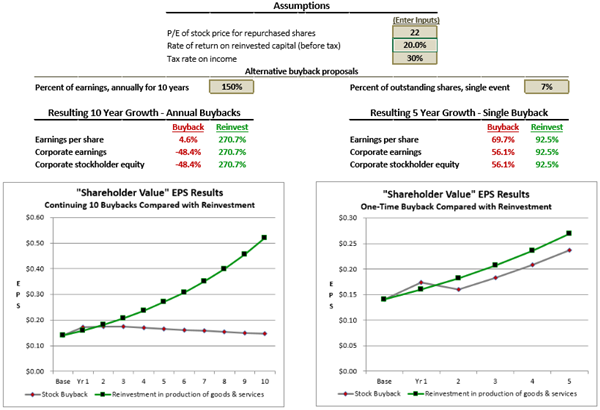

is urging Cognizant to complete a $2.5 billion share repurchase

program in the first half of fiscal year 2017, funded partly by cash

on its books and new debt. In addition, Elliott wants Cognizant to set

up a dividend program in part to help attract a new class of

investors.

Cognizant trades at $57.69 a share, up about 9% on the Elliott

campaign-- and Cohn suggests the IT services company can achieve a

value of between $80 and $90 a share by the end of 2017.

In addition, Elliott urged Cognizant to hike its unusually low

operating leverage to help it make "sound investments" in research and

development and M&A. The insurgent funds compared Cognizant to

Accenture PLC ( (ACN)

), which has a large IT services business, noting that the New

Jersey-based company has only made eight acquisitions since 2014 while

the Chicago-based professional services rival has bought 45 companies

in the same timeframe.

A person familiar with the situation noted that Cognizant could make a

number of bolt-on smaller acquisitions in the IT services space to

help drive profitability.

Elliott also urged Cognizant to make changes to its delivery process,

its sales and marketing program and make cuts to its human resources

department and finance unit. However, people familiar with the fund

said Cognizant should hike its operating leverage, in part, to invest

in hiring more employees focused on R&D.

It is very possible that Elliott could launch a contest if Cognizant

doesn't implement some or all of their recommendations. The New York

activist fund has launched more than 96 campaigns at 92 companies

since 1994, according to FactSet. It has also undertaken 13 proxy

fights and threatened director-election contests at four companies in

efforts to drive M&A and other moves.

In fact, Elliott hinted at a possible contest, arguing that

Cognizant's price "underperformance" suggests that "directors with new

experiences, skills and perspectives" would be welcome. The insurgent

fund could take advantage of some Cognizant governance red flags if it

were to launch a director election contest. In particular, a number of

the IT service company's directors have served on the company's board

for a long time, raising questions about whether they may be too cozy

with the management team. According to relationship mapping service

company BoardEx, a service of TheStreet, four directors have served on

Cognizant's 10-person board for more than 12 years, including chairman

John Klein, who has served for almost 19 years.

If Elliott wants to launch a contest, it would need to submit

dissident director candidates between Feb. 15 and March 17 to meet

Cognizant's director nomination rules for its 2017 annual meeting,

likely to take place in June. The person familiar with the situation

noted that Elliott is looking for Cognizant to produce its response to

the fund's concerns by February, when its next quarterly report comes

out.

Elliott

accumulated a 4% stake in common equity and share equivalents, for

about $1.4 billion, making the position one of the fund's largest

initial equity investments. Other activist funds, including Kerrisdale

Advisors LLC, Clinton Group Inc. and Carlson Capital LP, own small

stakes in Cognizant and would likely back a contest if one were

launched. Kerrisdale Capital tweeted on Monday that it agreed with the

Elliott plan, adding that Cohn's letter was ""excellent."

Cognizant directors are elected annually, which means Elliott could

launch a contest to take over the board if it so wished even though

the fund has almost never launched a change-of-control contest in its

past.

In hopes to generate shareholder backing for its thesis, Elliott noted

that it worked with a consulting firm, IT purchasers and senior

information technology services executives to develop its research

plan.

© 1996-2016 TheStreet,

Inc. |