THE

WALL STREET JOURNAL.

Markets

BlackRock’s Larry Fink Wants to Become the Next Warren Buffett

World’s largest

asset manager looks to raise over $10 billion to make direct

investments in companies

|

The effort sets up a rivalry for

Laurence Fink with his old firm. PHOTO: LAURENT GILLIERON/ASSOCIATED

PRESS |

By

Sarah Krouse

Feb. 7, 2018 8:00 p.m. ET

BlackRock

Inc. is looking to raise more than $10 billion that it would use to

buy and hold stakes in companies, replicating the approach of Warren

Buffett’s

Berkshire Hathaway Inc.

It is the first-ever attempt by the world’s largest asset manager

to make such direct investments, according to people familiar with the

matter. The move establishes BlackRock as a potential competitor to Wall Street

private-equity giants like

Carlyle Group LP and

Apollo Global Management LLC.

For BlackRock Chief Executive Laurence Fink, it also sets up a

rivalry with his old firm,

Blackstone Group LP. Mr. Fink co-founded

BlackRock as a division of

Blackstone in 1988 but split from the

private-equity giant in 1994.

BlackRock has since emerged as one of the biggest beneficiaries

of an investor shift to cheaper funds that mimic stock and bond indexes, topping

$6 trillion in assets for the first time in 2017.

Traditional asset managers like BlackRock and private-equity

firms like Blackstone are increasingly battling for cash from the same clients

as fees for certain products drop and competition for new pools of capital

intensifies.

Big asset managers that have long catered to cost-conscious

investors are trying to bulk up on products where they can charge big investors

private equity-like fees. It is a way to add new revenue as clients large and

small demand lower fees for traditional offerings. Private-equity firms,

meanwhile, are

offering more funds to wealthy retail investors

to broaden their pool of assets.

BlackRock’s new vehicle, known within the firm as a “long-term

private capital” vehicle, is part of that push to emphasize alternative

investments. The firm already manages $145 billion in higher-fee investment

strategies that include private equity and hedge funds of funds, real assets and

private credit. But it doesn’t have a buyout fund of its own.

It is currently seeking capital from sovereign-wealth funds,

pensions and other big investors that it would use to launch BlackRock Long-Term

Private Capital, according to people familiar with the matter.

If BlackRock can attract the roughly $10 billion it is seeking,

it would represent the largest amount ever raised by the company. BlackRock is

also contributing some of its own money to the effort.

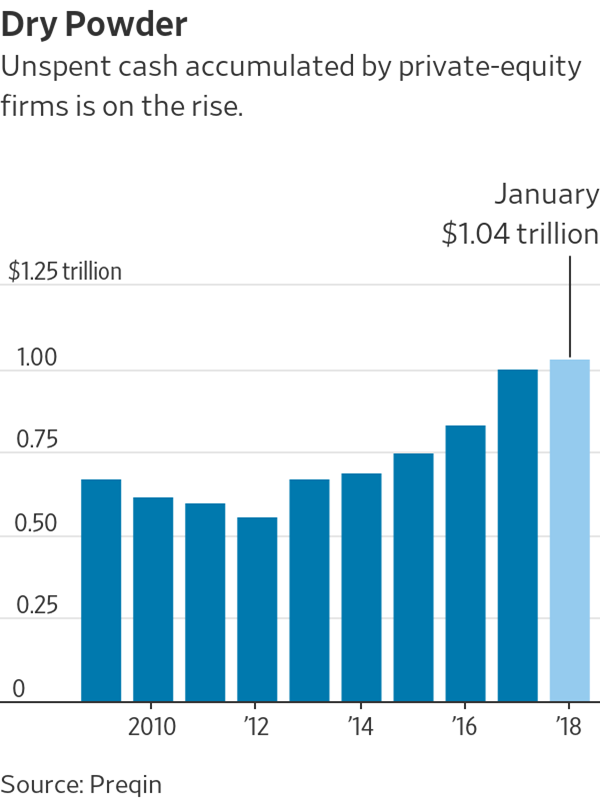

The company is raising money on the heels of a record year for

private-equity fundraising. Private-equity firms raised a record $453 billion in

2017, according to data provider Preqin, but the amount unspent rose to more

than $1 trillion for the first time ever. That pile of unspent money has raised

concerns that the firms won’t be able to find enough investment opportunities or

generate adequate returns.

The “best known” example of BlackRock’s approach with this new

vehicle is Berkshire Hathaway, according to a fundraising document reviewed by

The Wall Street Journal. The Omaha conglomerate run by Mr. Buffett is well known

for its long-term ownership of companies.

The new vehicle plans to make investments of between $500 million

and $2 billion in companies affected by what the document says are several

“long-term themes” such as diverging demographics globally, a growing middle

class in emerging markets and changing spending patterns by millennials. It is

targeting annual returns in the low to mid teens.

The vehicle will look for investments with risks and returns that

straddle those of stock investments and what buyout funds typically seek,

according to the document. It is planning to hold those positions for more than

10 years.

BlackRock Long-Term Private Capital is likely to acquire minority

stakes in companies, the people said. The investor document cites family-owned

businesses, companies being spun out of parent firms, or companies where

private-equity investors are seeking to exit their investment.

The effort is being overseen internally by Mark Wiseman, who is

viewed as a potential successor to Mr. Fink. Mr. Wiseman joined BlackRock in

late 2016 as chairman of its alternative investing business and global head of

active equities. Since joining, Mr. Wiseman has led an overhaul of the

stock-picking business and revamped the firm’s global investment committee.

BlackRock has also hired André Bourbonnais, the chief executive

of Canada’s Public Sector Pension Investment Board, to lead the BlackRock

Long-Term Private Capital effort. Prior to his current role, he spent nine years

at the Canada Pension Plan Investment Board working with Mr. Wiseman, who

previously was the organization’s chief.

Unlike many private-equity funds, the BlackRock vehicle will take

its investors’ full commitment upfront, instead of drawing it down over time,

and will reinvest proceeds as it exits investments. It aims to avoid a cash drag

that some private-equity funds suffer from as they shop for opportunity or

return cash to investors at the end of their lifespan. Executives envision a

secondary market developing for units in the vehicle when investors want their

money back, the people said.

BlackRock will receive a management fee that covers its expenses

and a certain profit margin and a performance fee. It aims to close the

fundraising by the second quarter with four to six large investors that will

also have the right to invest additional money in certain deals.

Write to

Sarah Krouse at

sarah.krouse@wsj.com

Appeared in the February 8,

2018, print edition as 'BlackRock Makes Like Buffett.'