Law360, New York (February 20, 2014, 1:53 PM ET)

-- A dissenting-shareholders condition in a merger

agreement permits an acquirer[1] not to close the

merger if the holders of more than a specified

percentage of outstanding shares exercise

appraisal rights. Generally, appraisal rights

allow a shareholder of a corporation that has been

acquired in a merger to be paid the “fair value”

of its shares, as determined by a court, instead

of accepting the merger consideration.[2]

While an acquirer would not typically have a right

to terminate the merger agreement if the

dissenting-shareholders condition is not

satisfied, a failure of the

dissenting-shareholders condition would excuse the

acquirer’s obligation to consummate the merger

and, accordingly, provide the acquirer certain

optionality with respect to the transaction.

For example, the acquirer could decide to increase

the amount of merger consideration to be paid to

all shareholders and thereby convince some or all

of the dissenting shareholders to revoke their

exercise of appraisal rights and accept the

increased merger consideration. Raising the amount

of merger consideration to an acceptable level is

generally not accomplished in a vacuum and could

involve negotiating with one or more dissenting

shareholders.

Alternatively, the acquirer could decide not to

increase the merger consideration and instead

waive the dissenting-shareholders condition, close

the transaction and deal with dissenting

shareholders after the closing. Under this

scenario, the acquirer would likely expect that at

least some of the dissenting shareholders would

withdraw their appraisal demands after the closing

and accept the merger consideration instead of

holding out for a settlement or litigating to a

final court decision.

Finally, if the acquirer did not waive a failed

dissenting-shareholders condition, the merger

agreement would eventually be terminated by one of

the parties for failure of the merger to be

consummated prior to an outside date provided for

in the merger agreement or, alternatively, by

mutual consent of the parties.

Recent developments in shareholders’ emphasis on

maximizing the value of appraisal rights and

changes to the Delaware corporate statute may lead

acquirers to increasingly seek and obtain

dissenting-shareholders conditions in their

transactions.

Historical Use

of Dissenting-Shareholders Conditions

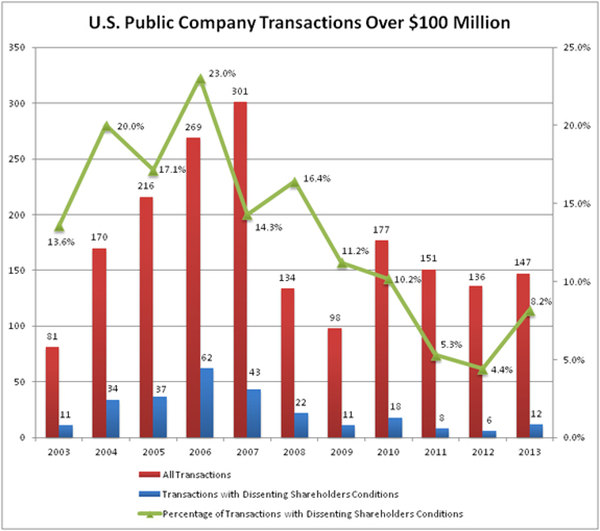

Set forth below is a chart analyzing U.S. public

company transactions for which definitive

agreements were signed during the 11-year period

ending Dec. 31, 2013, and that had transaction

values exceeding $100 million.[3] For each year,

the chart sets forth the total number of such

transactions and the total number of such

transactions that contained

dissenting-shareholders conditions. Using these

figures, the percentage of transactions that

contained dissenting-shareholders conditions is

plotted for each year.

The chart reveals

several interesting data points. Overall, 14

percent of the transactions covered in the chart

contained dissenting-shareholders conditions.[4]

Also, while 2007 had the highest number of deals,

it had the second-lowest percentage of

transactions with dissenting-shareholders

conditions during the six-year period leading up

to the 2008 banking crisis (2003 through 2008).[5]

In addition, each of the years since the 2008

banking crisis (2009 through 2013) had a lower

percentage of transactions with

dissenting-shareholders conditions than any of the

six years leading up to the 2008 banking crisis.

While the percentage of transactions with

dissenting-shareholders conditions decreased each

year after 2008, it began to increase in 2013. In

particular, the underlying data show that 11.8

percent of the transactions from the second half

of 2013 contained dissenting-shareholders

conditions.

Of course, dissenting-shareholders conditions are

not all the same. Significantly, the threshold

percentage of outstanding shares in excess of

which the exercise of appraisal rights will result

in the failure of the condition varies widely,

ranging from an acquirer-friendly 2 percent

threshold in some deals to a high of 50 percent in

one of the reviewed transactions.[6]

Commonly used thresholds for

dissenting-shareholders conditions are 5 percent,

10 percent and 15 percent of the corporation’s

outstanding shares, with 48.5 percent of the

reviewed transactions containing a

dissenting-shareholders condition specifying a 10

percent threshold.

The Threat of

Appraisal Litigation

The notable increase in the volume and

sophistication of appraisal litigation will likely

encourage more acquirers to consider whether to

demand the leverage provided by a

dissenting-shareholders condition.

Appraisal litigation differs from the more routine

shareholder class action suits that accompany

nearly all public deals. Appraisal litigation does

not seek to prohibit or restrain the transaction;

instead, the closing of the transaction is

necessary for an appraisal rights claim to

proceed.

Appraisal litigation takes place after the closing

of a transaction, and, if not settled, often

requires years to be finally adjudicated. For

Delaware corporations, dissenting stockholders

often hold meaningful positions in the shares for

which they exercise appraisal rights because, as a

general matter, the stockholders and the

corporation each bear their own attorneys’ fees in

the appraisal litigation.

While a judge’s determination of the fair value of

a stock can be an amount higher or lower than the

merger consideration, in Delaware, the fair value

exceeds the merger price in approximately 85

percent of cases litigated to decision.

In addition, under Delaware law, judgments of fair

value determined by a court are subject to

interest at a rate of 5 percent above the

Federal Reserve discount rate, which accrues

from the date of the merger through the date of

payment of the judgment by the acquirer. As such,

in the current interest rate environment, even a

fair-value determination that is less than the

merger price can result in an attractive return

for a dissenting stockholder.

Recognizing the incentives to bring appraisal

litigation, shareholder activists, hedge funds and

arbitrageurs have become more active in exercising

and publicly promoting the exercise of appraisal

rights. For example, in 2013, in response to the

announced $24.4 billion leveraged buyout of

Dell Inc., Carl Icahn exercised his appraisal

rights and led a high-profile, public campaign to

encourage other stockholders to do the same. Icahn

only dropped his demand for appraisal after the

buyout group increased the merger consideration

payable to all Dell stockholders.

In addition, certain hedge funds

now include appraisal litigation in their

investment strategy. As an example, Merion

Investment Management LP is a hedge fund that,

along with its affiliates, has been active in

appraisal litigation in connection with public

mergers going back to at least 2011, and most

recently, in the buyouts of

BMC Software Inc. and

Dole Food Co. Inc. in 2013 and

Lender Processing Services Inc. in 2014.

For Delaware corporations, this strategy is

facilitated by the fact that, in most cases,

stakes can be purchased and appraisal rights

exercised up until the taking of the vote to adopt

the merger agreement at the stockholders meeting,

giving potential investors the benefit of

additional time following the announcement of a

deal to assess market conditions and stockholder

sentiment prior to deciding whether to establish a

stake and seek appraisal.

For example, on Dec. 19, 2013, the same day that

the stockholders of Lender Processing Services

Inc. voted to adopt its merger agreement with

Fidelity National Financial Inc., Merion

Investment Management reported in a Schedule 13G

filing beneficial ownership of 6.6 percent of the

outstanding shares of Lender Processing Services.

The merger closed on Jan. 2, 2014. On Feb. 6,

2014, Merion Investment Management’s affiliates

filed an appraisal action in Delaware Chancery

Court for their shares of Lender Processing

Services.

Finally, appraisal rights trusts

have begun to be organized for the sole purpose of

allowing investors to participate in appraisal

rights claims for individual deals. These trusts

provide additional flexibility to potential

investors by allowing fund managers to buy, sell

or hold “appraised value rights” investments

through a trust that will manage the appraisal

litigation while providing investors liquidity

opportunities in the event they do not want to

wait until a final resolution of the appraisal

litigation.

Changes in Delaware Law

Amendments made to the Delaware corporate statute

in 2013 now make it possible for an acquirer to

include a dissenting-shareholders condition in a

tender offer or exchange offer transaction, a

closing condition that was previously unavailable.

Last year, the Delaware General Corporation Law

was amended to add Section 251(h), which provides

that, subject to certain conditions, upon

completion of a tender or exchange offer for any

and all outstanding target corporation shares, the

offeror can effect a second-step merger to squeeze

out the remaining minority stockholders without

having to obtain approval at a stockholders

meeting if, immediately following the consummation

of the offer, the offeror owns at least the number

of shares that would be required to adopt the

merger agreement at a meeting of the corporation’s

stockholders in accordance with applicable law and

the corporation’s charter.

Before Section 251(h) came into effect, nearly all

recent merger agreements for transactions using a

two-step structure contained the grant of an

option (a “top-up option”) by the target to the

offeror pursuant to which, upon the successful

completion of the offer, the offeror had the right

to purchase such number of newly issued shares

from the target to result in the offeror owning

the minimum percentage of outstanding shares (90

percent in Delaware) necessary for the offeror to

effect a second-step short-form merger to squeeze

out all remaining minority shareholders of the

target without the necessity of a shareholder

vote.

The top-up option allowed the offeror to close the

second-step merger as early as the same day that

the shares were purchased in the offer, thereby

dispensing with the need to hold a shareholders

meeting to approve the merger agreement, which

approval might require two or more months to

obtain.

Accordingly, Section 251(h) was added to the

Delaware merger statute to simplify a process[7]

that was for the most part already being

streamlined by the use of top-up options. Given

the speed and ease with which a transaction under

Section 251(h) can be effected, many practitioners

expect that use of the two-step structure for

acquisitions of Delaware public corporations will

increase.

Prior to the enactment of Section 251(h), however,

two-step transactions did not have

dissenting-shareholders conditions because

appraisal rights are not available in connection

with a tender or exchange offer. A stockholder

that wanted to demand appraisal of its shares in

connection with a two-step transaction had to wait

for the offer to be consummated and then, if a

short-form merger was effected without a

stockholder vote[8] (as would be the case if a

top-up option were exercised or the offeror

purchased in the offer a sufficient number of

outstanding shares), the stockholder would

exercise its appraisal rights after the

second-step merger was effected.

Accordingly, in two-step transactions, acquirers

historically have not had the ability to negotiate

dissenting-shareholders conditions into merger

agreements, even when such conditions would

otherwise be available if the transactions had

been structured as one-step mergers.[9]

The newly enacted Section 251(h) allows an

acquirer to incorporate a dissenting-shareholders

condition into its tender or exchange offer for

shares of a Delaware corporation because, as part

of the implementation of Section 251(h) into the

Delaware merger statute, the Delaware appraisal

statute was also changed to provide that in

connection with a merger under Section 251(h), a

corporation can send the required notice of the

availability of appraisal rights to its

stockholders prior to the closing of the offer.

In response to these changes, Delaware

corporations have begun using the recommendation

statement on Schedule 14D-9 filed in connection

with the offer to notify their stockholders of the

availability of appraisal rights and requiring

that all demands for appraisal be made no later

than as of the time that the first-step offer is

consummated.

By allowing two-step transactions to be structured

so that appraisal rights are required to be

exercised by no later than the consummation of the

offer, the Delaware statute has made it possible

for an acquirer to include a

dissenting-shareholders condition as a condition

to its obligation to consummate its offer, which

is, effectively, a condition to doing the entire

deal.

Accordingly, one of the significant effects of

Section 251(h) on the two-step structure is that

dissenting-shareholders conditions can now be used

for a class of transactions for which they were

previously unavailable. In fact, an acquirer has

already included a dissenting-shareholders

condition in a tender offer.

The transaction between

Harris Interactive Inc. and

Nielsen Holdings NV announced on Nov. 25,

2013, was structured as a tender offer followed by

a Section 251(h) merger, and the obligation of

Nielsen Holdings to consummate the tender offer is

subject to appraisal rights being demanded for no

more than 13 percent of the outstanding shares of

Harris Interactive.[10]

Conclusion

With market participants increasingly employing

creative approaches to put more focus on appraisal

litigation and recent changes in Delaware law

affording new opportunities to parties in two-step

transactions, acquirers will likely give more

consideration to whether they demand and obtain

dissenting-shareholders conditions in public

company M&A transactions going forward.

—By Andrew J. Noreuil,

Mayer Brown LLP

Andrew Noreuil is a partner in the Chicago

office of Mayer Brown. His practice focuses on

mergers and acquisitions and corporate governance

matters.

The opinions expressed are those of the author(s)

and do not necessarily reflect the views of the

firm, its clients, or Portfolio Media Inc., or any

of its or their respective affiliates. This

article is for general information purposes and is

not intended to be and should not be taken as

legal advice.

[1] Occasionally, the dissenting-shareholders

condition will also be for the benefit of the

target. For example, the transaction between

CapitalSource Inc. and

PacWest Bancorp announced in 2013 contained a

dissenting-shareholders condition that was for the

benefit of both parties.

[2] Appraisal rights vary from state to state and

are sometimes available for extraordinary

transactions other than mergers.

[3] Analysis based upon data available from

FactSet MergerMetrics.

[4] The data also show that

dissenting-shareholders conditions are not only

used in small- or middle-market transactions, they

have also been included in large-cap deals,

including

Procter & Gamble’s 2005 acquisition of The

Gillette Co., a transaction that was valued at

approximately $53.5 billion. In that all-stock

transaction, appraisal rights were not available

to Gillette stockholders because it was a Delaware

corporation; however, because Procter & Gamble was

an Ohio corporation, its shareholders were

entitled to appraisal rights. The

dissenting-shareholders condition for Procter &

Gamble’s benefit had a 5 percent threshold.

[5] Interestingly, for the year that had the

lowest number of deals (2003), the percentage of

transactions that contained

dissenting-shareholders conditions was only 0.7

percent less than the percentage of transactions

that contained dissenting-shareholders conditions

in the year with the highest number of deals

(2007).

[6] The 2010 transaction between Mariner Energy

Inc. and

Apache Corp. had a dissenting-shareholders

condition with a 50 percent threshold.

[7] Section 251(h) eliminates certain issues that

have complicated the use of top-up options. For

example, some target corporations might not have

enough authorized and unissued shares to ensure

that if an acquirer purchased the minimum number

of outstanding shares necessary to close the

offer, a sufficient number of shares could be

issued under the top-up option to permit the

acquirer to effect a short-form second-step

merger. While practitioners devised solutions to

this particular problem that added complication

and expense to transactions, Section 251(h)

provides a more elegant and cheaper solution.

[8] In Delaware, if a stockholders meeting would

be required to obtain approval of the merger

agreement in order to effect the second-step

merger, a stockholder would be required to demand

appraisal prior to the vote to adopt the merger

agreement at the stockholders meeting; however, an

offeror would not seek a dissenting-shareholders

condition in connection with this “long-form”

second-step merger because, among other reasons,

the offeror would already hold a majority of the

shares of the target as a result of the

consummation of the offer and it would seek to

squeeze out the minority stockholders regardless

of the number of shares for which appraisal rights

are exercised. As such, before the enactment of

Section 251(h), dissenting-shareholders conditions

were not available for two-step transactions.

[9] The Delaware statute provides that appraisal

rights are available for all mergers under Section

251(h), while appraisal rights are not available

for one-step mergers in all-stock transactions.

[10] The Section 251(h) merger for the Harris

Interactive/Nielsen Holdings transaction was

completed on February 3, 2014.