Posted by Kobi Kastiel,

Co-editor, HLS Forum on Corporate Governance and Financial Regulation,

on Tuesday September 23, 2014 at

9:17 am

|

Editor’s Note: The following post comes to us

from

Philip Richter, partner and co-head of the

Mergers and Acquisitions Practice at Fried, Frank, Harris, Shriver

& Jacobson LLP, and is based on a Fried Frank publication by Mr.

Richter,

Steven Epstein,

David Shine, and

Gail Weinstein. The complete publication, including footnotes,

is available

here. This post is part of the

Delaware law series, which is cosponsored by the Forum and

Corporation Service Company; links to other posts in the series

are available

here. |

As has been widely noted,

the number of post-merger appraisal petitions in Delaware has

increased significantly in recent years, due primarily to the rise of

appraisal arbitrage as a weapon of shareholder activists seeking

alternative methods of influence and value creation in the M&A sphere.

The phenomenon of appraisal arbitrage is to a great extent a product

of the frequency with which the Delaware Chancery Court has appraised

dissenting shares at “fair values” that are higher (often, far higher)

than the merger consideration in the transactions from which the

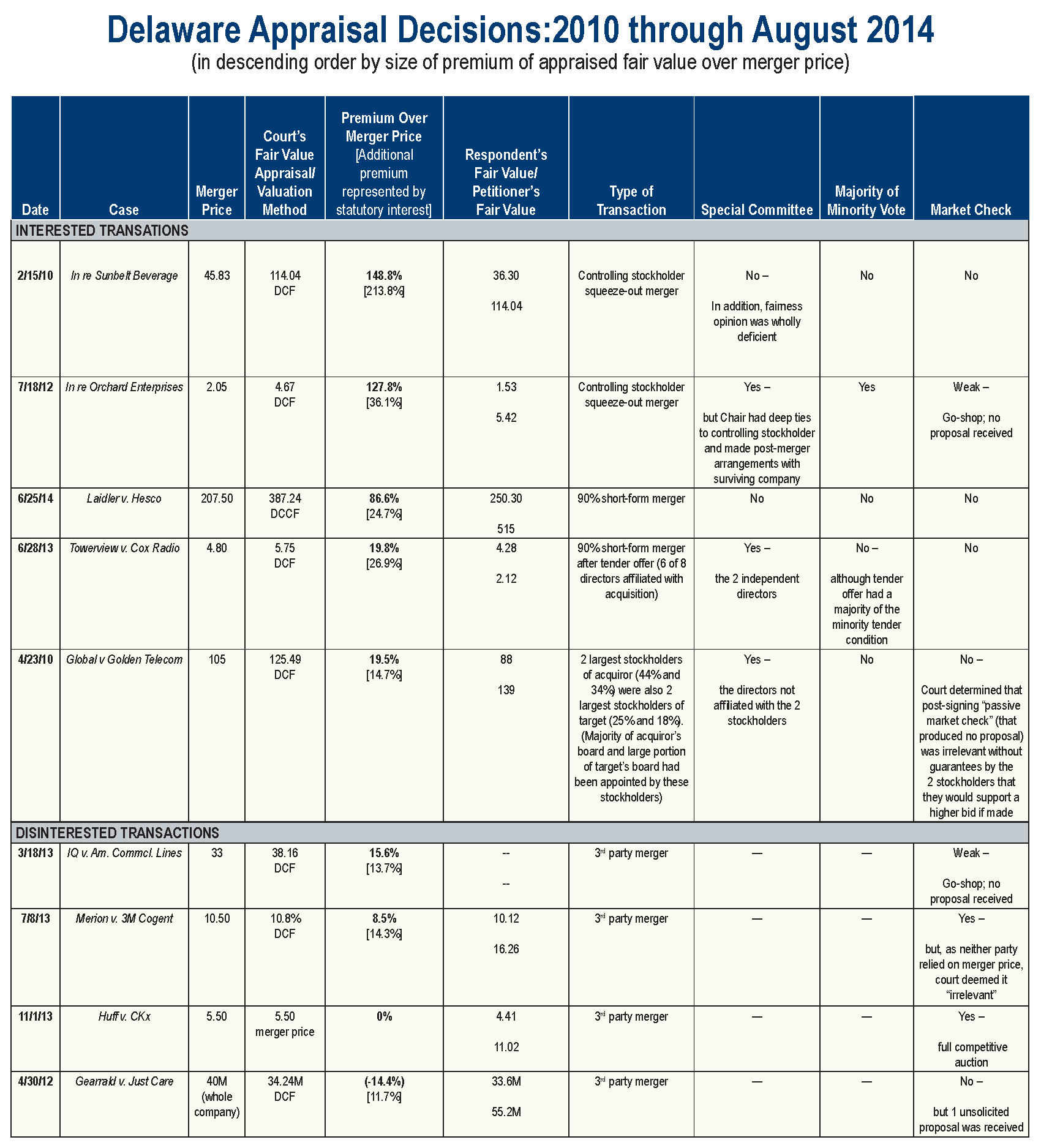

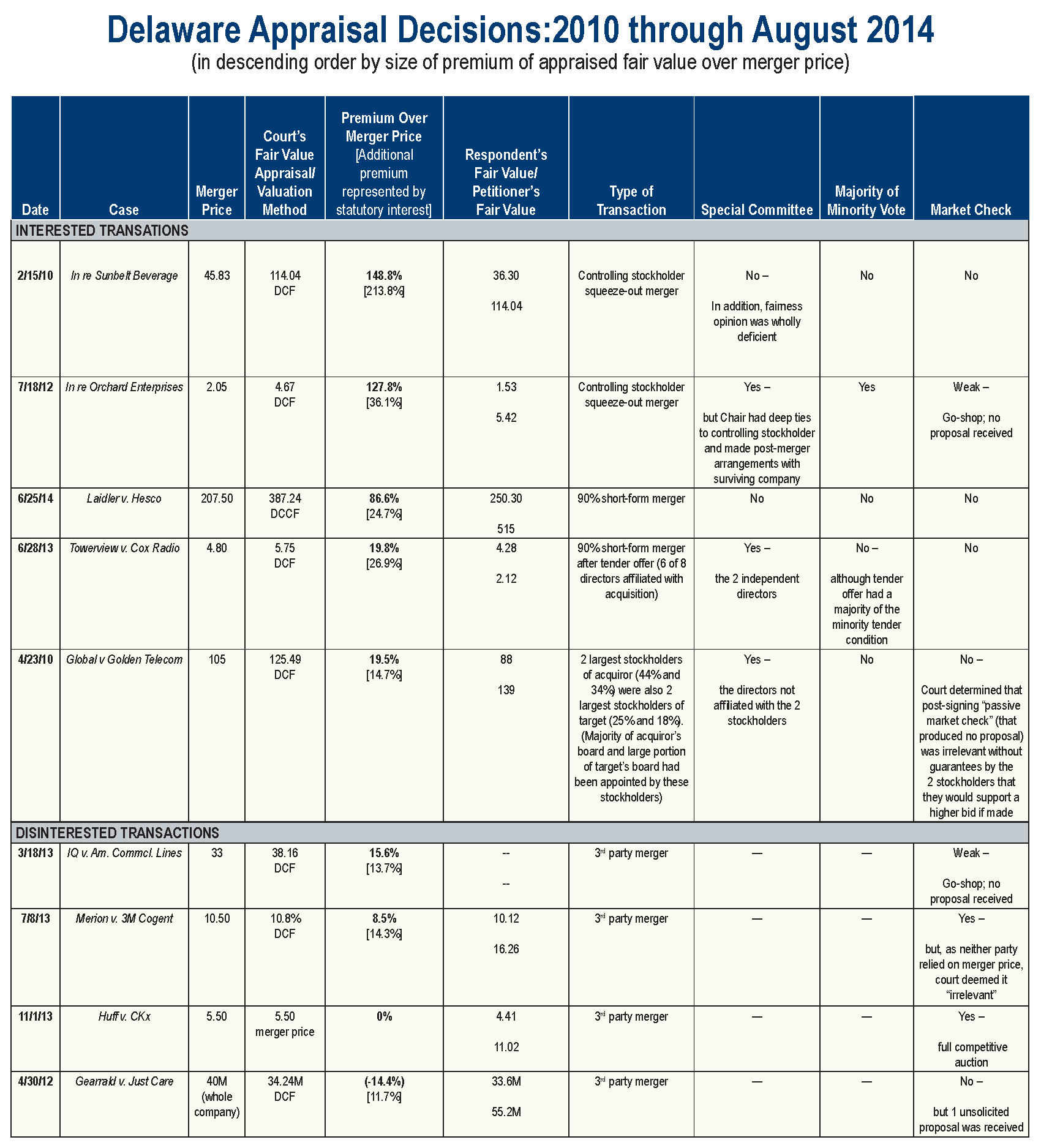

shareholders are dissenting. Our analysis of the post-trial appraisal

decisions issued in Delaware since 2010 indicates that the court’s

appraisal determinations have exceeded the merger price in all but two

cases—with the appraisal determinations representing premiums over the

merger price ranging from 8.5% to 149% (with an average of 61%).

There has been understandable concern. Practitioners and academics have

commented on the uncertainty created for deals from an unknowable and

potentially significant post-closing appraisal liability, and have

questioned the logic underlying the court’s almost invariable

determination that the “going concern” value of a target company just

prior to a merger was significantly higher than the merger price. Because

the Delaware appraisal statute prescribes that the “fair value” of

dissenting shares for appraisal purposes must be based on the going

concern value of the company just prior to the merger, but

excluding any value relating to the merger (such as merger synergies

and a control premium)—and because a merger price is essentially the going

concern value of a target company plus expected merger synergies

and a control premium—as a matter of simple logic, going concern value

should generally be well below the merger price, not far above

it.

Why

do the court’s appraisal awards exceed the merger price so often and by so

much? And who is affected?

Based on our analysis of the Delaware appraisal decisions since 2010, we

have concluded as follows:

»

First, the extent of the problem has been overstated. Appraisal cases,

while more prevalent than ever, still are not common. Moreover,

appraisal cases are largely self-selecting for transactions in which the

apparent facts provide a basis for believing that the merger price

seriously undervalues the target company.

»

Second, rather than indicating an illogical or highly uncertain approach

by the court, the actual results of the appraisal cases (as

opposed to the court’s expressed jurisprudence) indicate a deep—and

rational—skepticism by the court, not of merger prices generally but of

merger prices in “interested” transactions (that is, mergers involving a

controlling stockholder, parent-subsidiary, or management buyout) that

did not include a meaningful market check as part of the sale process.

»

Third, the court’s virtually exclusive reliance in appraisal cases on

the discounted cash flow (DCF) valuation methodology—an analysis that is

subject to significant uncertainty, particularly in terms of the

discount rate used (which involves a high degree of subjectivity and as

to which even a small change will produce a significant impact on the

result)—readily permits higher valuations in connection with interested

transactions that do not include a market check.

»

Finally, notwithstanding the court’s continuing reference to the

irrelevance of the merger price in appraisal proceedings, it would

appear that the merger price would always be relevant as a benchmark in

determining going concern value and that its use would not be

inconsistent with the prescriptions of the appraisal statute. Moreover,

consideration of the merger price, rather than its irrelevance, would

appear to reflect the reality of what the court has done in appraisal

cases (albeit contrary to what it has said in appraisal decisions).

The extent of the problem has been overstated.

It

should be noted that, despite the significant increase in the filing of

appraisal petitions over the last several years, the large majority of

appraisal-eligible transactions still do not attract appraisal petitions.

In 2013, appraisal petitions were filed in 17% of appraisal-eligible

transactions. By contrast, almost all strategic transactions now

attract breach of fiduciary duty litigation. Moreover, most appraisal

petitions are withdrawn or the cases settled (although often for

significant sums). Thus, there have been only nine Delaware post-trial

appraisal decisions since the beginning of 2010.

In

addition, appraisal cases are largely self-selecting for transactions in

which the merger price does not fairly value the company. Because

appraisal proceedings are complicated, lengthy, expensive and risky, and

because the expenses are shared by the dissenting stockholders (and cannot

be shifted to all shareholders as a group or to the target company),

generally appraisal cases that are brought and decided are those in which,

from the apparent facts, there is a likelihood that the merger price does

not fairly value the company. For example, Andrew Barroway, founder and

CEO of Merion Investment Management, one of the most prolific of the hedge

funds dedicated to filing appraisal petitions, has said that Merion looks

for deals that appear to be undervalued by at least 30% and focuses on

management-led buyouts. “The vast majority of deals are fair. We’re

looking for the outliers,” he has said. In effect, virtually every

appraisal decision relates to a transaction that is an outlier.

The actual results of the appraisal cases indicate a deep—and

rational—skepticism by the court, not of merger prices generally, but of

merger prices in “interested” transactions that did not include a market

check.

Rather than indicating an illogical or highly uncertain approach by the

court, the actual results of the appraisal cases (while belying

the jurisprudence and the court’s assertions in its opinions) indicate a

deep and rational skepticism by the court of merger prices in “interested”

transactions that do not include a market check—as well as skepticism

about the range of fairness established by the target company’s investment

bankers in connection with their fairness opinions and the financial

analyses of the target company’s experts in the appraisal proceedings in

these transactions. While the court espouses the traditional Delaware

jurisprudence that holds that the merger price and sale process are

irrelevant to an appraisal determination of going concern value, the

pattern of the court’s appraisal determinations appears to reflect an

elemental distrust by the court of the fairness of the merger price in the

case of interested transactions where there has not been a market check.

The data is consistent in supporting the inverse conclusion as well—that,

in the context of a transaction with a meaningful market check,

the court will tend to rely on the merger price as a significant factor in

determining going concern value.

In

the cases we have reviewed (from 2010 to date), the appraisal

determinations representing the highest premiums over the merger price

were all in “interested” transactions, and in

none of those transactions was there a meaningful market check as

part of the sale process. The premiums over the merger price in these

interested transaction cases ranged from 19.5% to 148.8% (averaging

80.5%). By contrast, in the four cases that involved “disinterested”

transactions (i.e., third party mergers), two of the appraisal

determinations were at a premium above the merger price, but at lower

premiums than in the interested cases—8.5% and 15.6%, respectively; one of

the determinations was equal to the merger price (where there was a full

market check with competing bidders in an open auction); and one was below

the merger price, reflecting a 14.4% discount to the merger price. One may

predict that for the cases that fall between these extremes—that is,

interested transactions with meaningful market checks and

disinterested transactions without full market checks—the court

is likely to be guided, in the former cases, by the extent to which it has

confidence that the market check was sufficient to overcome the skepticism

engendered by the interested nature of the transaction and, in the latter

cases, by the extent to which the disinterested arm’s length nature of the

transaction may overcome the skepticism arising from the absence of a

meaningful market check.

The court’s reliance on the DCF valuation methodology readily

permits higher valuations in interested transactions without a market

check.

Pursuant to the Delaware appraisal statute, the court may use any

financial analyses that are generally accepted by the financial community

to determine going concern value. In appraisal proceedings, both parties’

financial experts generally submit discounted cash flow (DCF) analyses,

sometimes along with comparable company or comparable transaction

analyses. The court has almost invariably used a DCF analysis, alone, to

determine going concern value.

Notably, determination of what discount rate to use in a DCF analysis is

highly subjective. In addition, even a slight change in the discount rate

used will have a significant impact on the result. Thus, a dissenting

stockholder who can convince the court to lower the discount rate used by

the company in its DCF analysis stands to achieve an appraisal

determination that is significantly higher than the merger price. A look

at the Sunbelt Beverage appraisal case is instructive.

The

price paid in the Sunbelt merger was $45.83 per share. Both parties’

experts in the appraisal proceeding agreed that the DCF methodology should

be used; agreed to use management’s projections in the analysis; agreed on

the basic discount rate to be used; agreed that a small-company risk

premium should be applied to increase the discount rate; and agreed that

the small-company risk premium should be derived from the Ibbotson risk

premium table. The only areas of disagreement between the experts with

respect to the DCF analysis related to two factors that affected the

discount rate—first, whether the company’s market capitalization placed it

in the 9th or the 10th decile of companies in the

Ibbotson table; and, second, whether a company-specific risk premium

should also be applied to the discount rate.

The

DCF analysis by the company’s expert (which used the small company premium

applicable to companies in the 10th decile of the table—5.78%;

and which also applied a company-specific risk premium of 3%) yielded a

fair value of $36.30 per share. The DCF analysis by the

petitioner’s expert (which used the premium applicable to companies that

were close to the line between the 9th and 10th

decile in the table—3.47%; and did not apply a company-specific premium)

resulted in a fair value of $114.04. The critical

difference between the two analyses, which led to these vastly different

amounts, was simply the relatively small effect of the two different risk

premiums on the discount rate. The court accepted the petitioner’s

expert’s view on these two factors and determined fair value to be $114.04

(significantly above the respondent’s determination of $36.30 and the

merger price of $45.83).

Consideration of the merger price, rather than its irrelevance,

would appear to reflect the reality of what the court has done in

appraisal cases (albeit contrary to what it has said), and would appear to

be not inconsistent with the prescriptions of the appraisal statute.

As

noted, it appears that the court harbors a deep skepticism that the merger

price in an interested transaction without a meaningful market check will

fairly value a company. This conclusion is not self-evident, as the court

goes to considerable length in its appraisal opinions to assert that any

consideration of the merger price is not appropriate in an appraisal case.

However, based on an analysis of the actual results of the cases, as

discussed above, there is an almost complete correlation between the

extent to which the sale process lends confidence to the merger price as

not undervaluing the company, on the one hand, and the amount by which the

court’s appraisal determination exceeds the merger price, on the other

hand.

In

our view, the statutory language does not command disregard of the merger

price in an appraisal proceeding. In fact, the statute’s direction to the

court that, in determining going concern value, it must consider “all

relevant factors” may be seen as expressly permitting (if not even

possibly requiring) that the merger price be considered as one,

among other, relevant factors. In CKx, the sole case (since the

seminal Golden Telecom decision) in which the court expressly

relied on the merger price to determine going concern value, Vice

Chancellor Glasscock expressed his view that the court’s rejection of

consideration of the merger price in Golden Telecom was only a

rejection of an automatic presumption in favor of the merger

price as itself establishing going concern value. Consideration of the

merger price as one relevant factor—or even, as Glasscock found it to be

in CKx, the most relevant factor—would not be inconsistent with

that holding, he reasoned.

Conclusion

Despite the court’s record in consistently determining appraisal awards

that significantly exceed the merger price, for a disinterested

transaction with a meaningful market check, there should be little

concern. For an interested transaction without a market check, there will

be a meaningful risk of an appraisal award above the merger price. For the

transactions that fall between these two extremes, appraisal risk should

approximate the extent to which the transaction is interested or

disinterested and has or has not included a meaningful market check.

Accordingly, parties to transactions, when considering merger price and

sale process issues, will want to factor into that calculus the risk

associated with appraisal. Target company stockholders, when deciding

whether or not to seek appraisal, will want to consider the nature of the

transaction and the reasonableness of the price and process—including the

range of fairness determined by the target company’s investment bankers in

connection with their fairness opinion, the investment bankers’ underlying

financial analyses (in particular, the DCF analysis) supporting their

range of fairness, the nature and extent of the market check in the sale

process, the presence of any other features lending credibility to the

merger price (such as a majority-of-the-minority stockholder vote

requirement), and the reaction of the market and analysts.

Despite much ado about the court’s appraisal decisions, it appears that

the court’s results have a reasonable foundation, although the court’s

process is opaque. In addition, it appears that, for at least certain

types of transactions, the court’s results are reasonably predictable—the

court is unlikely to make an appraisal determination that significantly

exceeds the merger price in a transaction that has been subjected to a

meaningful market check.

[for large image

of chart, click here]

|

All copyright and trademarks in content on this site are owned by

their respective owners. Other content © 2014 The President and

Fellows of Harvard College. |

|