|

In the News: Stock Valuation

In

February 2015, Bloomberg reported that Tesla chairman and CEO Elon

Musk had indicated that Tesla’s market valuation would approach $700

billion in a decade, up from approximately $27 billion at the time.

Musk said, “Our market cap would be basically the same as Apple’s is

today.”

It's

not unusual for managers of publicly held firms to suggest that their

companies’ stocks are undervalued, but it is rare for them to make

precise projections about the future valuation of their firms’ equity.

After all, a firm’s stock price is not entirely within a company’s

control. Investor sentiment, competition, and the regulatory

environment are just some of the factors affecting a stock’s

valuation.

In

this article, we take a closer look at a key topic in the Claritas

course of study—stock valuation (Module 4, Investment Instruments)—to

understand how investors can evaluate investment opportunities. For

example, valuation helps investors uncover underpriced or overpriced

securities, and an enterprising investor will take advantage of these

mispricings.

Approaches to Stock Valuation

There are three basic approaches to the valuation of common stock:

discounted cash flow valuation, relative valuation, and asset-based

valuation.

Discounted Cash Flow Valuation

The discounted cash flow (DCF) approach takes into account the time

value of money.

It estimates the value of a security as the present value of all

future cash flows—that is, dividends and the proceeds from

selling—that the investor expects to receive from the security.

|

The DCF valuation approach relies on an analysis of the unique

characteristics of the company issuing the shares, such as the

company’s ability to generate earnings, the expected growth rate

of earnings, and the level of risk associated with the company’s

business. |

An Example of Discounted Cash Flow Valuation

On 1

January 2015, an investor expects Volkswagen to generate dividends of

€4.00 per share at the end of 2015, €4.20 per share at the end of

2016, and €4.50 per share at the end of 2017. The investor also

estimates that the stock price of Volkswagen will trade at €150.00 per

share at the end of 2017. The investor considers the risks associated

with the investment and concludes that a discount rate (the rate used

to calculate the present value of some future amount) of 14% is

appropriate.

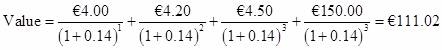

The

investor computes the present value of the expected cash flows as

follows:

The

investor’s estimated value of Volkswagen on a per share basis is

€111.02. If the shares of Volkswagen are priced at less than €111.02

on 1 January 2015, the investor may conclude that the stock is

undervalued and decide to buy it. Alternatively, if the stock trades

at more than €111.02, the investor may conclude that the stock is

overvalued.

Relative

Valuation

The

relative valuation approach estimates the value of a common share as

the multiple of some measure, such as earnings per share (EPS) or

revenue per share.

The multiple is determined based on price and the relevant measure for

publicly traded, comparable equity securities.

|

The key assumption of the relative valuation approach is that

common shares of companies with similar risk and return

characteristics should have similar values. |

An

Example of Relative Valuation

An

investor is estimating the value of an airline’s common stock on a per

share basis. The airline in question generates annual EPS of €2.00 and

exhibits risk and return characteristics that are in line with the

industry average. The investor finds that the average

price-to-earnings multiple, or P/E, for the industry is 9. Using

relative valuation, the investor estimates that the value of the

airline’s stock, on a per share basis, is €18.00 (= €2.00 x 9).

Asset-Based Valuation

The

asset-based valuation approach estimates the value of common stock by

calculating a company’s net asset value, which is the difference

between the value of a company’s total assets and its outstanding

liabilities.

The asset-based valuation approach implicitly assumes that the company

is liquidated, sells all its assets, and then pays off all its

liabilities. The residual value after paying off all liabilities is

the value to shareholders.

It is

important to note that some asset values on the balance sheet are

based on historical cost (the cost when they were purchased), and the

actual market value of these assets may be very different. For

instance, the value of land on a company’s balance sheet, typically

carried at historical cost, may be quite different from its current

market value. As a result, using asset values taken directly from the

balance sheet may provide a misleading estimate. To improve the

accuracy of the value estimate, current market values should be

estimated instead.

Also,

some assets, including some internally developed intangible assets,

such as a brand or reputation, may not be included on the balance

sheet because of financial reporting rules. Thus, it is important when

using asset-based valuation to estimate reasonable values for all of a

company’s assets, which can be very challenging to do.

Bottom

Line: Stock Valuation

Valuing common shares is an imprecise science and different valuation

methodologies can yield different results. Nevertheless, valuation

should be considered a foundational component of the investment

decision-making process. It is the process by which investors can make

a reasoned determination about whether Tesla will be able to duplicate

Apple’s success and warrant a market capitalization of $700 billion.

© 2015 CFA Institute. All

Rights Reserved. |