|

Opportunistic Investing – The Case for Merger Appraisal Rights

May 24, 2016, 02:18:50 PM EDT By Hedge Fund Solutions Group,

Neuberger Berman

This niche, legally intensive strategy has the potential for providing

compelling uncorrelated returns.

U.S. mergers and acquisitions activity surged to an all-time high in

2015, with deal volume growing over 50% year-over-year to

approximately $2.3 trillion.

1

Coinciding with this M&A growth has been an increase in corporate

litigation and, in particular, cases in which shareholders have

exercised their rights to seek appraisal to challenge the price

offered in a buyout. In this article, we discuss appraisal rights in

detail and why we believe the strategy represents a compelling

investment opportunity.

Overview

Appraisal rights exist to ensure that minority shareholders receive

fair value for their shares when a company is acquired in a cash deal.

While most states have some form of appraisal remedy (the rules vary

significantly from state to state), Delaware is the leading statutory

example, with more than half of U.S. public companies incorporated in

the state.

2

Given Delaware's extensive case law on the subject, we will focus our

thoughts on appraisal rights as it applies to the Delaware General

Corporation Law.

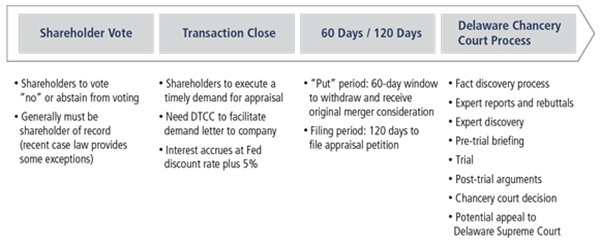

Appraisal rights provide shareholders in an acquisition with a legal

remedy to petition for an independent determination of fair value as

an alternative to accepting the offered deal price. Those seeking

appraisal forgo the merger consideration in anticipation that the

awarded amount through a judicial determination or settlement will be

higher. In order to demand appraisal, shareholders must vote against

the transaction (or abstain) and adhere to strict procedural

requirements, including several notice provisions. While most cases

are settled privately before going to court, those that go to

litigation involve discovery along with expert witness reports and

rebuttals. A general overview of an appraisal proceeding is provided

in Figure 3.1.

Figure 3.1: Appraisal Proceeding in Brief

Source: Magnetar Capital.

After listening to expert testimony and reviewing valuation analysis

provided by experts, the court will make a determination as to whether

the buyout price was fair. The court arrives at "fair value," which is

based on the closing date of the merger, primarily using a discounted

cash flow analysis, but it may apply other valuation methodologies

involving comparable companies and comparable transactions. In

addition to the "fair value" of their shares, appraisers are generally

entitled to receive statutory interest equal to the Federal Reserve

discount rate plus 5% (currently 6%), win or lose, to compensate the

shareholders for having capital tied up in the post-merger entity.

Interest is compounded quarterly from the merger closing date until

the date they receive "fair value" and is applied to the final

adjudicated price.

Growth of Appraisal Rights

Although the appraisal statute has been available for some time, it

has generally been overlooked as an investment tool until recently. It

is estimated that only about 5% of deals involving Delaware

incorporated companies were the subject of appraisal rights cases

between 2004 and 2010. By 2014, that figure increased to 15 percent.

3

We believe a number of factors have contributed to the growth of

appraisal litigation and the rise of its use as an investment

strategy:

·

Cash-financed deals

: Appraisal rights generally only apply to pending cash or heavily

cash merger transactions. As cash on corporate balance sheets has

increased to record highs, cash has been the preferred deal currency

for companies looking to expand. As a result, the number of deals in

which appraisal rights may be exercised has also increased.

·

Case law

: A number of key decisions have established precedents for appraisal

actions. For example, In re: Appraisal of Transkaryotic Therapies,

Inc.

3

provided that shareholders were permitted to seek appraisal so long as

they owned the stock as of the merger vote date (as opposed to the

much earlier record date). This ruling helped set the stage for

shareholders to employ appraisal rights as an investment strategy by

creating a time advantage; prospective appraisal investors now have

the ability to analyze a deal and delay purchasing shares until the

final minute, thereby reducing uncertainty about the merger closing.

Another, perhaps more impactful, factor driving shareholders to

increasingly pursue appraisal litigation has been the successful

outcomes of several recent high-profile cases, including Dell and Dole Food Company. We believe the

large payouts in those cases have encouraged others to repeat this

approach in other cash merger transactions.

·

Growth of activist and event-driven funds

: Significant amounts of capital have flowed into funds dedicated to

activist, event-driven and special situations investing. Many of these

funds have the valuation expertise as well as the resources to pursue

appraisal litigation. The onerous procedural requirements and the

length and high cost of litigation are significant barriers to entry

for smaller investors.

·

Low interest rate environment

: The statutory interest equal to the Fed discount rate plus 5% is

well above the current market rate and is attractive relative to other

yield alternatives.

Pursuing Appraisal as an Investment Strategy

For the reasons mentioned above, multi-strategy hedge funds have

entered the scene to pursue appraisal as an investment strategy, while

some funds have even been created solely for this purpose. While not

all funds seek appraisal rights in the same deals, their fundamental

strategies are fairly similar. In general, these funds invest in cash

merger deals where the target company is being acquired at a price

they believe is deficient, exercise their appraisal rights, and

litigate to achieve "fair value." They tend to be very selective in

their deal choices (i.e., 2-3 deals per year) and typically only

pursue the most egregiously undervalued mergers, particularly where

there are issues in the sales process and inherent conflicts of

interest (e.g., an insider's attempt to cheaply buy out minority

shareholders). In fact, recent case law has revealed that appraisal

cases are becoming more difficult to win on valuation alone, and in

these instances, the court commonly awards the merger consideration.

In contrast, the highest appraisal awards tend to involve transactions

for which there was not a meaningful market check as part of the sales

process. Given this trend, funds generally look for flaws in the sales

process (e.g., the company did not contact multiple bidders or did not

give prospective buyers the same access to due diligence), in

conjunction with a deficient takeout price, when determining whether

to exercise their appraisal rights. In the accompanying sidebar, we

provide a case study to demonstrate the characteristics of a

successful appraisal situation.

Appraisal Rights Case Study

Background:

·

An investor group led by a private equity firm (PE buyer) announced it

would acquire a grocery chain.

·

The deal closed almost a year later with each share receiving

approximately $35 in cash + two non-tradable contingent value rights (

CVR).

Valuation:

·

Appraisers believed the business was worth significantly more than the

purchase price, with discounted cash flow valuations generally ranging

between $40-$50 per share, excluding the value of the company's real

estate and the CVR.

·

Management had estimated that the company's real estate was worth

roughly $11 billion, which was more than the purchase price of the

entire company.

·

Between the announcement date and the closing date, the stock prices

of publicly traded peers moved significantly higher.

·

Appraisers believed the takeout price was inadequate based on these

findings.

Sales Process:

·

The company negotiated exclusively with one bidder, a PE buyer.

·

Other prospective buyers were reluctant to compete with the

agreed-upon transaction. Without competition, the PE buyer was not

compelled to put forth its best offer.

·

The company gave the PE buyer the right to fully review and match any

competing bid. This effectively reduced the company's negotiating

power to achieve the best price for its shareholders.

·

The company held a prohibitively short "go shop" period and as a

result other prospective buyers did not have the same time and access

to information.

·

Prior to agreeing to the sale, the company received a last-minute

offer from a competitor who proposed a higher price than PE buyer's

bid. Despite the potentially higher offer, the company's board agreed

to the PE buyer deal.

·

Appraisers concluded that management did not properly shop the company

to test its market value.

Outcome:

·

About four months after the closing date, the company reached a

settlement with some appraisers for roughly $44 in cash and the

retention of the CVR. The cash award represented about a 26% premium

to the deal price.

·

Other appraisers declined the settlement and went into litigation. The

trial is scheduled for later this year.

Once a fund petitions for appraisal, it becomes a creditor of the

acquiring company. The credit risk is akin to a multiyear unsecured

bond with no covenant protection, as appraisal litigation typically

lasts two to three years. For this reason, some funds will hedge their

credit risk to isolate the litigation component of the deal. Common

hedges include credit default swap protection on the acquirer with

terms varying based on the expected length of the case, and short

positions in the company's cash bonds. Hedging strategies can also

vary depending on the type of transaction (i.e., strategic deals may

have very different credit profiles from LBOs), with hedging more

common in deals with significant amounts of leverage. Some funds will

also focus on industries that have stable cash flows as a way to

mitigate credit risk.

Investment Merits

We believe appraisal strategies offer a number of potentially

compelling benefits:

·

Uncorrelated source of returns

: Outcomes are based on a negotiated settlement or decision from the

court and, as a result, the strategy's returns are not tied to the

performance of the equity or credit markets.

·

Asymmetric return profile with limited downside and strong upside

optionality

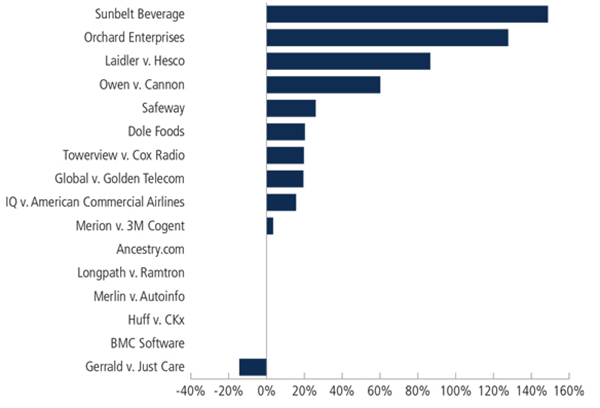

: A review of all Delaware appraisal cases over the last 20 years

found that 80% of the decisions resulted in a higher appraised value,

5

and, typically, the worst-case scenario is that investors receive the

merger price. The success rate is even higher in interested party

transactions (i.e., controlling shareholder or parent-subsidiary

mergers) where a robust competitive bidding process was not conducted,

which are the situations most funds focus on when seeking appraisal.

We believe cases with the proper characteristics for appraisal have

the potential to offer double-digit returns. Below is a summary of the

premiums over merger prices of the Delaware appraisal decisions since

2010, many of which have exceeded 15%.

Figure 3.2: Delaware Appraisal Decisions - Premium Over Merger Price

Source: Harvard Law School Forum on Corporate Governance and Financial

Regulation and Fried Frank Harris Shriver & Jacobson LLP.

·

Statutory interest

: The accrual of statutory interest at 5% plus the Fed discount rate

is attractive in a low rate environment. It also cushions the downside

in the event that the court determines that the "fair value" is below

the merger price. Currently, appraisers earn 6% on their stake from

the closing date of the merger to the date of the final determination.

·

Robust M&A environment

: The increase in M&A activity has resulted in a greater opportunity

set for the strategy. However, the type of activity matters;

transactions involving motivated selling shareholders, particularly an

insider or management team that has strong financial incentives to

take the company private at a discount, tend to be better candidates

for appraisal.

·

Limited competition

: Appraisal rights strategies do not have a natural fit within the

hedge fund universe given their liquidity constraints and strict

operational requirements. Despite having the merger valuation

expertise, risk arbitrageurs tend to avoid asserting their appraisal

rights because the litigation duration and illiquidity of such actions

do not match the redemption terms of their funds (typically monthly

redemptions with 30 days' notice). As a result, multi-strategy funds,

which can take more illiquidity risk, and a handful of funds with

dedicated appraisal rights strategies are the only real players in the

space.

Investment Risks

We believe investors must consider the following risks associated with

the strategy:

·

Liquidity/duration

: Once a deal closes, the shares held by appraisers no longer trade

and their investment is tied up while the lawsuit is adjudicated. It

has not been uncommon for the process to last two-plus years until a

final judgment occurs (unless a settlement is reached).

·

Deal break risk

: There is the potential for the deal to fall apart if not enough

shareholders vote in favor of the transaction.

·

Opportunity set

: There is no guarantee that the deals with the proper characteristics

for appraisal will occur as the vast majority of mergers are fairly

valued. Additionally, given the rise of appraisal litigation, it may

become more common for merger agreements to include appraisal closing

conditions that give the buyer the option to terminate the deal should

the percentage of dissenting shareholders reach a certain level.

Lastly, recent appraisal decisions suggest that there is a greater

burden on the petitioner to prove there was a flaw in the sales

process in addition to a deficient valuation, which may further

constrain the opportunity set.

·

Unfavorable decisions

: There is the potential for the court to rule that "fair value" is

below the deal price; however, this has only happened in a very small

percentage of cases. It is even rarer in transactions involving

insiders that did not conduct a fair auction process.

·

Credit risk

: Once entering appraisal, the plaintiff bears the credit risk of the

acquiring company, which is responsible for the payment of any

settlement or court award. However, this risk can be hedged a number

of ways as discussed earlier in the article.

·

Legislative change

: The Delaware bar recently proposed amendments to the appraisal

statute, which, if adopted, would allow a company to cut off the

accrual of interest by pre-paying dissenting shareholders a certain

amount. However, interest would accrue on any excess of the final

appraisal award over the prepaid amount.

·

Credit availability

: A regulatory cap of total debt/EBITDA of 6:1 could reduce the number

of private equity buyouts. At the same time, deals that are completed

could look more favorable from a valuation standpoint as a result of

these financing limitations.

Conclusion

Hedge funds have helped transform appraisal rights litigation, a

long-ignored part of corporate law, into an important weapon in their

activist investment arsenal. We believe funds that have developed

specialized investment strategies based on appraisal, particularly

those that are highly selective in the deals they pursue, offer

investors access to a niche strategy with limited competition and the

potential to earn attractive returns in a relatively low-risk and

uncorrelated manner.

1

FactSet.

2

Delaware Department of State, Division of Corporations.

3

Fried, Frank, Harris, Shriver & Jacobson LLP

4

Harvard Law School Forum on Corporate Governance and Financial

Regulation.

5

Fish & Richardson P.C.

Definitions

Alpha (Jensen's Alpha)

: A risk-adjusted performance measure that is the excess return of a

portfolio over and above that predicted by the Capital Asset Pricing

Model ("CAPM"), given the portfolio's beta and the average market

return. Jensen's Alpha measures the value added of an active strategy.

Barclays Aggregate Bond Index

: Represents securities that are U.S. domestic, taxable and

dollar-denominated. The Index covers the U.S. investment grade, fixed

rate bond market, with index components for government and corporate

securities, mortgage pass-through securities and asset-backed

securities.

Barclays Capital Global High Yield Index

: An unmanaged index considered representative of fixed-rate,

non-investment grade debt of companies in the U.S., developed markets

and emerging markets.

Barclays Capital Long Government Credit Index

: Measures the investment return of all medium and larger public

issues of U.S. Treasury, agency, investment-grade corporate and

investment-grade international dollar-denominated bonds with

maturities longer than 10 years.

Barclays Capital Pan-European Aggregate Index

: The Pan-European Aggregate Index tracks fixed-rate, investment-

grade securities issued in the following European currencies: Euro,

British pounds, Norwegian krone, Danish krone, Swedish krona, Czech

koruna, Hungarian forint, Polish zloty and Slovakian koruna. The

principal asset classes in the index are Treasuries,

Government-Related, Corporate and Securitized, which include

Pfandbriefe, other covered bonds and asset-backed securities.

Barclays Capital U.S. MBS Index

: Measures the performance of investment-grade fixed-rate

mortgage-backed pass- through securities of Government National

Mortgage Association ("GNMA"), Federal National Mortgage Association

("FNMA") and Freddie Mac ("FHLMC") that have 30-, 20-, 15-year and

balloon securities that have a remaining maturity of at least one

year, are investment grade and have more than $250 million or more of

outstanding face value. In addition, the securities must be

denominated in U.S. dollars and must be fixed-rate and

non-convertible. The Index is market-capitalization weighted, and the

securities in the Index are updated on the last calendar day of each

month.

Barclays CTA Index

: Measures the composite performance of established programs. For

purposes of this index, an established trading program is a trading

program that has four years or more of documented performance history.

Once a trading program passes this four-year hurdle, its subsequent

performance is included in this unweighted index. The Barclay Index

does not represent an actual portfolio, which could be invested in,

and therefore the index performance results should be deemed to be

hypothetical in nature and of comparative value only.

Barclays U.S. Corporate High Yield

: An unmanaged index considered representative of fixed-rate,

non-investment grade debt of companies in the U.S.

Basis Risk

: Basis risk refers to the imperfect correlation where offsetting

investments in a hedging strategy do not experience price changes in

entirely opposite directions from each other. This creates the

potential for excess gains or losses in a hedging strategy and adds

risk to the position.

Beta

: A measure of the systematic risk of a portfolio. It is the

covariance of the portfolio and the benchmark divided by the variance

of the benchmark. Beta measures the historical sensitivity of a

portfolio's returns to movements in the benchmark. The beta of the

benchmark will always be one. A portfolio with a beta above the

benchmark (i.e. >1) means that the portfolio has greater volatility

than the benchmark. If the beta of the portfolio is 1.2, a market

increase in return of 1% implies a 1.2% increase in the portfolio's

return. If the beta of the portfolio is 0.8, a market decrease in

return of 1% implies a 0.8% decrease in the portfolio's return.

Bloomberg High Yield Corporate Bond Energy Index

: A rules-based, market-value weighted index engineered to measure

publicly issued non-investment grade USD fixed-rate, taxable,

corporate bonds.

Correlation

: A statistical measure of how a portfolio moves in relation to its

benchmark. Correlation values range from +1.0 to -1.0. A positive

correlation implies that they move in the same direction. Negative

correlation means they move in opposite paths. A correlation of +1.0

means that the portfolio and benchmark move in exactly the same

direction; -1.0 means they move in exactly the opposite direction; 0.0

means they do not correlate at all with each other.

Credit Suisse High Yield Index

: Designed to mirror the investable universe of U.S.

Dollar-denominated non-investment grade corporate bonds.

Dow Jones-UBS Commodity Index

: An index composed of futures contracts on physical commodities,

consisting of commodities traded on U.S. exchanges, with the exception

of aluminum, nickel and zinc, which trade on the London Metal

Exchange.

HFRI Fund Weighted Composite Index

: Includes equally weighted performance indexes, utilized by numerous

hedge fund managers as a benchmark for their own hedge funds. The HFRI

is broken down into four main strategies, each with multiple

sub-strategies. All single-manager HFRI Index constituents are

included in the index, which accounts for over 2,200 funds listed on

the internal HFR Database.

HFRI Macro Index

: Tracks a broad range of hedge fund strategies in which the

investment process is predicated on movements in underlying economic

variables and the impact these have on various types of investments.

Macro strategies employ a distinct investment thesis that is

predicated on predicted or future movements in the underlying

instruments rather than realization of a valuation discrepancy between

securities.

HFRX Absolute Return Index

: This index is designed to be representative of the overall

composition of the hedge fund universe. It is comprised of all

eligible hedge fund strategies, including but not limited to

convertible arbitrage, distressed securities, equity hedge, equity

market neutral, event driven, macro, merger arbitrage and relative

value arbitrage. As a component of the optimization process, the index

selects constituents which characteristically exhibit lower

volatilities and lower correlations to standard directional benchmarks

of equity market and hedge fund industry performance. Hedge Fund

Research, Inc. (HFR) utilizes a UCITSIII compliant methodology to

construct the HFRX Hedge Fund Indices. The methodology is based on

defined and predetermined rules and objective criteria to select and

rebalance components to maximize representation of the Hedge Fund

Universe. HFRX Indices utilize state-of-the-art quantitative

techniques and analysis; multi-level screening, cluster analysis,

Monte-Carlo simulations and optimization techniques ensure that each

Index is a pure representation of its corresponding investment focus.

HFRX Macro Commodity Index

: Includes strategies which invest in commodities on both a

discretionary and systematic basis. Systematic commodity managers have

investment processes typically as a function of mathematical,

algorithmic and technical models, with little or no influence of

individuals over the portfolio positioning. Strategies employ an

investment process designed to identify opportunities in markets

exhibiting trending or momentum characteristics across commodity

assets classes, frequently with related ancillary exposure in

commodity sensitive equities or other derivative instruments.

Discretionary commodity strategies are reliant on the fundamental

evaluation of market data, relationships and influences as they

pertain primarily to commodity markets including positions in energy,

agricultural, resources or metal assets. Portfolio positions typically

are predicated on the evolution of investment themes the managers

expect to materialize over a relevant timeframe, which in many cases

contain contrarian or volatility focused components.

HFRX Macro Systematic Diversified CTA Index

: Has investment processes typically as function of mathematical,

algorithmic and technical models, with little or no influence of

individuals over the portfolio positioning. Strategies which employ an

investment process designed to identify opportunities in markets

exhibiting trending or momentum characteristics across individual

instruments or asset classes. Strategies typically employ quantitative

process which focus on statistically robust or technical patterns in

the return series of the asset, and typically focus on highly liquid

instruments and maintain shorter holding periods than either

discretionary or mean reverting strategies. Although some strategies

seek to employ counter trend models, strategies benefit most from an

environment characterized by persistent, discernible trending

behavior. Systematic Diversified strategies typically would expect to

have no greater than 35% of portfolio in either dedicated currency or

commodity exposures over a given market cycle.

Information ratio

: A measure of risk-adjusted return. The average excess return (over

an appropriate benchmark or risk-free rate) is divided by the standard

deviation of these excess returns. The higher the measure, the higher

the risk-adjusted return. The Information Ratio of the benchmark will

equal zero.

J.P. Morgan High Yield Index

: Designed to mirror the investable universe of the U.S. dollar global

high yield corporate debt market, including domestic and international

issues.

Loan-to-value ratio (LTV)

: A lending risk assessment ratio that financial institutions and

other lenders examine prior to approving a mortgage. Typically,

assessments with high LTV ratios are generally seen as higher risk

and, therefore, if the mortgage is accepted, the loan will generally

cost the borrower more.

Russell 2000® Index

: Measures the performance of the 2,000 smallest companies in the

Russell 3000® Index, which represents approximately 8% of the total

market capitalization of the Russell 3000 Index. As of the latest

reconstitution, the weighted average market capitalization was

approximately $732 million; the median market capitalization was

approximately $306 million. The largest company in the index had an

approximate market capitalization of $1.7 billion and the smallest of

$78 million.

S&P 500 Index

: Consists of 500 stocks chosen for market size, liquidity and

industry group representation. It is a market value-weighted index

(stock price times number of shares outstanding), with each stock's

weight in the Index proportionate to its market value. The "500" is

one of the most widely used benchmarks of U.S. equity performance. As

of September 16, 2005, S&P switched to a float-adjusted format, which

weights only those shares that are available to investors, not all of

a company's outstanding shares. The value of the index now reflects

the value available in the public markets.

S&P GSCI Index

: Formerly known as the S&P Goldman Sachs Commodity Index, the S&P

GSCI Index serves as a benchmark for investment in the commodity

markets and as a measure of commodity performance over time. It is a

tradable index that is readily available to market participants of the

Chicago Mercantile Exchange. The index was originally developed by

Goldman Sachs. In 2007, ownership transferred to Standard & Poor's,

who currently own and publish it. Futures of the S&P GSCI use a

multiple of 250. The index contains a much higher exposure to energy

than other commodity price indices such as the Bloomberg Commodity

Index.

U.S. Dollar Index

: Measures the performance of the U.S. Dollar against a basket of

currencies: EUR, JPY, GBP, CAD, CHF and SEK. It includes nine chart

types, one up to 1,000 periods and a vast range of customizable

technical indicators.

Risk Considerations

While hedge funds offer you the potential for attractive returns and

diversification for your portfolio, they also pose greater risks than

more traditional investments. There is no guarantee that any fund will

meet its investment objective. An investment in hedge funds is only

intended for sophisticated investors. Investors may lose all or a

substantial portion of their investment.

You should consider the risks inherent with investing in hedge funds:

Leveraged and Speculative Investments

-An investment in hedge funds is speculative and involves a high

degree of risk. Hedge funds commonly engage in swaps, futures,

forwards, options and other derivative transactions that can result in

volatile fund performance. Leveraging may increase risk in hedge

funds.

Limited Liquidity

-There are limited channels in the secondary market through which

investors can attempt to sell and/ or purchase interests in hedge

funds; and an investor's ability to transact business in the secondary

market is subject to restrictions on transferring interest in hedge

funds. Hedge funds may suspend or limit the right of redemption under

certain circumstances. Thus, an investment in hedge funds should be

regarded as illiquid.

Absence of Regulatory Oversight

-Hedge funds are not required to be registered under the U.S.

Investment Company Act of 1940; therefore hedge funds are not subject

to the same regulatory requirements as mutual funds.

Dependence upon Investment Manager

-The General Partner or manager of a hedge fund normally has total

trading authority over its respective fund. The use of a single

advisor applying generally similar trading programs could mean the

lack of diversification and, consequently, higher risk.

Foreign Exchanges

-Selective hedge funds may execute a portion of their trades on

foreign exchanges. Material economic conditions and/or events

involving those exchanges may affect future results.

Fees and Expenses

-Hedge funds often charge high fees; such fees and expenses may offset

trading profits. Fees on funds of funds are in addition to the fees of

underlying funds, resulting in two layers of fees. Performance or

incentive fees may incentivize the manager of those funds to make

riskier investments.

Complex Tax Structures

-Hedge funds may involve complex tax structures and delays in

distributing important tax information.

Limited Reporting

-While hedge funds generally may provide periodic performance reports

and annual audited financial statements, they are not otherwise

required to provide periodic pricing or valuation information to

investors.

Business and Regulatory Risks of Hedge Funds

-Legal, tax and regulatory changes could occur during the term of a

hedge fund that may adversely affect the fund or its managers.

In addition to these risk considerations, specific risks will apply to

each hedge fund based on its particular investment strategy. Any

investment decision with respect to an investment in a hedge fund or a

private equity fund of funds should be made based upon the information

contained in the Confidential Private Placement Memorandum of that

fund.

Hedge Fund Data and Analyses

-The hedge fund data contained in this material is based upon internal

analyses of information obtained from public and third-party sources.

Any returns shown were constructed for illustrative purposes only.

There are numerous limitations inherent in the data presented,

including incompleteness and unavailability of hedge fund holdings,

activity and performance data (i.e., unavailability of short activity

and intraquarter activity), and the reliance upon assumptions. No

representation or warranty is made as to the accuracy of the

information shown, the reasonableness of the assumptions used, or that

all assumptions and limitations inherent in such analysis have been

fully stated or considered. Changes in assumptions may have a material

impact on the data and the results presented. The simulated, estimated

and expected returns and characteristics constructed for any hedge

fund strategies are shown for illustrative purposes only, and actual

returns and characteristics of any fund or group of funds may differ

significantly from any simulated, estimated and expected returns

shown. All return data is shown net of fees and other expenses and

reflect reinvestment of any dividend and distributions.

This material is provided for informational purposes only and nothing

herein constitutes investment, legal, accounting or tax advice, or a

recommendation to buy, sell or hold a security. Information is

obtained from sources deemed reliable, but there is no representation

or warranty as to its accuracy, completeness or reliability. All

information is current as of the date of this material and is subject

to change without notice. Any views or opinions expressed may not

reflect those of the firm as a whole. Neuberger Berman products and

services may not be available in all jurisdictions or to all client

types.

This material may include estimates, outlooks, projections and other

"forward-looking statements." Due to a variety of factors, actual

events may differ significantly from those presented. Investing

entails risks, including possible loss of principal. Investments in

hedge funds and private equity are speculative and involve a higher

degree of risk than more traditional investments. Investments in hedge

funds and private equity are intended for sophisticated investors

only. Indexes are unmanaged and are not available for direct

investment. Past performance is no guarantee of future results.

All information as of the date indicated, except as otherwise noted.

Firm data, including employee and assets under management figures,

reflect collective data for the various affiliated investment advisers

that are subsidiaries of Neuberger Berman Group LLC.

This material is being issued on a limited basis through various

global subsidiaries and affiliates of Neuberger Berman Group LLC.

Please visit

www.nb.com/disclosure-global-communications for the

specific entities and jurisdictional limitations and restrictions.

The "Neuberger Berman" name and logo are registered service marks of

Neuberger Berman Group LLC.

© 2009-2016 Neuberger Berman LLC. | All rights reserved

The views and opinions expressed herein are the views and opinions of

the author and do not necessarily reflect those of Nasdaq, Inc.

|