OMPUTER

ASSOCIATES, embroiled in one of the nation's longest-running accounting

fraud investigations, announced on Friday that Sanjay Kumar, its chief

software architect and former chief executive, was finally making his

exit.

OMPUTER

ASSOCIATES, embroiled in one of the nation's longest-running accounting

fraud investigations, announced on Friday that Sanjay Kumar, its chief

software architect and former chief executive, was finally making his

exit.

|

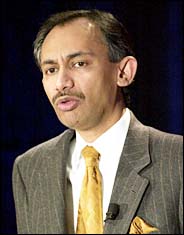

Bloomberg News

Sanjay

Kumar said he is leaving

Computer

Associates altogether. |

In a blinding glimpse of the obvious, Mr. Kumar, who clung to the

company even as investigators from the Justice Department and the

Securities and Exchange Commission inched closer, said: "It has become

increasingly clear to me in the past few days that my continued role at

C.A. is not helping the company's efforts to move forward."

Is the company really trying to move forward? Mr. Kumar's

defenestration is only the last in a line of disappointingly incremental

moves by

Computer Associates International to clean house. The company does

not seem to understand that such big problems - a recent $2.2 billion

restatement of sales booked during 1999 and 2000 and a federal

investigation that has produced four guilty pleas among former managers,

including a chief financial officer - require decisive and comprehensive

action.

Lewis S. Ranieri, a Computer Associates director since 2001 and

former Wall Streeter, is running the company now. It is something of a

mystery why Mr. Ranieri, known as an aggressive trader in his years at

Salomon Brothers, has not acted more boldly to set the company on a

fresh course.

|

Associated Press

Lewis S. Ranieri

|

An especially odd move was the company's ludicrously lowball, $10

million offer to the United States government to make the twin

investigations go away. The offer, described as "initial," was disclosed

in a company filing last month.

The $10 million offer matches what Computer Associates paid two years

ago to Sam Wyly, a dissident shareholder, to get him to pipe down. Mr.

Wyly, a Texas investor, accepted the money and dropped a challenge he

had made to elect five new members to the Computer Associates board.

Maybe the company figured that what worked with Mr. Wyly could work

with Uncle Sam. But offering the same amount to the government

investigating allegations of accounting fraud seems wildly

inappropriate, to put it mildly.

An even larger question is this: What's up with the notion of

offering $10 million of shareholders' money to settle with the

government? If the government finds that management misconduct occurred

at Computer Associates, it seems wrong to ask the shareholders to pay

for a settlement.

GARY LUTIN, an investment banker at Lutin & Company in New York,

conducted a nonpartisan forum for Computer Associates' shareholders

during a proxy fight in 2001. In a letter last week, he asked Mr.

Ranieri to withdraw the offer and instead tell shareholders what he was

doing to fix the company. "As you must know, management's effort to

appease their investigators with corporate funds - the property of

shareholders, the victims whose interests the investigators are

protecting - has not improved investor confidence," Mr. Lutin wrote.

Dan Kaferle, a Computer Associates spokesman, said that Mr. Ranieri

had received the letter but that the executive would not comment on it.

By the way, there is still no word on whether Mr. Kumar will have to

give up any of the outsized pay he received for the years in which

Computer Associates has restated its results. In 2000, for example, he

received $13 million in salary, bonus and restricted stock awards.

Lawyers for Mr. Kumar have said he has done nothing wrong.

"Decisions on compensation have been deferred until the resolution of

the government's investigation," Mr. Kaferle said.

Why? "The government is investigating whether the accounting

miscalculations were a result of criminal conduct," Mr. Lutin said. "But

there is no question about whether the numbers were miscalculated, so

why does the company need to wait for the result of the government's

investigation to adjust compensation?"

And last April, Mr. Kumar received $7.6 million in restricted

Computer Associates stock, which vests over the next three years.

Unfortunately for investors, Computer Associates is by no means alone

in responding so glacially to crisis. A study conducted for the Center

for Corporate Change in Beaver Creek, Colo., found that many companies

continue to reject major change. R. Bruce Hutton, a marketing professor

at the Daniels College of Business at the University of Denver, helped

conduct the study. He said: "While external forces - legal action,

investor pressure - have gotten stronger, the internal abuses -

accounting fraud, consumer misrepresentation, even compensation -

actually seem to have gotten worse."

Some companies and people "get it," Mr. Hutton said, and are doing

what's right.

But the overall picture remains dispiriting.

"I don't think anybody believes that we've seen the end of the

discovery process of how broke the system is," he said. "The problem is

us, and that we've lost our bearings in some kind of systemic way."

Agreed.