|

|

If Dell Deal Fails, Look Out Below |

|

By Steven Russolillo

| |

— ZUMAPRESS.com

|

If the closely

watched deal to take

Dell Inc. private doesn’t pass, the stock price could be in for an ugly

tumble.

Shareholders are

scheduled to vote this Wednesday on

Michael Dell

and Silver Lake Partners’ $24.4 billion buyout offer, after the PC maker

delayed last week’s vote, which at the time looked likely to fail. The

company and its potential buyers are now trying drum up enough support of

the deal through renewed sales pitches.

“By all accounts,

it appears the vote to take Dell private will be a nail-biter,” says Chris

Whitmore, research analyst at

Deutsche Bank.

Should the

$13.65-a-share buyout fail, he predicts the stock would fall to about $9.

“If shareholders

vote down the deal, we’d expect a proxy fight to ensue and the future of

Dell (and its strategy) to become highly uncertain,” Whitmore says.

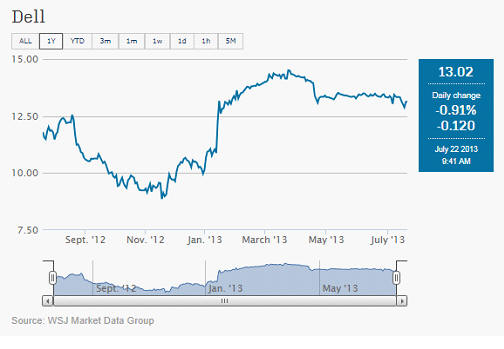

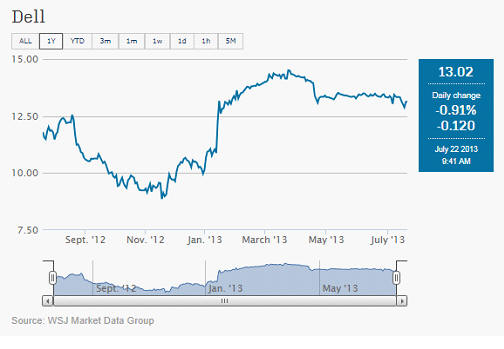

Shares closed

Friday at $13.14 and have traded in the $13-and-$14 range throughout much of

the five-month fight for the technology company. “We see roughly 30%

downside to Dell’s share price if the deal were to collapse,” he says.

Here’s a look at

Dell’s stock price over the past 12 months, including the spike earlier this

year after reports initially broke about Mr. Dell’s intentions to take the

company private.

Last week, Dell and

Silver Lake appeared to fall short of the 751 million shares they needed to

win approval. Only about 77% of the eligible shares voted, a turnout low

enough to spook the company into adjourning the vote for fear of failure.

Since shares not cast count as no votes, the buyout group has targeted a

turnout of 85%. Wednesday’s count will come down to whether an additional

days of cajoling by the buyout camp is successful at increasing the turnout.

If the proxy

solicitors charged with trying to sway holders for Mr. Dell and Silver Lake

fail to get out the vote or flip a few key votes to their side, as they

appeared to just ahead of last week’s deadline, the vote could be in trouble

again.

In addition to the

drama surrounding the deal, the fundamentals surrounding Dell’s core PC

business look troublesome. “Insights gleaned from

Microsoft's recent earnings call paint a concerning picture for

medium-term PC corporate demand,” Whitmore says.

For instance,

Microsoft last week said about 75% of its installed base has moved from XP

and onto Windows 7, “which suggests the low hanging fruit in this corporate

PC refresh cycle has been peaked,” Whitmore says.

“The decline of

this relatively high margin segment of the PC industry and ongoing tablet/smartphone

cannibalization in both the consumer and corporate PC market will likely

translate into several years of declining revenue and margin pressure across

the PC industry,” Whitmore says.

“With a proxy fight

looming in a ‘no’ scenario in the Dell shareholder vote and PC industry

fundamentals under considerable strain, we’d think twice before voting

against a bird in the hand.”

–David Benoit

contributed to this post.

|

Copyright ©2013 Dow Jones & Company, Inc. All Rights

Reserved |

|