|

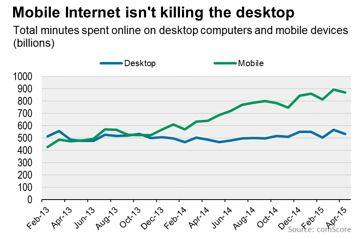

Mobile Isn’t Killing the Desktop Internet |

|

By

Jack Marshall

People are increasingly accessing online content on mobile devices,

but that doesn’t mean the desktop is in decline.

A theory sometimes bandied about the media industry says audiences are

deserting desktops and “going mobile” instead. But actually, data from

online measurement firms doesn’t seem to support that view, at least

at the aggregate market level.

The share of overall consumption coming from mobile devices is

growing, but desktop web usage isn’t dropping. In fact, it might be

increasing.

| |

─

comScore |

According to data from comScore, for example, the overall time spent

online with desktop devices in the U.S. has remained relatively stable

for the past two years. Time spent with mobile devices has grown

rapidly in that time, but the numbers suggest mobile use is adding to

desktop use, not subtracting from it.

“The key thing to remember is that percentages are not zero-sum,” said

Tony Haile, CEO of online analytics firm Chartbeat. “You can have

mobile growing to 50% of your traffic and desktop traffic remaining

healthy.”

According to Mr. Haile, mobile devices are actually “unlocking” new

Web time in the morning and the evening, while desktop traffic remains

dominant during weekdays.

In other words: mobile’s share of traffic is growing, but the overall

pie is growing too.

That understanding has important implications for media owners and

marketers, who often say they’re altering their sites and strategies

to cater for their growing mobile audiences. It makes sense to

optimize for mobile if that’s a large and growing audience, but mobile

isn’t the only game in town. In fact, it seems desktop Internet use is

here to stay, for the time being at least.

.”

|