|

|

Social media fail to replace direct

company contact |

|

by

Garnet Roach |

|

Digital and social media

make gains but direct company information remains most important

Social media are becoming

increasingly important, according to new research, but have done

little to tear investors away from their primary source of

information: companies themselves.

There’s no doubt the investment community is embracing social media;

more than 200,000 investors, market professionals and public companies

now share information through StockTwits, according to the company,

which was launched in 2008, and Twitter got its own trading platform

earlier this month in the form of DCM Dealer.

In fact, investor

interaction with digital and social media is increasing

‘substantially’, according to new research from the Brunswick Group.

Of almost 500 investors and sell-side analysts in Europe, the US and

Asia surveyed by Brunswick, more than half read blogs, a quarter use

social networks and 30 percent now use Twitter – a 19 percentage point

increase since the study was last conducted in 2010.

‘Use and engagement of digital and social media among those in the

investment community is increasing rapidly,’ says Rachelle Spero,

partner at Brunswick, in a company press release.

‘More telling, however, is that their influence on investment

decisions continues to grow, too. Now, a quarter of those surveyed say

they have made an investment decision or recommendation after

initially reading a blog. For Twitter, that figure is one in eight, up

considerably from our last survey two years ago. This suggests now is

the time for companies to adopt digital and social media for

investor-related content distribution and influencer engagement.’

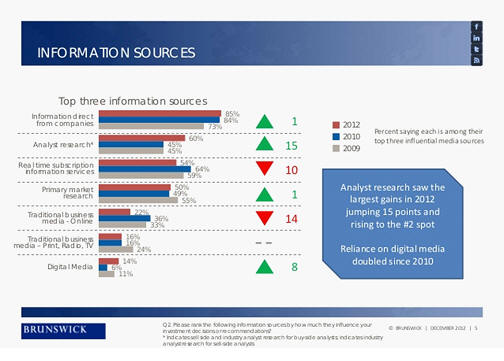

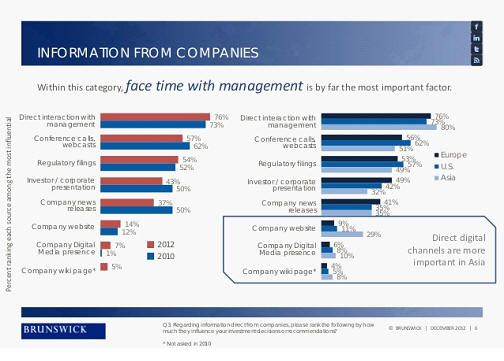

Overall, digital reliance has doubled since 2010, says Brunswick, with

the big push coming from Asia, where investors are more likely than

counterparts in the US or Europe to take action based on digital

information or to rely on a digital relationship with a company.

‘The intensive use of social media as an information channel in Asia

is a surprise to me,’ says Patrick Kiss, investor relations expert and

founder of the IR Club in Germany. He adds that the US ‘as creators of

most of the social media tools’ is lagging behind.

Spero says this can be explained to some extent by demographics.

‘Asian populations tend to be much younger than the rapidly aging

populations in the West. Our data shows investors surveyed in Asia as

being a little younger than those in Europe or North America,’ she

says, adding that the blocking of social media networks by some

companies in the US ‘for a number of reasons including legal,

regulatory, and security’ could also have an impact.

Almost a quarter of Asian investors and analysts say information

posted on a micro-blogging site – such as Twitter – has led to an

investment decision or recommendation, yet the same is true for only 4

percent in the US. A similar gap can be seen when it comes to social

networks, though the gulf closes to 28 percent for Asia and 24 percent

in the US when it comes to blogs.

While Brunswick reports that 86 percent of investors say online

resources have become more important this year, it seems nothing can

replace traditional sources. More than half (57 percent) still rank

‘information direct from the company’ as the biggest influence on

their investing decisions, while 85 percent put it in their top three

– an increase from 84 percent in 2010 and 73 percent in 2009.

Unsurprisingly, access to senior management is the most important

factor within this category. This compares with 14 percent who place

‘digital and social media’ in the top three most influential sources,

up from 6 percent in 2010.

Kiss says it is no surprise investors want information direct from

companies. ‘This was and always will be the best, unfiltered source,’

he explains. ‘But only institutional investors have the chance to meet

the CEO in person. Social media could be tools for investor democracy,

a direct way to inform 85 percent of private investors, too.’

With the clearly growing importance of social media, Kiss adds that

changes in information dissemination can take time and a breakthrough

could be on the cards. ‘In former times companies sent out faxes;

nowadays they email information,’ he says. ‘Maybe in the future

they’ll tweet.’

©

Copyright Cross Border Ltd. 1995–2013. All rights reserved. |