Posted by Matteo Tonello, The

Conference Board, on Thursday May 29, 2014 at

9:35

Activist hedge funds

merit the attention of corporate directors, as the value of the assets

under management increases and activist funds’ targets expand well

beyond small capitalization companies. This post reviews the tactics

used by two prominent activist hedge fund managers to create change in

13 companies in their portfolio and highlights four perceived

governance failures at target companies that attracted activist funds’

attention. This post also includes a review of characteristics of

activist hedge funds, the incentives their managers have to generate

positive returns, and current research investigating whether and how

hedge fund activism affects target companies.

The value of assets managed

by activist hedge funds has increased dramatically in recent years. A

study by eVestment documents a seven-fold increase in the assets managed

by such funds from $23 billion in 2002 to an estimated $166 billion in

early 2014. The momentum continues, with total new capital inflows into

activist funds reaching $6 billion in the first quarter of 2014, which

represents approximately 30 percent of all inflows into event driven

funds. According to eVestment, activism continues to be among the

best-performing primary fund strategies, posting returns of nearly 10

percent since October 2013 and 18 percent for the year. The number of

shareholder activist events has also increased—from 97 events in 2001 to

219 events in 2012. Those trends have led some observers to characterize

activist hedge funds as the “new sheriffs of the boardroom.” By 2013, an

estimated 100 hedge funds had adopted activist tactics as part of their

investment strategies.

As such, it is increasingly

important for directors to become knowledgeable of the tactics activists

use to advance investor arguments for changes in target companies. In

particular, and as recommended by The Conference Board and its Expert

Committee on Shareholder Activism, directors should consider maintaining

detailed profiles of hedge funds with material investments in the

company’s securities.

This post adds to the store

of knowledge available on how this class of hedge funds operates by

focusing on the tactics deployed by two prominent figures in the activist

world: Carl Icahn of Icahn Enterprises and William “Bill” Ackman of

Pershing Square Capital Management. The discussion is particularly timely

because Icahn and Ackman have recently agreed to end their prolonged feud,

with Ackman suggesting that “[t]here is a much greater possibility that we

are on the same side than the opposite.”

Hedge

Fund Activism, in a Nutshell

A few words on hedge

funds

While there is no generally

agreed-upon definition of a hedge fund (a Securities and Exchange

Commission roundtable discussion on hedge funds considered 14 different

definitions) hedge funds are usually identified by four characteristics:

-

they are pooled, privately

organized investment vehicles;

-

they are administered by

professional investment managers with performance-based compensation and

significant investments in the fund;

-

they cater to a small number

of sophisticated investors and are not generally readily available to

the retail investment market; and

-

they mostly operate outside of

securities regulation and registration requirements.

The typical hedge fund is a

partnership entity managed by a general partner; the investors are limited

partners who have little or no say in the hedge fund’s business. Hedge

fund managers have strong incentives to generate positive returns because

their pay depends primarily on performance. A typical hedge fund charges

its investors a fixed annual fee of 2 percent of its assets plus a 20

percent performance fee based on the fund’s annual return. Although

managers of other institutions can be awarded bonus compensation based in

part on their performance, their incentives tend to be more muted because

they capture a much smaller percentage of any returns and the Investment

Company Act of 1940 limits performance fees.

Unlike mutual funds, which

are generally required by law to hold diversified portfolios and sell

securities within one day to satisfy investor redemptions, hedge funds are

not subject to diversification and prudent investment requirements. Hedge

funds can also allocate large portions of their capital to a few target

companies, and they may require that investors “lock-up” their funds for a

period of two years or longer. Moreover, because hedge funds do not fall

under the Investment Company Act regulation, they are permitted to trade

on margin and engage in derivatives trading, strategies that are not

available to institutions such as mutual and pension funds. As a result,

hedge funds have greater flexibility in trading than other institutions.

Hedge funds also differ from

pension funds and many other institutional investors because they are

generally not subject to heightened fiduciary standards, such as those

embodied in ERISA. Another difference is that, unlike pension funds, hedge

funds are not subject to state or local influence or political control.

The majority of hedge fund investors tend to be wealthy individuals and

large institutions, and hedge funds typically raise capital through

private offerings that are not subject to extensive disclosure

requirements. Although hedge fund managers are bound by antifraud

provisions, funds are not otherwise subject to more extensive regulation.

Finally, hedge fund managers typically suffer fewer conflicts of interest

than managers at other institutions. For example, unlike mutual funds that

are affiliated with large financial institutions, hedge funds do not sell

products to the companies whose shares they hold.

Hedge fund managers have

powerful and independent incentives to generate positive returns. Although

many private equity or venture capital funds also have these

characteristics, they are distinguished from hedge funds because of their

focus on particular private capital markets. Private equity investors

typically target private companies or going private transactions, and they

acquire larger percentage ownership stakes than activist hedge funds.

Venture capital investors typically target private companies exclusively,

with a view to selling the company, merging, or going public, which means

they invest at much earlier stages than both private equity and activist

hedge funds. Nevertheless, the lines between these investors are often

blurred, particularly between some private equity firms and activist hedge

funds that pursue multiple strategies.

Trends in hedge fund

activism

Hedge funds may adopt

activist tactics as part of their investment strategies, and there has

been a significant increase in the value of assets managed by such funds.

Studies document a seven-fold increase in the assets managed by such funds

from 2002 ($23 billion) to early 2014 ($166 billion) in activist fund

assets under management (AUM), with total new investments by the top 10

activist funds reaching $30 billion in 2013. The rising AUM and

increasingly bold activism have contributed to the business press

identifying activist hedge funds as the “new sheriffs of the boardroom.”

One particularly important

channel through which activist hedge funds implement their strategies is

by requesting that a certain matter be put to a vote at the target

company’s annual shareholder meeting. In 2013, hedge funds submitted 24

shareholder proposals (3 percent of all shareholder proposals), up from 20

proposals in 2012 but below the 33 proposals filed in 2009.Hedge funds

waged the majority of proxy contests in 2013, accounting for 24 of the 35

contests at Russell 3000 companies. They have consistently been the most

active dissident type, constituting the largest percentage of contests

waged (69 percent of the total in Russell 3000 in 2013, up from 39 percent

in 2009). Most important, they were highly likely to succeed in these

contests, winning or earning partial victories in 19 of the 24 contests

waged.

Targets of hedge fund

activism

There are a limited number of

systematic studies of hedge fund activism, but those that are available

provide important insights, both on hedge-fund tactics and their effects

on the target company. Hedge-fund activists tend to target companies with

low market value relative to book value, although target companies are

profitable with consistent operating cash f lows and positive return on

assets. Dividend payout at target companies before an activist

intervention is generally lower than that at comparable companies. Target

companies also have more takeover defenses and pay their CEOs considerably

more than comparable companies. Historically, relatively few targeted

companies are large-cap companies, which is not surprising given the

comparatively high cost of amassing a meaningful stake in such a target.

Targets exhibit significantly higher institutional ownership and trading

liquidity, making it somewhat easier for activists to acquire a

significant stake quickly. However, as activism evolves into an investment

class of its own and attracts more and more capital, the characteristics

of their target companies may be changing: in 2013, for the first time,

almost one-third of shareholder activism took place in companies with

market capitalizations of more than $2 billion. In addition, only 23

companies targeted by activist investors were larger than $10 billion in

2012; by 2013, that number jumped to 42 companies.

Does activism

generate value?

There is substantial debate

about the extent to which activist events affect target company value. A

study by Alon Brav, Wei Jiang, Randall S. Thomas, and Frank Partnoy

documents a 7 percent abnormal stock return around the filing of a

Schedule 13D (an indication of an activist fund’s investment in a target

company), suggesting that market participants view hedge fund activism as

value creating. Most important, the same study finds that the favorable

effect on stock price does not reverse within the following year.

According to these findings, it appears that promising returns depend on

what the activists demand. Activism that targets the sale of the company

or changes in business strategy, such as refocusing and spinning-off

noncore assets, is associated with the largest positive abnormal partial

effects. In contrast, there is little evidence of a favorable market

reaction to capital structure-related activism—including debt

restructuring, recapitalization, dividends, and share repurchases— or to

governance-related activism—including attempts to rescind takeover

defenses, oust CEOs, enhance board independence, and curtail CEO

compensation.

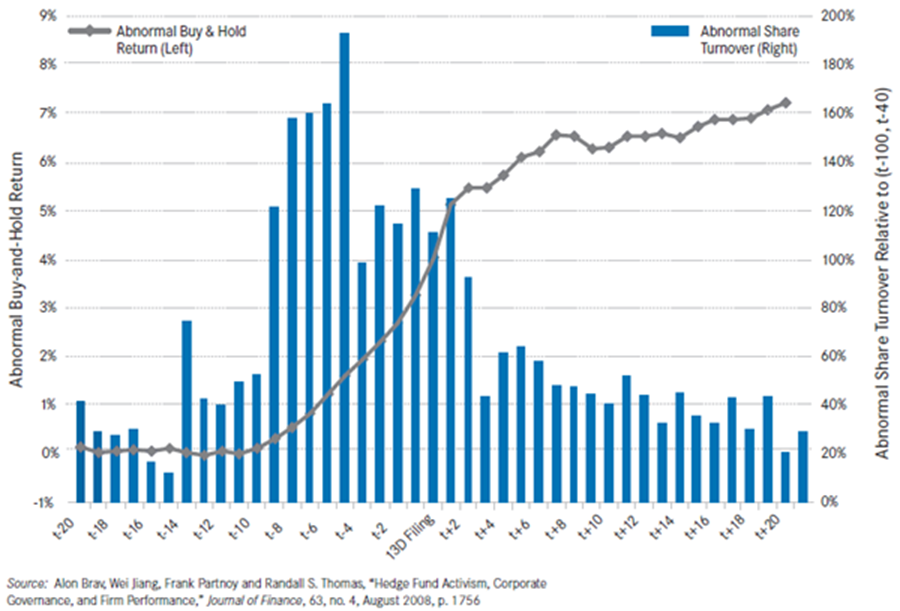

Chart 1. Number of

large-cap companies targeted by activist investors (2010–2013)

Chart 2. Buy-and-hold

abnormal return around the filing of Schedule 13Ds

The solid line (left axis)

plots the average buy-and-hold return around the Schedule 13D filing, in

excess of the buy-and-hold return of the value weighted market, from 20

days prior the 13D file date to 20 days afterwards. The bars (right axis)

plot the increase (in percentage points) in the share trading turnover

during the same time window compared to the average turnover rate during

the preceding (-100, -40) event window.

A separate but related study

by Robin Greenwood and Michael Schor argues that the documented increase

in stock returns is largely concentrated among activist interventions that

involve a subsequent takeover, suggesting there is little relation between

hedge fund activism and returns when a takeover is not part of the

activist strategy. Aside from equity performance, other investigations

reveal that activist interventions by hedge funds are associated with

improvements in the operating performance of the target company, changes

in corporate governance, lower CEO compensation, higher sensitivity of CEO

turnover to company performance, and higher rates of director turnover.

Activist tactics

While activists generally

propose a wide variety of changes to targeted companies, approximately 45

percent seek changes in corporate governance and the remaining 55 percent

pursue non-board-related proposals. In 2013, the 24 shareholder proposals

submitted by activist hedge funds were mostly concentrated on asset

divestiture, capital distributions, the election of dissidents’ director

nominees, and the removal of board members. Hedge funds led the majority

of contests seeking board representation last year, representing 14 proxy

contests out of the 22 motivated by the election of a dissident’s

nominee(s) to the board of directors.

The following discussion

provides detailed insights into the tactics used by two prominent activist

hedge fund managers—Carl Icahn of Icahn Enterprises and Bill Ackman of

Pershing Square Capital Management—to effect change in 13 target companies

from 2002 through 2014. The review highlights four perceived corporate

governance failures at target companies that attract the attention of

activist funds.

Specifically, hedge fund

activism is more likely when an entrenched board fails to:

- establish a clear

corporate strategy;

- replace a CEO in a timely

manner, impeding the execution of the corporate strategy;

- seek alternative uses for

the company’s valuable noncore assets (for example, through divestiture)

or fails to maximize shareholder value when taking the company private;

- distribute “sufficient”

levels of cash to shareholders through dividend payouts and share

repurchase programs.

In addition to these

perceived governance failures, the analysis of Ackman’s hostile

interaction at Herbalife, Inc. and Allergan provide timely examples of

potential emerging trends in hedge fund activism: the use of derivative

instruments to target companies with a perceived overvaluation of equity

given the company’s economic fundamentals (Herbalife) and combining

efforts with a public company to launch a hostile takeover bid of another

public company (Allergan).

The

Activism of Icahn Enterprises

Carl Icahn is chairman of

Icahn Enterprises, a diversified holding company which trades on the

NASDAQ and has a market capitalization of $12 billion.

Icahn recently stated that

“[t]here are lots of good CEOs in this country, but the management in many

companies leaves a lot to be desired. What we do is bring accountability

to these underperforming CEOs when we get elected to the boards.” Icahn’s

statement highlights one of his main activist strategies: identifying

companies with perceived managerial deficiencies and attempting to gain a

board seat(s) to discipline boards that fail to remove poorly performing

managers.

The case studies reinforce

his image as an activist investor who buys large stakes in companies he

believes to be undervalued and then seeks to change the business. The

studies reveal that Icahn’s primary activist tactic is to identify boards

whose directors are unable to deftly navigate fundamental issues with

corporate strategy, perhaps due to a failed acquisition (Yahoo!) or

multiple strategic setbacks (Netflix, Dell). In addition, Icahn targets

boards whose directors do not adequately identify profitable uses of the

company’s assets, whether the assets are patent portfolios (Motorola),

cash reserves (Apple), or a division (eBay). His recent effort at eBay to

target the corporate governance practices of a Silicon Valley company is

new and might signal an emerging trend in hedge fund activism.

Icahn actively uses various

media channels to advance his agenda. He frequently issues open letters to

the shareholders of his targets, appears on television, and makes

statements via social media and his Shareholders’ Square Table website. As

a result, corporate boards should have an integrated, cross-platform

response to the various types of public messages that activist fund

managers may employ to reach a diverse shareholder base and communicate

their message to market participants in general.

Motorola (2007-2011)

Tactics:

Proxy contest to gain board representation; public statements and letter

to shareholders; access to company records; threat of litigation

Outcome:

Spin off and sale of company for a 63 percent premium over closing price

On January 30, 2007, Icahn

revealed that he had accumulated 33.5 million shares of Motorola,

representing 1.4 percent of the company prior to its split into Motorola

Mobility and Motorola Solutions. Icahn met with Motorola CEO Ed Zander to

discuss Icahn’s proposal for the company to buyback $12 billion in company

stock. Motorola was struggling as sales of the KRZR mobile phone were

below expectations. By April 2007, Icahn had launched a proxy contest to

gain a seat on the board. He faulted Motorola’s directors as a “passive

and reactive board, which failed to timely steer management in the right

direction.” However, on May 7, 2007, the preliminary results of a

shareholder vote revealed that the activist had failed to win a seat on

the board, despite increasing his ownership stake to 2.9 percent.

In 2008, Icahn changed his

tactics. On March 24, he announced that he was suing Motorola to be

granted access to documents related to its mobile device business that

would be critical for assessing whether the board of directors had failed

to protect Motorola’s shareholders. In a heated letter to shareholders, he

nominated his own candidates for the board and said, “It is essential to

the future of Motorola that its directors realize that the BOARD,

especially at this precarious time, is NOT A COUNTRY CLUB OR A FRATERNITY,

and that truly ‘qualified’ people whose interests are truly aligned with

stockholders are needed on the board in order to save Motorola.” By that

time, Icahn had further increased his stake in Motorola to 6.3 percent (or

142 million shares). Two days later, the board gave in to the pressure

resulting from Icahn’s public campaign and announced that Motorola would

split into two entities, a mobile phone unit and a set-top box and

communications equipment unit. By April 8, 2008, Motorola had agreed to

appoint two of Icahn’s nominees to the board in exchange for the dismissal

of his litigation against the company.

Icahn continued to increase

his Motorola holdings, and he owned 10.4 percent (247.1 million shares) by

August 2010.After a delay due to the economic crisis, Motorola finally

split into Motorola Mobility and Motorola Solutions on January 3, 2011.On

August 15, 2011, Google announced that it would buy Motorola Mobility for

$12.5 billion, representing a 63 percent premium over its previous closing

price. The acquisition was spurred in part by Icahn who, in July of that

year, had encouraged Motorola to sell its lucrative portfolio of mobile

phone patents.

Yahoo! Inc.

(2008-2010)

Tactics:

Proxy contest to gain board representation or control

Outcome:

$320 million loss in two years; Icahn and two directors appointed to

board; failed CEO succession; exited position

In May 2008, Icahn purchased

50 million shares of Yahoo and launched a proxy contest to gain control of

its board of directors. Yahoo was losing ground to Google and Microsoft in

the core search market, and there was growing disappointment with Yahoo’s

management team, which nixed Microsoft’s offer to buy the company for a 35

percent premium. Icahn stepped up his rhetoric and accused CEO and

cofounder Jerry Yang and the Yahoo board of being entrenched and unwilling

to truly consider an acquisition offer. By August 2008, Yahoo’s board

agreed to provide Icahn a board seat and expand the board to 11 directors,

allowing Icahn to appoint two directors himself. Icahn sought to replace

Yang, who had assumed the CEO post at the board’s request in June 2007.

Yang relinquished the CEO

position in November 2008, and Carol Bartz became chief executive three

months later. Upon her appointment, Bartz was praised for her technology

sector experience and her status as an outsider who could bring a fresh

perspective to both the board and the company’s strategy. While Icahn was

critical of Yang, and he and his two affiliated directors were Yahoo board

members when Bartz was appointed as CEO, the extent of Icahn’s involvement

in selecting Bartz is unclear.

Bartz’s tenure was

controversial, and she was terminated, reportedly by phone, in early

September 2009.In October 2009, Icahn resigned from the board and his

departure was reported to be on amicable terms. When he resigned, Icahn

stated that it was no longer “necessary at this time to have an activist

on the board.” From October 2009 through May 2010, Icahn slowly exited his

position. He reportedly lost an estimated $320 million on his investment.

Netflix

(2012-present)

Tactics:

Public statement on value resulting from sale of the company

Outcome:

$825 million earnings in 14 months, despite limited or no action against

company; reduced position

On October 31, 2012, Icahn

disclosed a 9.98 percent stake in Netflix. Icahn accumulated his position

at a time when Netflix was reeling from a failed attempt to raise

consumer-subscription prices and split the company into two separate

businesses while simultaneously implementing a cash-draining effort to

expand overseas and develop original content. Icahn used the announcement

of the strategy redirection as an opportunity to tell shareholders that

the company would have “significant strategic value” if it were acquired

by a larger company. On November 5, 2012, the board of directors adopted a

shareholder rights plan that would come into effect if any investor

acquired more than 10 percent of the company.

Between November 2012 and

October 2013, Netflix continued to execute its strategy of growing

international markets and developing original content. During this time,

there were no public statements from Icahn about his interactions with

Netflix management. While it is conceivable that private interactions did

occur, it appears that Icahn supported the company’s management team

during the strategic transition, with an Icahn associate stating that the

company’s management team was “exceedingly competent.” In October 2013,

Icahn reduced his holdings to 4.5 percent, earning $825 million on his

Netflix investment in only 14 months.

Although Icahn’s original

intent at time the he acquired his position appeared to be to press

management to sell the company quickly, it seems that his appreciation for

the company’s strategy and confidence in the management team led him to

maintain a more passive role in the company’s transformation.

Dell Inc. (2013)

Tactics:

Effort to gain board representation or control; public statements on

undervaluation resulting from taking the company private via letters to

shareholders, media interviews, and social media

Outcome:

Estimated $200 million earnings in seven months; failed effort to gain

board representation or control; exited position

In February 2013, Michael

Dell and Silver Lake Partners sought to take Dell private for $13.65 per

share. This price valued the company at $24.4 billion, representing a 37

percent premium over the average share price at that time. Michael Dell

sought to take the company private to enable him to transform the company

free from public scrutiny from a maker of personal computers into a

provider of enterprise computing services. However, several large

shareholders, including Southeastern Asset Management and T. Rowe Price,

opposed the deal, believing that Dell’s bid undervalued the company. Icahn

entered the fray in March 2013, announcing that he had accumulated a 9

percent stake in the company. He began a lengthy and public campaign

against Michael Dell and the company’s board to either prevent Dell from

going private or to force Michael Dell and Silver Lake to increase their

bid.

Icahn used a series of

letters to shareholders, combined with relatively newer tactics via media

interviews and social media, to communicate with Dell’s shareholders and

market participants in general. He called Dell’s board entrenched and

pushed for Michael Dell to be fired and for the entire board to be

replaced. Using rather extreme language, Icahn even appealed for

shareholders to consider “What is the difference between Dell and a

dictatorship?”

Icahn also used legal action

against the company. He tried to get the courts to force Dell to hold its

shareholder meeting at the same time as the special vote on the decision

to go private, thereby giving Icahn a chance to propose a slate of

directors to replace the current board. However, in August 2013, a judge

refused to fast track this lawsuit, which stopped Icahn’s legal efforts on

that front. In a separate effort, Icahn encouraged Dell shareholders to

exercise their right to an appraisal of the transaction, which would allow

shareholders to demand a court hearing on the value of their holdings, a

process that would likely have taken months to navigate the court system.

By July 2013, Michael Dell

and the board had restructured their proposal by increasing their bid to

$13.75 per share plus a one-time dividend of $0.13 per share. Using their

own legal moves, Dell’s board was able to change the company’s voting

rules to ignore shareholder abstentions instead of counting them as “no”

votes, and to change the record date for stockholders to determine

eligibility to vote on the proposed takeover, limiting the rights of

shareholders who purchased their shares recently. Icahn also revealed that

his unnamed CEO-in-waiting backed out at the last minute.

In the end, these setbacks

prompted Icahn to end his opposition to Michael Dell’s bid in September

2013, writing that “The Dell board, like so many boards in this country,

reminds me of Clark Gable’s last words in Gone with the Wind,

they simply ‘don’t give a damn.’”

Apple Co.

(2013-present)

Tactics:

Public statements on need for company to distribute cash to shareholders

Outcome:

More aggressive share buyback plan; maintains position

In April 2013, Apple bowed to

Wall Street pressure and said it would return $100 billion to shareholders

by the end of 2015, double the amount previously set aside. The cash

distributions would include a $60 billion stock repurchase program.

By August 2013, Icahn began

to accumulate a position in Apple, and he started to push for the company

to complete a $150 billion buyback by taking advantage of low interest

rates to borrow funds, a move that Icahn argued could push the company’s

share price back to the $700 level it reached briefly in September 2012.

The following month, he met with Apple CEO Tim Cook to discuss the

potential for a large share buyback program.

In January 2014, Icahn

purchased an additional $500 million of the company’s shares, raising his

total ownership stake to $3.6 billion. On February 10, 2014, Icahn

announced that he was backing down from his nonbinding proposal to force

the company to return cash to shareholders due to opposition by proxy

advisory firm ISS and the company’s announcement of a more aggressive

share buyback plan.

While not entirely

successful, Icahn’s actions did appear to affect the company’s capital

return program. In April 2014, the company increased its share repurchase

authorization to $90 billion from the $60 billion announced in 2013. The

company also increased its quarterly dividend by 8 percent and said it

will split its stock seven-for-one in June 2014.

In addition, the company

announced that it would boost the overall size of its capital return

program to more than $130 billion by the end of 2015, up from its previous

$100 billion plan. To demonstrate his use of social media, Icahn tweeted

that he “agree[s] completely” with Apple’s plans to boost its buyback

plan.

eBay Inc.

(2014-present)

Tactics:

Public statements via letters to shareholders, media interviews, and

social media on need for company to revamp corporate governance practices

and to spin off a division; effort to gain board representation or control

Outcome:

One mutually agreed-upon independent director added to board; failed

attempt to spin off division; maintains position

In January 2014, Icahn

disclosed that he had taken a nearly 2 percent stake in eBay, nominated

two candidates to eBay’s board of directors, and submitted a proposal to

spin-off eBay’s PayPal business. Icahn stated that he was prepared for a

proxy contest, if necessary.

On February 24, Icahn

released an open letter to eBay shareholders, stating that eBay’s lapses

in corporate governance were the “most blatant we have ever seen.” In

particular, Icahn believed there were conflicts of interest among its

board. Icahn highlighted eBay director Marc Andreessen, who has

investments in seven startups that compete with eBay’s PayPal unit and was

part of an investor group that acquired a controlling interest in Skype

from eBay in 2009. Icahn questioned Andreessen’s knowledge of the Skype

deal and what information was withheld from eBay shareholders. In

addition, Icahn claimed that eBay director Scott Cook has material

conflicts of interest; Cook is the founder of Intuit, a PayPal competitor.

eBay’s board responded to

Icahn’s claims, citing Icahn’s “mudslinging attacks.” Icahn subsequently

released eight additional open letters to eBay shareholders from late

February to early March. Icahn was, “growing a bit tired of reading eBay’s

repetitive evasive responses” and stated that he was “demanding an

inspection of eBay’s relevant books and records pursuant to his right as a

stockholder under Delaware corporate law.” eBay’s board replied by stating

that Icahn should “stick to the facts” and challenged him to an “honest,

accurate debate.” In his fifth open letter to eBay shareholders, Icahn

escalated his criticism by accusing eBay CEO John Donahoe for “inexcusable

incompetence” over the Skype deal, costing shareholders over $4 billion.

eBay retaliated by rejecting Icahn’s nominees for its board and

renominating all current directors up for reelection, including Andreessen

and Cook. In addition to publishing open letters on his Shareholders’

Square Table website, Icahn used other forms of media including twitter

and TV appearances.

On April 10, 2014, Icahn and

eBay agreed to settle their months-long debate after Icahn failed to

garner support for a spin-off of eBay’s PayPal unit from the company’s

major shareholders. Under the agreement, Icahn withdrew his two nominees

for board seats and his demands for a PayPal spin-off, while eBay added an

additional, mutually agreed-upon independent director, David Dorman.

The

Activism of Pershing Square

William “Bill” Ackman is CEO

of Pershing Square Capital Management, which, according to a Form 13F

filed December 31, 2013, has $8.23 billion in assets under management.

Ackman has a reputation as a

brazen activist investor who buys large stakes in companies he believes

are undervalued. The case studies—notably, his joint hostile takeover

effort with Valeant Pharmaceuticals at Allergan—reinforce that image and

highlight several differences between his activist approach and that of

Icahn.

In particular, Ackman’s

primary tactic appears to be his hands-on efforts to completely transform

a company, often through substantial changes in both board representation

and top management, as evidenced by his actions at J.C. Penney, Canadian

Pacific Railways, and Air Products and Chemicals. Similar to Icahn, Ackman

targets boards he feels have not adequately identified profitable uses of

the company’s assets, such as his efforts at Target to revamp the

company’s credit card holdings and real estate assets.

In contrast to Icahn, Ackman

is perhaps best known for his high-profile campaigns to bring down his

target companies through detailed and often overwhelming arguments

designed to move a target’s share price. The MBIA and Herbalife cases

demonstrate how Ackman targets companies that he believes are overvalued

given their current economic fundamentals, and the extreme measures he

will take to make the case against the target company’s valuation. His

heavily publicized presentations, often held with little advance notice,

highlight the need for boards of directors to have the ability to quickly

respond to such an attack.

MBIA (2002-2008)

Tactics:

Public statements and presentations challenging the company’s credit

rating

Outcome:

Over $1 billion earnings in six years; exited position

In 2002, Ackman’s first hedge

fund, Gotham Partners, began to scrutinize MBIA, challenging the company’s

AAA credit rating. Ackman released a lengthy report titled, “Is MBIA

Triple A?” that criticized MBIA as too highly leveraged to hold a AAA

credit rating, citing the firm’s high outstanding guarantee liabilities

and a heavy use of off-balance sheet vehicles for fund-raising purposes.

Ackman’s bets against MBIA

eventually paid off in 2007, when reports surfaced of potential trouble

resulting from MBIA’s guarantee of collateralized debt obligations (CDOs).

As of March 31, 2007, MBIA had insured $5.4 billion in subprime

mortgage-backed securities, which reportedly presented “negligible” risk

because the insurer generally insured higher-rated classes of

mortgage-backed securities. MBIA, however, had increased its exposure to

CDOs. MBIA disclosed that, as of the end of 2006, $2.4 billion of the $7.7

billion in mortgage CDOs it had insured were backed by subprime mortgages.

As the economy began to

falter in 2007, Ackman released a presentation provocatively titled “Who’s

Holding the Bag?” that contended MBIA had guarantees on some $5 billion

worth of potentially low-quality securitizations of subprime-mortgages and

other types of asset-backed debt that could ultimately damage the

company’s balance sheet. By October 2007, MBIA’s shares had dropped 40

percent on rising concerns that losses from the mortgage-related

securities the company insured would deplete the capital reserve required

to maintain its AAA credit rating. Ackman profited handsomely from his

position in MBIA as the company’s business eroded during the financial

crisis, contributing to his returns of nearly 26 percent during a period

of economic instability and significant market losses.

Target Corp.

(2007-2011)

Tactics:

Proxy contest to gain board representation or control; public statements

on need for company to spin off a division and sell non-core assets

Outcome:

Partially successful sale of noncore assets; failed proxy contest; exited

position

In April 2007, Ackman began

to accumulate a position in Target Corp., establishing a special fund to

invest in the company that eventually held a 9.97 percent stake through a

combination of options and stock purchases. Ackman had made further bets

on the company through options and derivatives called total return swaps.

Although these total return swaps did not confer voting power, Ackman

claimed that the swaps brought his total economic exposure to 12.6 percent

of Target’s shares.

Ackman argued that Target

could unlock shareholder value through the sale of its credit card

business and the reduction of its real estate holdings. Target was one of

the few retailers that still managed its own credit card operations, while

Ackman noted that similar retailers had sold their portfolios. In

September 2007, under pressure from Ackman, Target announced it was

exploring strategic options for its credit card portfolio. In March 2008,

the company said it engaged in talks to divest 50 percent of its credit

portfolio for approximately $4 billion. In May 2008, the company announced

the sale of an undivided interest that represented 47 percent of its

credit card portfolio for $3.6 billion. Target said the proceeds would

fund store expansion, debt repayment, and share repurchases.

In October 2008, Ackman

pushed for a second strategic change at the company—the creation of a

separate company that would own the land on which its stores are located,

aimed at unlocking the value of a real estate portfolio with an estimated

value of $40 billion. However, Ackman quickly backed down from this

proposal and pushed instead for the company to spin off its real estate

assets via a real estate investment trust (REIT) with only 20 percent of

the land under its stores, instead of the 100 percent he originally

suggested only one month earlier. Ackman, who claimed that an IPO of the

new REIT would raise about $5.1 billion, said he would invest $250 million

in the new company.

Ackman’s vision for the

company’s real estate assets proved untenable. In November, 2008, the

company publically rejected his proposal to create a real estate

investment trust, saying the potential value it would create was “highly

speculative.” The investment fund that held Ackman’s position in Target

fell 40 percent in the month of January 2009 alone. By February 2009,

Ackman had reduced his position in the company to 7.8 percent. Undeterred,

Ackman entered into a prolonged proxy contest in an attempt to gain five

board seats, including one for himself. Ackman lost the proxy contest with

70 percent of votes cast in favor of management’s proposed board. He

estimated that his hedge fund had spent more than $10 million on the

failed proxy fight. After this failed attempt to gain control of the board

and convert company-owned property into a real-estate investment trust,

Ackman continued to draw down his Target position to 4.4 percent by August

2009. By 2011, Ackman had closed his position in Target.

J.C. Penney

(2010-2013)

Tactics:

Appointed to board; public statements calling for the resignation of the

CEO and board chairman

Outcome:

$712 million losses in 23 months; resigned from the board; failed CEO

succession; exited position

In October 2010, Ackman began

to accumulate a position in J.C. Penney for approximately $25 per share.

Steven Roth of Vornado Realty Trust also started to accumulate a position,

and Ackman/Roth eventually held 26 percent of outstanding shares. Ackman

joined the company’s board in February 2011 and promptly pressed for the

replacement of the sitting CEO Myron Ullman. On June 14, 2011, the

company’s board announced that Ackman’s preferred CEO candidate, Ron

Johnson, would replace Ullman as CEO. At the time, Johnson was senior vice

president of retail operations of Apple. He assumed the role of CEO in

November 2011.

Following Ackman’s plan for

transforming J.C. Penney, Johnson revealed a strategy to reinvent the

company by converting its department stores into smaller boutiques and

eliminating coupon discounts. However, the transformation was not an

immediate success, and the strategy required significant cash outflows to

remodel stores. By February 2013, Johnson admitted that his turnaround

effort was not working as planned, and J.C. Penney reported a much larger

than expected fourth-quarter loss. The strategic shift not only alienated

existing customers but it also failed to attract new customers. Revenues

declined as much as 25 percent during Johnson’s tenure. In early April

2013, the company’s board announced Ron Johnson’s departure and reinstated

Myron Ullman as CEO.

In August 2013, a public

dispute arose between Ackman and the other directors over the company’s

leadership. In a letter sent to fellow directors that was publicly

disclosed, Ackman called for the departures of Ullman and the company’s

chairman of the board. The board responded in an August 8 letter, stating,

“The company has made significant progress since Myron E. (Mike) Ullman

III returned as CEO four months ago, under unusually difficult

circumstances. Since then, Mike has led significant actions to correct the

errors of previous management and to return the company to sustainable,

profitable growth.” In the letter, the company’s chairman called Ackman’s

actions “disruptive and counterproductive.”

On August 12, 2013, Ackman

resigned from the board. By August 27, he had sold his entire stake in the

company (some 39 million shares) to Citigroup for $12.90 per share. In

total, Ackman lost approximately $712 million on his stock ownership and

swaps tied to the company’s share price.

Canadian Pacific

Railway (2011-present)

Tactics:

Proxy contest to gain board representation or control

Outcome:

Successful proxy contest; board control; successful CEO succession;

reduced position after 300 percent increase in share price

In late 2011, Ackman acquired

a 14 percent stake in Canadian Pacific Railway, making Pershing Square

Capital Management the company’s largest shareholder. Ackman quickly

pushed for changes to transform the company, including the ouster of its

CEO. When the board rejected his plan, Ackman launched a proxy contest and

received overwhelming support from shareholders. Hours before the

company’s annual meeting in 2012, CEO Fred Green and four other directors

resigned, giving Ackman a major victory.

Ackman’s victory was soon

tested, as the Teamsters Canada Rail Conference, a union that represented

some 4,800 Canadian Pacific rail workers, began a week-long strike shortly

after Ackman won his drawn-out proxy battle. The strike was due in part to

stalled union contract talks that started in October 2011, and Ackman’s

involvement in the company became the tipping point. In particular, union

employees were concerned about possible cuts to pension funding by an

estimated 40 percent; the issue of work rules was also highly contentious.

By early July 2012, E. Hunter

Harrison, Ackman’s pick for the company’s new CEO and a railroad veteran,

began to implement a turnaround strategy. Within days, Harrison replaced

most of Green’s senior management team with his contacts from Canadian

National Railway Corporation. Harrison and his new management team boosted

the company’s operating performance to record levels of operating

efficiency. Harrison also achieved his original three-year plan within two

years, which sent share prices up 300 percent, a result that prompted

Ackman to sell one-third of his holdings in late 2013.

However, the company’s

longer-term outlook is unclear. Harrison has cut a net 4,800 jobs (from a

total of 19,500 when he took over as CEO) and initiated disciplinary

actions against employees that reportedly caused many to resign. His

actions have revived an image of a “culture of fear and discipline”

similar to that during his tenure at Canadian National. Prominent union

organizers have publicly criticized his cost-cutting strategy contending

that it will leave his hand-picked successor, Keith Creel, who is slated

to take the reigns as CEO in 2016, with a hostile workforce and a

management team that “lacks experience and independent thought.” Ackman’s

actions after Harrison’s departure remain to be seen.

Air Products and

Chemicals (2013-present)

Tactics:

Public statements regarding “ideas on how to add value”

Outcome:

Ongoing; maintains position

In July 2013, Ackman

circulated a letter to his investors seeking up to $1 billion for a new

investment fund that would target a single company, quickly stirring

speculation about the target company’s identity. On July 31, 2013, Ackman

announced he had acquired a 9.8 percent stake in Air Products, a producer

of industrial gases. This investment, valued at $2.2 billion, represented

Ackman’s largest investment at that time.

Ackman stated publically that

his company had “some ideas on how to add value.” Pershing Square

indicated that it intended to engage in talks with the company’s board,

top management, and other major shareholders about the company’s current

management and its strategic plans. The firm also announced it might

pursue a proxy solicitation.

The company’s board, noting

unusual trading in the company’s shares a week prior to Ackman’s

announcement, adopted a shareholder rights plan to foil any potential

takeover attempts. Shortly after Ackman announced his stake, he reportedly

had a phone call with the company’s sitting CEO, John McGlade, to discuss

the situation. Several meetings followed, and Ackman presented his

proposal to improve shareholder value to the board in late August 2013,

which included a search for a new CEO.

Within one month, the company

announced that McGlade would depart the company in 2014 and that the board

would appoint three new independent directors—two directors proposed by

Ackman and one mutually agreed-upon nominee. However, by the end of April

2014, roughly seven months after announcing McGlade’s departure, the

company had yet to name a new CEO, increasing concern among Wall Street

analysts about the lack of an heir apparent.

Herbalife Ltd.: A

Confluence of Activist Conflict (2012-present)

Tactics:

Public statements and presentations challenging that the company’s

business model; stirred investigations of the company by multiple US

regulatory agencies; attempts to motivate investigations by foreign

governments

Outcome:

Ongoing; restructured position due to $500 million loss in 10 months

There is perhaps no better

example of the public tumult that activists can cause than the ongoing

interventions at Herbalife Ltd., a nutrition and weight management

company.

In December 2012, Ackman

disclosed that he had taken a $1 billion short position in Herbalife. His

detailed, lengthy, and widely publicized presentation titled, “Who Wants

to be a Millionaire?” portrayed the company as a pyramid scheme that

lacked any true retail customers. Herbalife shares declined nearly 40

percent following Ackman’s statements.

Ackman’s presentation,

however, did not persuade all investors. In January 2013, Icahn and Ackman

engaged in a heated televised debate regarding Herbalife’s business

prospects. Other hedge funds disclosed that they accumulated significant

positions in Herbalife: George Soros’s Soros Fund Management disclosed a

4.9 percent stake, Icahn accumulated a 16.5 percent stake, and Dan Loeb’s

Third Point reported an 8.2 percent stake (Third Point has since exited

its position.) In addition, Bill Stiritz disclosed a 6.5 percent stake as

of late 2013.Stiritz stated his intention to advise Herbalife’s board on

“potential strategies for confronting the speculative short position that

currently exists in the company’s stock and its attendant negative

publicity campaign.”

On October 29, 2013, Ackman,

with momentum building against him, sent a 52-page letter to

PricewaterhouseCoopers (PwC), Herbalife’s auditor. The letter warned that

“PwC may incur substantial liabilities in the event of the company’s

failure.” In response, an Herbalife spokeswoman told CNBC, “As Mr. Ackman

continues to lose his investors’ money on a reckless $1 billion bet

against Herbalife, he has become increasingly desperate.” At least part of

this statement was true, as, by October 2013, Ackman had lost an estimated

$500 million on his position.

On November 22, 2013, Ackman

renewed pressure on the company with a new 62-slide presentation at the

Robin Hood Investors Conference that questioned where Herbalife was

getting all of its sales and offered to pay for the collection and audit

by an independent company of all retail data from Herbalife’s

distributors. Ackman claimed that the company targeted vulnerable,

low-income minorities. In an interview with Bloomberg, Ackman stated that

he would take his efforts against Herbalife to “the end of the earth.”

On December 16, 2013,

Herbalife announced the completion of PwC’s review of the company’s

financial statements, which failed to identify any significant issues. In

response, Ackman circulated a letter to his investors on December 23 that

said he would release further information in 2014 about the company’s

violations of multi-level market restrictions in China. He stated,

“Herbalife is not an accounting fraud; it is a business opportunity fraud

that relies on deception.”

An investigation by the

New York Times showed the “unprecedented” scale and depth of Ackman’s

behind-the-scene efforts to bring down Herbalife. Ackman’s team used a

wide reaching lobbying and public image strategy that included organizing

protests, setting up news conferences, orchestrating letter writing

campaigns, and lobbying members of Congress. His team also paid over

$130,000 to civil rights organizations, notably several large Latino

organizations, to support his message or collect names of victims. This

has not been without controversy, as several of the supposed victims did

not recall writing letters to complain about Herbalife and there are

instances of letters being nearly identical. There is also evidence of

ties between Ackman and several members of Congress. The support of

congressmen and congresswomen will be instrumental in pushing regulators

to investigate Herbalife, a catalyst that could drive the stock price down

significantly. Meanwhile, Herbalife has not been idle; they have hired an

entire lobby team, including the Glover Park Group and the Podesta Group,

to counter Ackman’s lobby. They have also increased donations to various

organizations to neutralize Ackman’s payments.

On January 23, 2014, Senator

Edward Markey of Massachusetts filed letters with Securities and Exchange

Commission and the Federal Trade Commission requesting that the agencies

investigate Herbalife as a possible pyramid scheme. Markey also sent a

letter to the company’s CEO Michael Johnson that questioned the company’s

compensation and sales data. To support his request for an investigation,

he cited a single instance in which a Massachusetts family reportedly lost

$130,000 by investing in Herbalife. The company’s shares declined more

than 10 percent on the day Senator Markey’s letters were filed.

On March 11, 2014, Pershing

Square presented the results of an independent investigation it funded

into Herbalife’s business practices in China. Pershing Square alleged that

Herbalife violated China’s direct selling and pyramid sales laws. Legal

experts in China say that the laws are unclear, making it a “regulatory

grey area.” In addition, even though “the law in China says one thing, if

it’s actually enforced is a completely different thing.” Thus, many do not

expect regulators to take strong action against China.

However, on March 12, 2014,

Herbalife disclosed that the US Federal Trade Commission was initiating an

investigation into the company. Herbalife management indicated that the

company “welcomes the inquiry given the tremendous amount of

misinformation in the marketplace … We are confident that Herbalife is in

compliance with all applicable laws and regulations.” On April 11, 2014,

the Financial Times reported that that the US attorney’s office

in Manhattan and the FBI were investigating Herbalife. Before news of the

criminal probe was reported, Herbalife’s shares were down just over 2

percent, and ended the day 14 percent lower at $51.48.On April 17, 2014,

the Illinois Attorney General joined the fight, announcing its own

investigation into Herbalife. Ackman’s campaign highlights a relatively

unique strategy of leveraging political pressure against a company’s

business practices. Whether or not Ackman will succeed has yet to be

determined, but it is clear that he will go to “the end of the earth” in

his tactics against Herbalife.

Allergan

(2014-current)

Tactics:

Partnered with corporate acquirer to pursue a joint bid for a public

company

Outcome:

Ongoing

In March and April 2014,

Ackman began accumulating a position in Allergan, the maker of Botox and

other cosmetic drugs, amassing a 9.7 stake in the company that was

reportedly valued at more than $4 billion. In an unusual move, Ackman

teamed up with Canadian-based health care company Valeant, which

contributed $76 million to support Ackman’s acquisitions and agreed to

pursue a joint bid for Allergan with Ackman’s assistance. If successful,

the joint bid—which exemplifies Ackman’s penchant for bold activist

tactics—could provide a new template for the structure of acquisitions.

Critics have questioned the ethics of Ackman’s use of options to obtain $4

billion worth of Allergan stock to circumvent disclosure rules. The

Allergan deal represents Ackman’s largest ever investment.

Ackman’s strategy was

reportedly months in the making, beginning when Ackman hired his former

Harvard classmate William F. Doyle, who was also friends with J. Michael

Pearson, Valeant’s CEO. When Pearson and Ackman met to discuss potential

partnerships, Pearson confided that he had sought to acquire Allergan for

over a year. Ackman agreed to help make the acquisition a reality.

After Ackman acquired the

position in Allergan with Valeant’s financial assistance, Valeant’s board

met to settle on an exact offer price. A regulatory filing disclosed that

Ackman planned to offer a cash component of $15 billion as part of the

offer. If the deal succeeds, Ackman will retain a significant stake in the

combined drug maker and would be contractually obligated to hold

$1.5-billion of Valeant shares for one year following the merger. In the

wake of the hostile bid, Allergan announced that it adopted a shareholder

rights plan to allow its board more time to craft a response. The rights

plan is designed to last one year, and it will become active if one or

more shareholders acquire 10 percent or more of its shares.

Within days of the Ackman/Valeant

move, in a bid to thwart Ackman’s hostile tactics, Allergan reportedly

began preparing its own acquisition bid, targeting Shire PLC for a second

time within a year. On May 13, a day after Allergan rejected its bid,

Valeant said it would improve its unsolicited $47 billion takeover offer.

Valeant is expected to unveil the improved offer at an open meeting to

discuss the merger with shareholders of both companies scheduled for May

28.

Conclusion

By 2013, an estimated 100

hedge funds had adopted activist tactics as part of their investment

strategies. To increase firm value, activist hedge fund managers often

attempt to gain seats on boards, replace underperforming executives, seek

alternative uses for the target company’s resources, and return cash to

shareholders. Carl Icahn and Bill Ackman are two notable activist fund

managers whose tactics put the spotlight on target company directors to

respond quickly and capably to activist strategies. The case studies

examined in this post are provided to contextualize the strategies

activist fund managers employ and detail the tactics activists use to

advance investor arguments for changes in target companies.

|

All

copyright and trademarks in content on this site are owned by their

respective owners. Other content © 2014 The President and Fellows of

Harvard College. |

|