|

At Rovi, Activist Investor's Years of Protests Against Executive Pay

May Give Leverage on Board

By

Ronald Orol

|

03/30/15 - 09:49 AM EDT

NEW YORK (The

Deal) -- Three years of protest votes by shareholders against

Rovi's (ROVI)

executive pay packages mean activist investor

Glenn Welling picked a relatively soft target for his short-slate

proxy fight at the digital entertainment technology provider.

Welling's Engaged Capital is seeking to

install three directors, including himself, on the Santa Clara,

Calif.-based company's board at an annual meeting set for May 13. In a

letter to Rovi's directors, Welling argues that shareholder returns

have been negative overall since the company was formed by the

combination of Macrovision and Gemstar-TV Guide International in May

2008. He also raised concerns about the "long tenured" board -- five

independent directors have been around since the merger while most

have had much longer tenures -- and that new cost management and

return on investment expertise is needed.

The company operates an interactive TV-guide technology for multiple

devices, an intellectual property licensing operation and an analytics

business.

In a small way,

Welling's campaign has already succeeded -- last Monday, Rovi

expanded its board to seven members and added a little new blood in

the form of a new director,

Steven Lucas, an analytics and technology expert.

Will that be enough to appease the company's investor base? Not

likely.

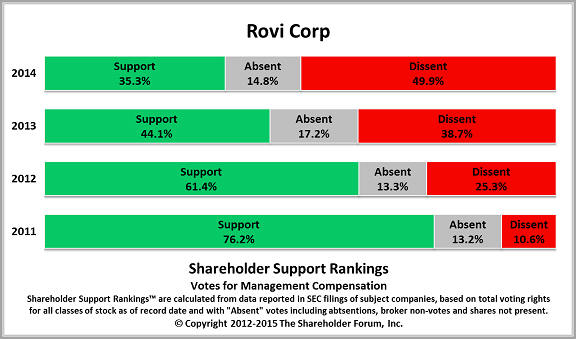

A review of non-binding shareholder votes on the company's executive

pay packages, including compensation paid to

Rovi CEO Tom Carson over the past three years suggests that there

may be a number of disgruntled investors who could back Welling in his

campaign.

In 2012, only about 70% of voting shares backed the

top executive pay packages at Rovi, already a substantial vote of

no-confidence. In 2013 Rovi received the backing of just 53% of voting

shares. Finally, last year Carson and other executives received the

backing of merely 40%, suggesting that a substantial majority of

shares have significant concerns about pay and the performance of the

company.

In both 2013 and 2014, proxy advisory firm

Institutional Shareholder Services recommended shareholders vote

against the Rovi executive pay plans. The substantial negative vote in

2014 was partly focused on Carson's 2013 compensation of $5.8 million,

including roughly $4.7 million in equity grants. The 2013 vote was

also likely a reaction to Carson's "new hire" pay of $9.98 million in

2012, which included an $8.9 million equity grant. According to the

2015 proxy statement, Carson was paid $6.7 million in 2014, including

roughly $5.5 million in equity grants.

Semler Brossy Consulting, an executive compensation firm, in a May

2014 report attributed the sizable no vote that year to the level of

Rovi's pay package compared to peers, the company's negative

three-year total shareholder return -- which includes stock price and

dividends -- and a reduction in short-term incentive goals in fiscal

2013 compared to fiscal 2012. A recent ISS Quickscore report, obtained

by The Deal, gives Rovi its lowest score for compensation, 10

out of 10, suggesting that the company still has executive pay issues.

Nevertheless, Rovi has made a number of pay-related improvements,

according to its March 23 preliminary proxy statement. It adopted a

clawback policy, which authorizes the board to recover

compensation paid to executives based on results that were

subsequently restated or corrected. It also changed its pay package

peer group of corporations.

© 1996-2015 TheStreet,

Inc. |