|

THE

WALL STREET JOURNAL.

Markets |

Stocks |

Abreast of the Market

Is the Surge in Stock Buybacks Good or Evil?

Companies are on track to purchase the highest number of their own

shares since the crisis

By

E.S. Browning

Updated Nov. 22, 2015 9:17

p.m. ET

Corporate stock buybacks are climbing toward a

post-financial-crisis high this year, furthering the debate about the

use of hundreds of billions of dollars in company cash to enhance

quarterly earnings reports.

Stock repurchases boost earnings per share, even if total earnings don’t

change, by reducing the number of shares. Analysts and investors typically

track per-share earnings, not overall earnings.

Buybacks have drawn criticism from some fund managers including

Larry Fink, chief executive of BlackRock Inc., which oversees $4.5

trillion in assets. He has said some companies invest too much in buybacks

and too little in longer-term business growth. Repurchases also have

become a political issue. Democratic presidential candidate

Hillary Clinton has called for more-frequent and fuller disclosure of

them by the companies involved, even as some activist investors push for

more buybacks as a way of returning cash to investors.

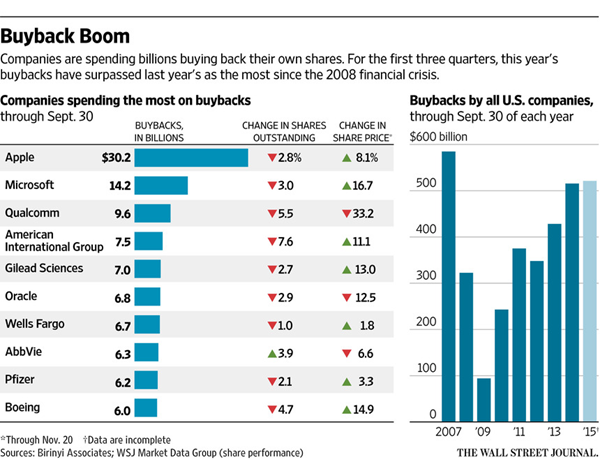

In the year’s first nine months, U.S. companies spent $516.72 billion

buying their own shares, with third-quarter reports still not complete,

according to Birinyi Associates. That is the highest amount for the first

three quarters since the record year of 2007, the year before the

financial crisis. It leaves this year on track for a post-2007 high if

fourth-quarter buybacks hold up.

Buybacks can have a significant impact on earnings, as was illustrated

this quarter by companies including

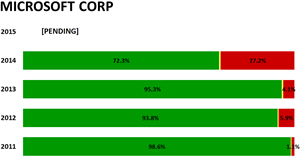

Microsoft Corp.,

Wells Fargo

& Co.,

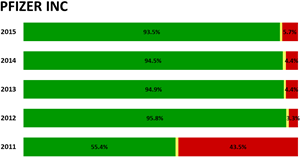

Pfizer Inc.

and

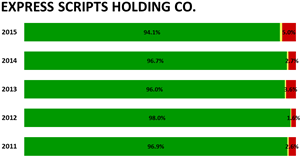

Express Scripts Holding Co.

Microsoft turned a

decline in total earnings into a per-share gain by repurchasing a little

more than 3% of its shares in the past 12 months. Its total third-quarter

earnings were down 1.3% from a year earlier, but per-share earnings rose

3.1%, according to FactSet.

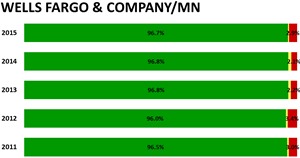

For Wells Fargo, a 0.6% increase in total earnings became a 2.9% gain in

earnings per share after buybacks. At Pfizer, a 2% overall earnings gain

became a 5.3% per-share jump. Express Scripts, a large drug-benefits

manager, turned a 2.8% overall gain into a 12.4% per-share increase.

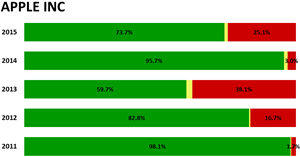

Apple

Inc.

is by far the biggest buyback spender this year, with

$30.22 billion, followed by Microsoft,

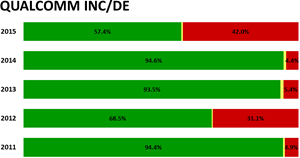

Qualcomm Inc.

and

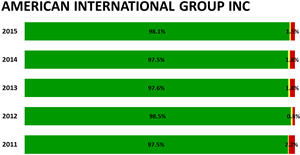

American International Group Inc.

|

Most of the

heaviest buyers of their own shares have seen their stock prices

rise this year, including Apple, which is up 8.1%.

Photo:

STEPHEN

LAM/REUTERS

|

|

This year isn’t on pace to surpass 2007 in total buybacks. But Birinyi’s

data show that announcements of planned future buybacks are the highest

for any year’s first 10 months, more even than in 2007.

“If companies execute their plans, we are looking at a record amount being

deployed over the next couple of years,” said Birinyi analyst Robert

Leiphart.

Some analysts have said for years that the buyback pace will slow, but

there is little sign of that.

Nike Inc.

on Thursday announced plans for up to $12 billion in

buybacks over the next four years, following an $8 billion program that

ends next May.

With corporate cash levels near records and interest rates low, use of

cash or debt to finance buybacks is becoming widespread.

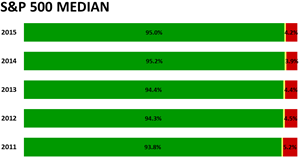

“More than 20% of all companies in the S&P 500 reduced share count by at

least 4%” over the 12 months through the third quarter, said Howard

Silverblatt, senior index analyst at S&P Dow Jones Indices. It marked the

seventh quarter in a row that at least 20% of S&P 500 companies reported

that kind of share reduction. A buyback of 4% or more can have a

noticeable impact on earnings per share, Mr. Silverblatt said.

He calculates that about 12% of S&P 500 companies already have bought so

many shares that, even if their total fourth-quarter earnings don’t rise

and they buy no more shares, their fourth-quarter earnings per share will

be up at least 4%, due simply to reduced share count.

Last year, he said, he calculated that S&P 500 companies got a return of

about 1.3% on cash they held, which put pressure on them to put the money

to work.

Buybacks sometimes can push up a company’s stock price simply by boosting

demand. Most of the heaviest buyers of their own shares have seen their

stock prices rise this year, with Apple up 8.1% and Microsoft up 16.7%.

But Qualcomm is down 33.2% this year,

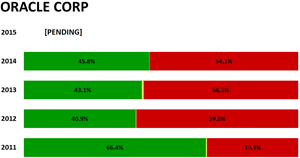

Oracle Corp.

has retreated 12.5% and biotechnology company

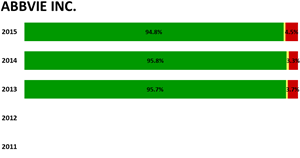

AbbVie Inc.

has fallen 6.6%.

Some critics have complained that buybacks also can represent a hidden

cost of using stock awards or options as executive pay. When issuing stock

to executives, companies typically buy back shares in the market to keep

share count from rising. They don’t typically announce the buybacks as a

compensation cost, analysts say.

Some analysts would like companies to be more forthcoming. Currently,

buybacks permit managers to receive “more of a company’s cash flow than is

reported as compensation on the income statement,” said an October study

by Research Affiliates, a research firm and investment-products designer

in Newport Beach, Calif.

Mark Clements, one of the authors of the Research Affiliates report, noted

that managers’ pay also sometimes depends on gains in earnings per share,

which can provide a further temptation to initiate buybacks.

More generally, critics have said that buybacks represent an artificial,

short-term method of boosting profits. Some companies have made large

buybacks in quarters when earnings were soft, leading to complaints that

they were simply managing earnings.

In a letter this year to companies in which BlackRock invests, Mr. Fink,

the CEO, wrote that “more and more corporate leaders” are taking “actions

that can deliver immediate returns to shareholders, such as buybacks or

dividend increases, while underinvesting in innovation, skilled workforces

or essential capital expenditures necessary to sustain long-term growth.”

Write to

E.S. Browning at

jim.browning@wsj.com

Corrections & Amplifications

An earlier version of a chart running with this article incorrectly

indicated that the stock buybacks shown for all U.S. companies were

through Nov. 20 of each year. They were through Sept. 30.

|