|

THE

WALL STREET JOURNAL.

MoneyBeat

When It Comes to ROIC, Investors May Not Be Buying the Company

Line

A survey suggests companies need to do a better job selling their

plans to improve returns on invested capital

By

David Benoit

May 18, 2016 9:33 am ET

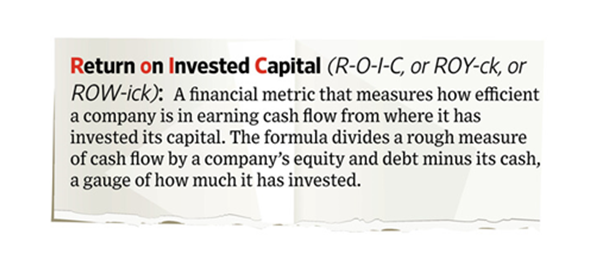

Investors are clamoring

for companies to disclose their return on invested capital, but they

aren’t exactly buying the story companies are trying to tell with the

metric.

In a survey this spring by

investor relations experts Rivel Research Group, ROIC once again

scored as the most important financial metric for global investors

that companies can talk about, as The Wall Street Journal

wrote about earlier this month.

When asked what metric is

“very important” to investment decisions, 57% of those surveyed

answered ROIC, the highest score among the various measurements. That

was up from 49% in December 2013. Two years ago, ROIC trailed

earnings-per-share growth but climbed to the top spot in a survey

conducted at the end of 2014.

The second-highest scorer

this year was free cash flow margin, another efficiency metric, which

jumped from fifth place in the previous survey. (Note to companies:

Investors could do without price-to-book value, which only 1 in 5 said

they need to hear about.)

But Rivel dove deeper into

conversations with 353 buy-side professionals and found some signs

companies need to be on their game when discussing ROIC.

Roughly 75% of those

surveyed around the globe said they were at least somewhat satisfied

with the disclosures from companies, a good sign for companies. But

when asked to compare a company’s discussion of its ROIC with an

activist’s argument about the company’s ROIC, the survey was more

tepid for companies.

In North America, less

than half of those surveyed, 43%, gave the company the nod while 32%

said they bought into the activist. (Some 6% said both and 18% were

uncertain.)

That seems to imply

companies need to do a better job selling their plans on ROIC, or

potentially risk investors taking the side of the activists.

ROIC is becoming a

flashpoint in activist fights. Investors argue that companies are

failing to earn returns on their spending and companies say investors

are failing to give them time.

In their comments to Rivel,

various unnamed investors raised concerns about the difficulty in

finding ROIC and whether it’s comparable to peers, urging companies to

disclosure how they calculate it.

|