|

Cognizant Technology

Shares Spike on Elliott Campaign

■ The IT

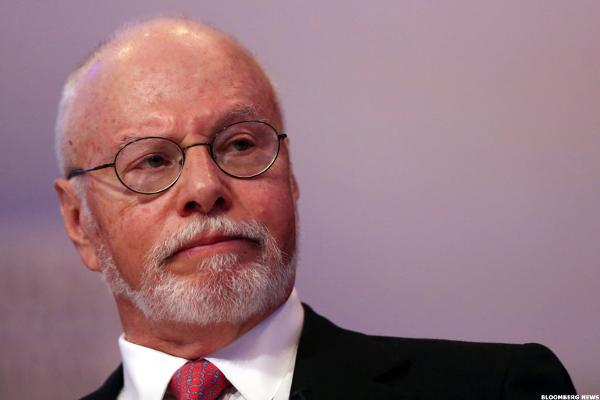

company's shares were up 10% early Monday after billionaire activist

Paul Singer launched a campaign urging the company to set up a capital

distribution program.

IT services company Cognizant Technology Solutions ( (CTSH)

) shares spiked up by 10% early Monday after billionaire activist Paul

Singer and his activist investment fund Elliott Management launched an

activist campaign urging the company to make a variety of changes,

such as establishing a capital distribution program.

"Despite growing into a scale market leader with stable and

significant cash flows, Cognizant has remained unwilling to establish

a capital return program," said Elliott portfolio manager Jesse Cohn

in a 16-page-letter.

The activist fund pointed out that Cognizant has $4 billion in cash as

well as $1.1 billion in onshore cash following a recent repatriation,

and "virtually no debt." The activist fund said that Cognizant is

trading at its lowest valuation since the financial crisis. The fund

also urged Cognizant to make changes to its delivery process, its

sales and marketing program and make cuts to its human resources

department and finance unit.

If the company doesn't respond soon, the New York-based Elliott could

launch a proxy contest to elect dissident directors and drive the

change the fund is seeking. Elliott has launched more than 96

campaigns at 92 companies since 1994, including 13 proxy fights,

according to Factset.

© 1996-2016 TheStreet,

Inc. |