Opinion:

Wal-Mart might finally be a better investment than Amazon

Published: Nov 17, 2017 6:35 a.m.

ET

Amazon is

steamrolling the retail industry, but old-line Wal-Mart is hitting

back ó and producing impressive numbers

|

Bloomberg,

iStockphoto

Wal-Martís online sales in the third quarter jumped 50% from a

year earlier. |

The

mighty Amazon.com has been a game-changer, a disrupter, an online

retail pioneer that seems to be unstoppable.

But

old Wal-Mart Stores Inc.

WMT has a few tricks up its

sleeve. The Bentonville, Ark.-based companyís investments in its

employees, its online offerings and delivery, and its stores are

paying off in a major way. Investors in Seattle-based Amazon should

pay attention.

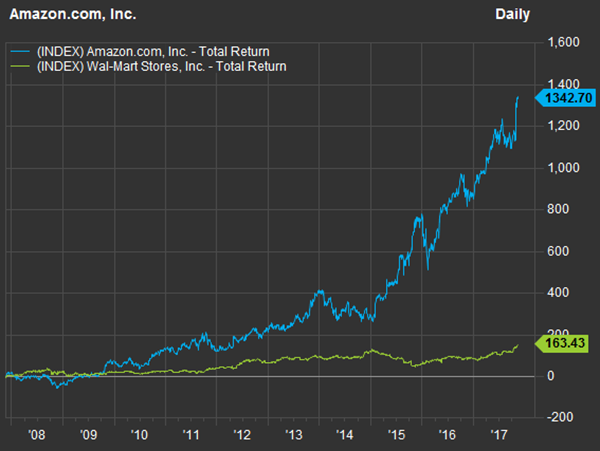

These

charts tell an interesting story. This 10-year chart shows how well

shares of Amazon.com Inc.

AMZN have performed against

those of Wal-Mart:

|

FactSet

|

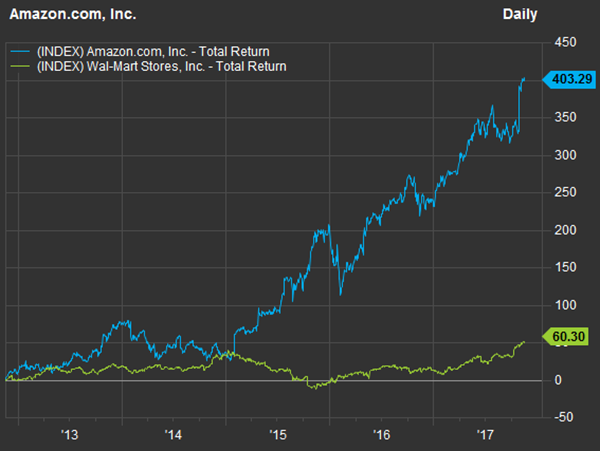

And

five years:

|

FactSet

|

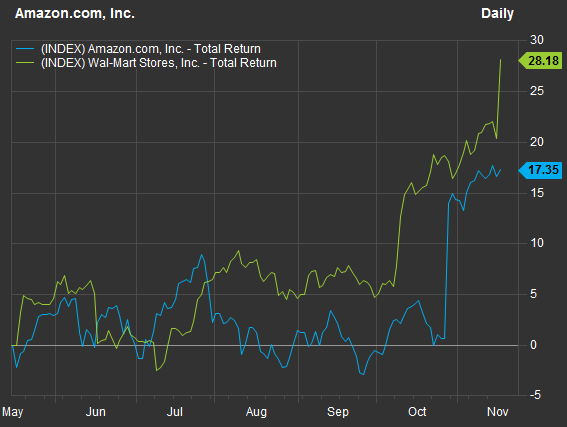

And

now a six-month chart, which reveals something has changed:

|

FactSet

|

Those

six-month returns are through Nov. 15, before Wal-Mart released

third-quarter results, which sent the shares up as much as 8%

Thursday. Wal-Mart reported a 4.2% increase in net sales from a year

earlier, with comparable sales (excluding fuel) rising 2.7% and

comparable foot traffic up 1.5%. Those are impressive figures for an

old brick-and-motor retailer, especially when itís the largest one in

the world, with revenue of almost half a trillion dollars last

year.

Meanwhile, Wal-Martís online sales jumped 50% from a year earlier. And

online sales accounted for 80 basis points of the companyís 2.7%

increase in comparable sales. Thatís a heavy effect for a business

that the company had not traditionally been well-known for.

Why

would you consider making an online purchase with Walmart rather than

Amazon? My own experience has been that it pays to look at both sites.

In one case, an item was attractively priced for $99 at Amazon, but

one had to be an Amazon Prime member to purchase it. I wasnít.

Walmart.com offered the same item for the same price with free

shipping.

Another personal anecdote is that, at the three local Walmart stores

Iím familiar with, the companyís investment in improving its automatic

checkout service means I no longer have to wait in line. Not only are

there many more automatic checkout lanes, there is always at least one

employee (and usually several) hovering about and helping customers

through the automated process.

The numbers

Wal-Martís shares closed at $89.83 on Wednesday and traded for 19.4

times the consensus earning estimate of $4.64, among analysts polled

by FactSet. In comparison, Amazonís shares closed at $1,126.69 and

traded for 142.1 times the consensus 2018 estimate of $7.93.

Amazonís price-to-earnings ratios have been similarly high for years,

showing that investors love the stock because of the companyís amazing

long-term sales growth and its ability to disrupt one industry after

another. In the third quarter, Amazonís sales were up 34% from a year

earlier, to $43.7 billion.

Can

Amazon keep up this pace of sales growth for years? I donít know. If

you have a firm conviction that it can, and you are correct, Amazon

should continue to be a world-beating stock. But itís a tough act to

continue.

Another interesting thing to consider is that Amazonís market

capitalization as of the close on Wednesday was $542.9 billion, or 3.4

times its $161.2 billion in sales over the past 12 reported months.

Wal-Martís market cap was $268.3 billion, or 0.5 times its 12 monthsí

sales of $495 billion.

Those

valuations, along with Wal-Martís online initiative and the improved

results of its stores, make it appear to be a less risky stock than

Amazon.

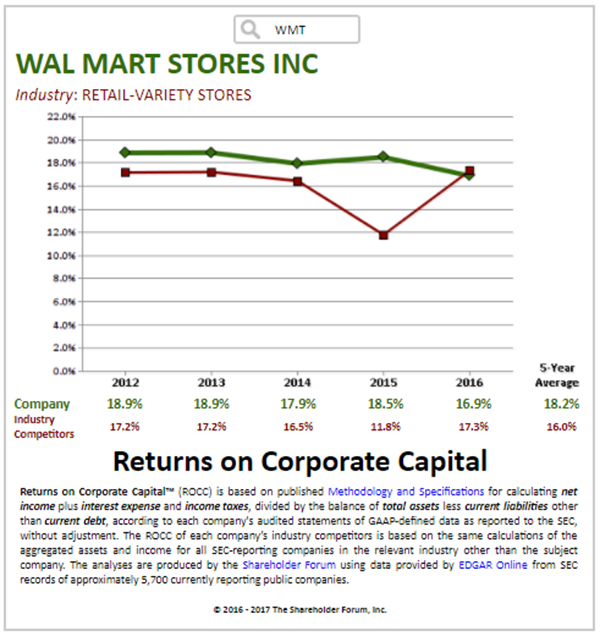

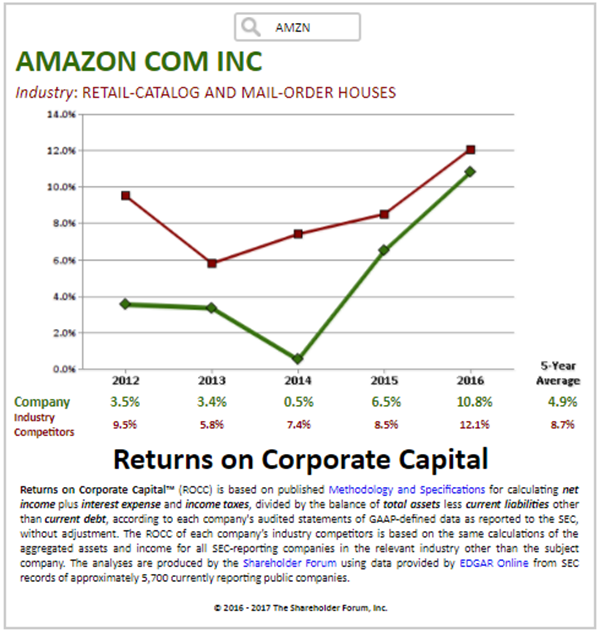

Return on corporate

capital

Hereís another interesting way to look at the companiesí results over

the long term: return on corporate capital (ROCC). It was developed by

the Shareholder Forum.

A

companyís ROCC is its net income plus interest expenses and income

taxes, divided by the ending balance of total assets less total

liabilities other than interest-bearing debt. It is similar to return

on invested capital (ROIC), however, it is uniformly calculated using

GAAP data from annual SEC filings. You can look up ROCC for the past

five full fiscal years for individual companies

here, with each company

compared to its industry group.

Hereís the Shareholder Forumís ROCC information for Wal-Mart:

|

The Shareholder Forum

|

And

for Amazon:

|

The Shareholder Forum |

The

companiesí ROCC industry groups are the Standard Industrial

Classifications (SIC) from their SEC filings. Wal-Martís average ROCC

for the past five full fiscal years has beaten that of the

ďretail-variety storesĒ category. Amazonís average ROCC has trailed

that of the ďretail catalog and mail-order housesĒ category, and that

of Wal-Mart, by a mile.

To be

sure, Gary Lutin, a former investment banker at Lutin & Co. who

oversees the Shareholder Forum in New York, has said ROCC comparisons

are most meaningful within industry groups and that ďspending what

could be booked as profits today in their development of goods and

services to make bigger profits tomorrowĒ will be reflected in a low

ROCC.

So

Amazonís approach has been worthwhile for a very long time, and its

patient shareholders have been well-rewarded.

Meanwhile, Wal-Mart is making a strong case that a traditional

retailer can succeed in the modern economy. And its numbers underline

a less risky long-term investment play. If you still believe in

Amazon, you might want to add Wal-Mart to your portfolio. If youíve

missed out on the Amazon story from your fear of its high P/E ratio,

or if you believe the company cannot possibly maintain its amazing

pace of sales growth over the next 10 years, Wal-Mart might be the

better play for you.

|

|

Philip

van Doorn |

|

Philip van Doorn covers various investment and industry topics.

He has previously worked as a senior analyst at TheStreet.com.

He also has experience in community banking and as a credit

analyst at the Federal Home Loan Bank of New York. |

|

Copyright ©2017 MarketWatch, Inc. |