THE

WALL STREET JOURNAL.

MoneyBeat

|

The Intelligent Investor

Meet an Intrepid Stock-Market Sleuth. He Just Turned 19 Years Old

What happens when a

college freshman digs very deep into a company’s finances

|

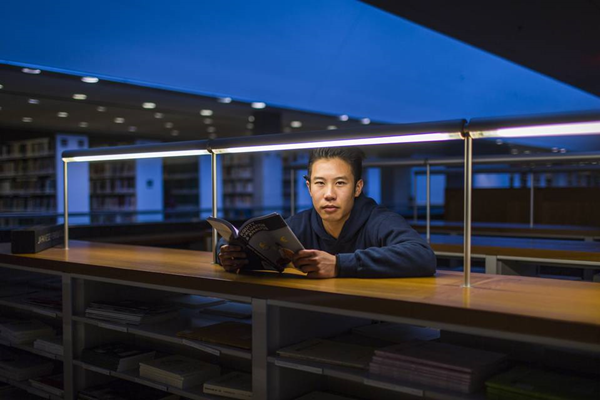

Aaron Chow, a freshman at the

University of California, Berkeley, was bitten by the investment

bug at age 13. PHOTO: ERIC KAYNE FOR THE WALL STREET JOURNAL |

Retiree Tom Miller was

recently talking with his friend Aaron Chow about an investment Mr.

Miller had made in Rich Uncles Real Estate Investment Trust I,

a property fund whose

shares don’t trade publicly.

Yes, it’s called “Rich Uncles.”

Mr. Chow studied its website, read every page of every regulatory

document the company had filed, researched its accounting practices and peppered

its investor-relations staff with phone calls. By the time he was done, even the

REIT’s chief executive knew who he was.

A month ago, Mr. Chow turned 19 years old.

His story — and his approach — show that even in a market

dominated by fast-trading computers and by index funds that do no research on

their holdings, intrepid individual investors can still distinguish themselves

with diligent research.

Mr. Chow, now a freshman majoring in economics at the University

of California, Berkeley, is curious, skeptical and relentless in the pursuit of

information that others may have overlooked.

Benjamin Graham, mentor to Warren Buffett, defined two basic

types of investors in his classic book “The Intelligent Investor”: defensive and

enterprising.

|

TOP: Aaron Chow, left, speaks

with his dorm roommates Siddharth Karia and Kaushal Partani.

BOTTOM: Mr. Chow speaks on the

phone. Photo: Eric Kayne for The Wall Street Journal.

PHOTO: ERIC KAYNE FOR THE WALL

STREET JOURNAL

|

|

The defensive investor, wrote Graham, seeks “freedom from effort,

annoyance and the need for making frequent decisions,” while avoiding “serious

mistakes or losses.”

The enterprising investor is willing to “devote time and care to

the selection of securities that are both sound and more attractive than the

average.” Over long periods, Graham added, the enterprising investor should earn

“a better average return than that realized by the passive investor.”

Mr. Chow was bitten by the investment bug at age 13, when he

picked up a copy of The Wall Street Journal while waiting to board a flight with

his family. He soon borrowed Graham’s book from the library and tried finding

bargains among low-priced “penny stocks.”

Before long he had burned through most of the $2,000 his parents,

a biotechnology consultant and an accountant, had given him. On the verge of

tears, he exclaimed to his father, “I’m not going to lose any more money!”

While other teenagers were playing “Minecraft” and “Grand Theft

Auto,” Mr. Chow was reading Graham’s masterwork, “Security Analysis,” and

teaching himself how to read companies’ financial reports.

“Business is fascinating,” he says. “Investing is just a way to

own a stake in businesses that generate cash by producing the things you see

around you in people’s daily lives.”

When he scoured Rich Uncles’ website, Mr. Chow saw large type

proclaiming its fees at “0%,” although a pop-up, fine-print disclosure mentions

“substantial fees.”

In fact, the fund

charges an offering fee of approximately 3%, along with 2% on each purchase of

property, 3% on each sale and a 0.6% annual management fee. Total fees, as a

percentage of the company’s net worth, exceeded 1.8% in 2016, the latest year

for which results are available. (Unlike mutual funds, private REITs generally

don’t express their expenses as a percentage of per-share value.)

Mr. Chow spotted a reference in a filing to a “fact-finding

inquiry” by the SEC “related to the advertising and sale of securities by the

company.”

He even questioned a highly technical detail: how Rich Uncles

conformed with

a 2016 rule from

the Financial Accounting Standards Board on reporting cash flows. He contends

that the way the company changed its reporting makes its business look more

robust and its dividend safer.

The accounting change does seem to have had the effect of making

Rich Uncles’ operating and free cash flows appear larger, says Howard Schilit,

founder of Schilit Forensics, an accounting-analysis firm in New York.

John Davis, chief financial officer at Rich Uncles, says the

change had no impact on the REIT’s cash or net income. The REIT, one of several

from the Costa Mesa, Calif.-based firm, launched in 2012 and holds about $130

million in commercial real estate.

Finally, Mr. Chow noticed that Rich Uncles hadn’t filed a report

to disclose that its independent auditor, Anton & Chia, was

charged with civil fraud by the SEC in December.

“We respectfully disagree with the [SEC] proceeding against our

firm,” says Gregory Wahl, founder and managing partner of Anton & Chia. “We’re

committed to litigating and getting due process.”

Harold Hofer, chief executive of Rich Uncles, says it will soon

file a disclosure relating to Anton & Chia and will do “whatever our legal

counsel advises us to do.” Securities attorneys say such a disclosure is

probably optional.

He says Rich Uncles voluntarily disclosed — and is cooperating

with — the SEC’s non-public investigation of its marketing practices, which

isn’t an allegation of wrongdoing.

The company pays quarterly dividends at a 7.5% annual rate;

however, there is no public market for its shares, and Rich Uncles warns that it

could need to sell properties in order to buy back shares from investors.

The marketing statements on its website were all submitted for

review to lawyers and regulators, says Mr. Hofer.

Mr. Chow was valedictorian of his high-school class and, as a

first-year undergraduate, is taking an MBA course on financial analysis and

valuation at Berkeley’s business school. His professor in that class, Panos

Patatoukas, says Mr. Chow is “in the top 1%” of students he has taught at any

level.

Mr. Miller, the friend who asked for Mr. Chow’s advice, still

holds the fund after his financial planner advised him to keep it. Even so, this

young investor is living proof that there is still scope for humans to analyze

investments in a financial world dominated by machines.

Write to Jason Zweig at intelligentinvestor@wsj.com