Big Pay Packages Are a Powerful Weapon

for Activist Investors

Shareholder votes have focused

attention on the link between compensation and company performance.

Here's how hedge funds use executive pay as a lever.

By

Anders Melin

February 2, 2018 5:01 AM

From

Bloomberg Markets

Attacking CEOs! Shining a light on

boards’ shortcomings as independent overseers! Girding for proxy

battles!

To do those kinds of things, activists

often focus on executive compensation. Pay has become even more

important in the years since the financial crisis, which underscored

how poorly thought-out incentive structures can motivate bad behavior.

Shareholder votes on executive

compensation have focused the attention of some of the world’s largest

institutional shareholders on the link between pay and company

performance. That’s opened an additional avenue for activists to shore

up support for their proposals, says Steven Balet, a managing director

and activism expert at

FTI Consulting Inc. “Activists don’t necessarily have an issue

with the quantity of pay, which makes sense coming from a hedge fund

that charges 2 and 20,” Balet says, referring to the standard 2

percent of assets and 20 percent of profits that funds typically

collect. Instead, he says, they view pay as “a means of driving

behavior.”

Consider the campaign

by New York-based hedge fund Starboard Value LP against Darden

Restaurants Inc. In late 2013, Starboard

disclosed it had acquired a 5.6 percent stake in Darden, the

operator of the Olive Garden and Red Lobster restaurant chains. The

next year the activist investor came out with a

294-page

presentation, which famously said that Darden had stopped salting

pasta water to get an extended warranty on its cooking pots.

Starboard also argued that Darden’s

incentive structure had fueled bad decisions by executives. Because it

focused on total sales and net earnings per share, management had

tried to expand the business regardless of cost, the hedge fund said.

And after the board suddenly shifted compensation targets to link some

awards to same-restaurant sales growth, Darden five months later moved

to sell off Red Lobster, a poor performer under that metric. According

to Starboard, the pay program “encouraged excessive spending as the

answer to every problem,” regardless of whether it would create or

destroy value.

The activist’s pitch was persuasive. In

October 2014, Darden’s shareholders

voted to oust the entire slate of incumbent directors and handed

the reins to Starboard Chief Executive Officer Jeffrey Smith and his

handpicked team. The new board sped up improvements to the pay program

that Darden had begun after Starboard disclosed its stake. They linked

bonuses to adjusted per-share earnings and same-restaurant sales. And

they changed long-term awards to pay out mainly in shares tied to

return on invested capital and stock return relative to a group of

about 50 other restaurant companies. They also cut stock-option

grants.

Gene Lee, who stepped into the CEO role

after the vote, was awarded $5.8 million for his first year, according

to the Bloomberg Pay Index. Since then his pay has risen to $10

million; Darden’s shares returned 150 percent through Jan. 23, more

than double the gain of the S&P 500 for the same period.

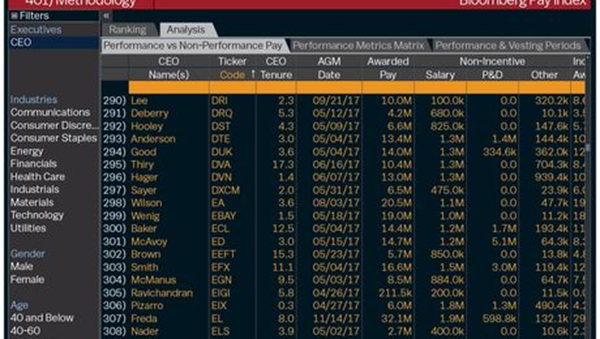

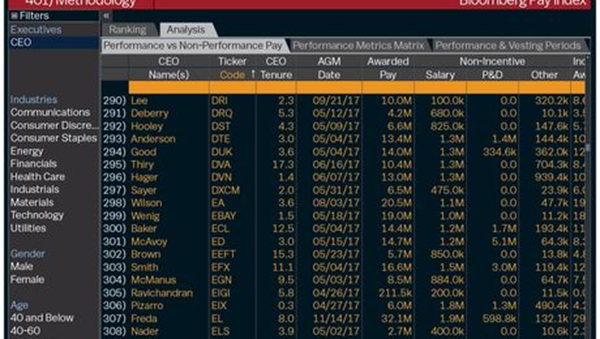

You can get the details

on executive pay on the Bloomberg terminal. Head to {PAY <GO>} to see

who the highest-paid public company executives are in the U.S. based

on awarded pay, which values equity at each company’s fiscal yearend.

Click on the Analysis tab for a new enhancement that lets you review

pay details for more than 1,000 U.S. CEOs. The Performance vs

Non-Performance Pay enables you to see which executives have the

greatest percentage of their compensation tied to company results. The

Performance Metrics Matrix and the Performance & Vesting Periods tabs

let you explore what overarching goals awards are tied to, their time

frames, and when executives will be able to pocket the pay. You can

also narrow your queries to a specific industry to compare the

compensation plans with their peers’.

|

For details of CEO pay at major U.S. companies,

go to {PAY <GO>} on the Bloomberg terminal. |

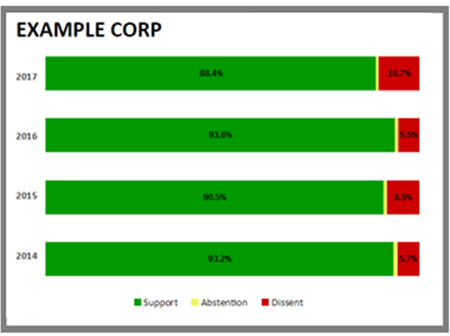

Taking that a

step further, you can run searches on the Equity Screening (EQS)

function using the new pay metrics or data on say-on-pay, which refers

to shareholders’ right to vote on management remuneration. To see

Russell 1000 companies with the lowest support on pay, for example, go

to {EQS <GO>}. In the Add Criteria field, enter RIY and click on the

Russell 1000 Index match. Next, enter Say on Pay, click on the Say on

Pay Support Level item, and press <GO>. Click on the See Results |

WATC button for a list of companies in the benchmark that you can sort

by the percentage of shareholders supporting management on pay.

That kind of search may help you spot

the next target. Pay will remain an important metric in activist

campaigns, according to Balet. “They use it to show that a board is

beholden to management,” he says. “And it’s effective because it’s a

direct way to attack a CEO.”

Melin

covers executive compensation at Bloomberg News in New York.

©2018 Bloomberg L.P. All Rights Reserved