How to

select oil stocks? Find companies that know how to handle money

Published: May 29, 2018 2:56 p.m.

ET

This

stock screen identifies energy companies — Valero, Phillips 66 and

Marathon, among them — that deploy investors’ money most efficiently

|

Bloomberg

Valero Energy has been a solid performer through the extended

period of low oil prices

|

As

oil prices slumped to less than $30 a barrel in January 2016, many

U.S. producers with heavy debt burdens suddenly found themselves in

serious trouble.

The

result: Earnings turned to losses, and stock prices cratered. And then

came the cost cuts, as companies struggled to dig out from potentially

crippling debt.

But

now, a new set of data shows which U.S.-traded energy companies have

deployed capital most efficiently. (Please see the table below.) The

top companies include Valero Energy Corp.

VLO Phillips 66

PSX and Marathon Petroleum

Corp.

MRO among refiners, and also

Core Laboratories

CLB and Oceaneering

International

OII among oil-services

companies.

Some

companies with high return on corporate capital (ROCC) have seen their

share prices rise more than that of their rivals as well as the S&P

500 Index over the past five years. But the link sometimes isn’t so

clear. (Again, see the table below.) ROCC, incidentally, means net

income plus interest expense and income taxes, divided by the ending

balance of total assets less total liabilities other than

interest-bearing debt.

Even

as West Texas crude

CLN8 has more than doubled to

about $67 a barrel since reaching a low two and a half years ago,

conditions seem ripe for the more efficient oil players. Oil producers

have learned their lesson and worked on cost controls. Credit Suisse

analyst William Featherston said in a report this month that the

average break-even price for the oil exploration and production

companies he covers was $43 a barrel in the fourth quarter, below the

$56 average in early 2015.

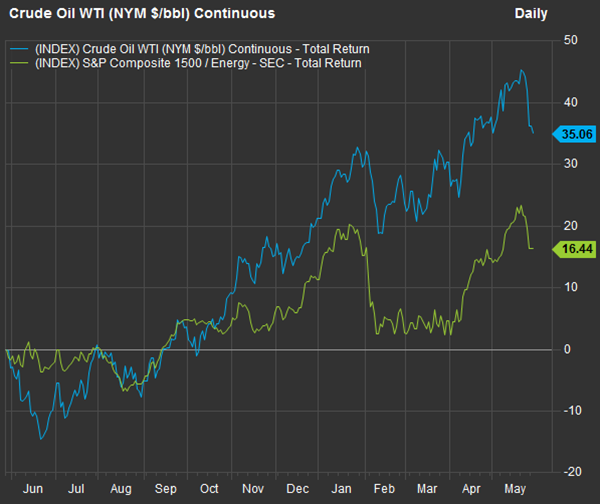

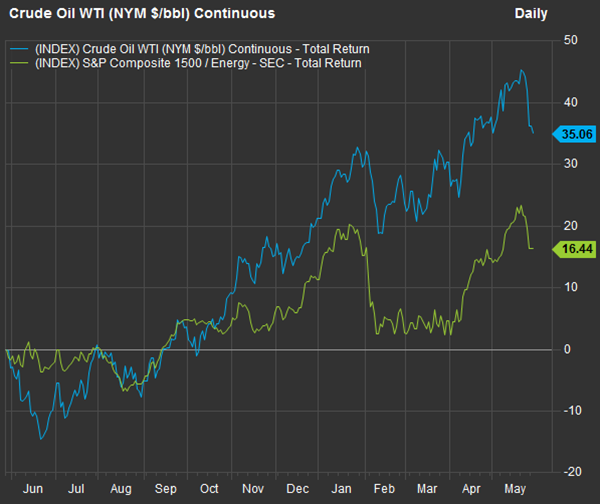

Here’s a one-year chart showing the percentage increase in West Texas

crude prices against the S&P Composite 1500 energy sector’s total

return:

|

FactSet

|

Stock investors are not yet believers in the oil-price recovery.

A

review of the S&P 500 Index energy sector shed light on

oil refiners — the best-performing

industry group through the oil bust and (partial) recovery.

We

then revisited

energy companies with low leverage (debt),

which have for the most part fared well during the recovery.

Now

that the Shareholder Forum has updated its annual return on corporate

capital (ROCC) data, we can look at a large number of energy companies

and compare performance within their reported industry groups.

Return on corporate

capital

Each

company’s ROCC is compared to its industry competitors, based on the

company’s Standard Industrial Classification (SIC), which also comes

from Securities and Exchange Commission annual reports. You can access

ROCC comparisons for U.S.-traded companies

here.

ROCC

is meant to help investors understand how well a company’s management

has used the capital it has raised through selling shares or borrowing

money to produce goods and services for a profit.

Investors can find recovery plays or potential bargain stocks that

might be temporarily undervalued by the market, but concentrating on a

company’s success in its core business relative to competitors is a

better way to limit risk while improving long-term returns overall,

says Gary Lutin of the Shareholder Forum.

A

company’s ROCC is compared to the aggregated assets and income data

for the entire SIC group (of companies publicly traded in the U.S., no

matter their size), excluding for the subject company. This

means that the industry ROCCs for two companies in the same group may

be different.

ROCC

is most meaningful within industries, because some industries require

more investment capital than others.

One

drawback to ROCC is that companies’ reported SIC codes may not always

perfectly match their core businesses, especially if the companies are

conglomerates. So screening stocks by ROCC has its drawbacks, as does

any other initial screening method. But it can help you pare a list

before doing your own research to consider how well a company is

likely to compete over the next decade.

ROCC winners among

energy companies

The

S&P 1500 Composite Index is made up of the S&P 500 Index

SPX the S&P 400 Mid-Cap Index

MID and the S&P Small-Cap

Index

SML There are 89 companies in

the S&P 1500 energy sector, and the Shareholder Forum was able to

gather sufficient data to calculate five-year ROCC averages for 83 of

them. Of that group, 39 have negative average ROCC over the past five

years, leaving us with 44 companies with positive average ROCC.

Of

the remaining 44 energy companies, 23 have five-year average ROCC

higher than the average for their SIC group. Here are all 23, ranked

within each group. The larger groups are listed first, and there are

five SIC groups with only one company represented.

|

Company |

Ticker |

Five-year average ROCC |

Competitors' ROCC |

Standard Industrial Classification (SIC) |

Total return - 2018 through May 25 |

Total return - 12 months |

Total return - 3 years |

Total return - 5 years |

|

Valero Energy

Corp. |

VLO |

12.8% |

7.2% |

Petroleum Refining |

31% |

95% |

118% |

247% |

|

Phillips 66 |

PSX |

12.6% |

7.2% |

Petroleum Refining |

16% |

54% |

56% |

103% |

|

Marathon Petroleum

Corp. |

MPC |

11.8% |

7.2% |

Petroleum Refining |

18% |

51% |

63% |

114% |

|

Andeavor |

ANDV |

10.9% |

7.3% |

Petroleum Refining |

24% |

71% |

68% |

157% |

|

Exxon Mobil Corp. |

XOM |

10.5% |

6.5% |

Petroleum Refining |

-4% |

0% |

2% |

2% |

|

HollyFrontier

Corp. |

HFC |

8.7% |

7.3% |

Petroleum Refining |

44% |

194% |

92% |

90% |

|

PBF Energy Inc.

Class A |

PBF |

7.5% |

7.3% |

Petroleum Refining |

28% |

128% |

85% |

87% |

|

Dril-Quip Inc. |

DRQ |

12.5% |

0.6% |

Oil and Gas Field

Machinery and Equipment |

-4% |

-9% |

-41% |

-50% |

|

Oil States

International Inc. |

OIS |

4.8% |

0.7% |

Oil and Gas Field

Machinery and Equipment |

24% |

22% |

-18% |

-38% |

|

Newpark Resources

Inc. |

NR |

2.1% |

0.9% |

Oil and Gas Field

Machinery and Equipment |

23% |

40% |

18% |

-7% |

|

Baker Hughes, a GE

Co. Class A |

BHGE |

2.0% |

-6.6% |

Oil and Gas Field

Machinery and Equipment |

11% |

-5% |

-18% |

16% |

|

National Oilwell

Varco Inc. |

NOV |

1.7% |

-0.7% |

Oil and Gas Field

Machinery and Equipment |

15% |

27% |

-14% |

-28% |

|

Rowan Cos. Plc

Class A |

RDC |

3.0% |

0.1% |

Drilling Oil and

Gas Wells |

-3% |

22% |

-35% |

-55% |

|

Diamond Offshore

Drilling Inc. |

DO |

1.8% |

0.3% |

Drilling Oil and

Gas Wells |

-5% |

44% |

-45% |

-71% |

|

Noble Corp. PLC |

NE |

1.3% |

0.3% |

Drilling Oil and

Gas Wells |

20% |

29% |

-67% |

-82% |

|

Core Laboratories

NV |

CLB |

40.2% |

2.6% |

Oil and Gas Field

Services, NEC |

13% |

25% |

5% |

-7% |

|

Oceaneering

International Inc. |

OII |

12.2% |

2.5% |

Oil and Gas Field

Services, NEC |

8% |

-6% |

-54% |

-66% |

|

Schlumberger NV |

SLB |

6.4% |

-1.8% |

Oil and Gas Field

Services, NEC |

3% |

2% |

-19% |

3% |

|

Cloud Peak Energy

Inc. |

CLD |

2.9% |

1.2% |

Bituminous Coal

and Lignite Surface Mining |

-29% |

-10% |

-49% |

-84% |

|

Matrix Service Co. |

MTRX |

11.7% |

4.4% |

Construction -

Specisl Trade Contractor |

4% |

127% |

3% |

14% |

|

Oasis Petroleum

Inc. |

OAS |

5.8% |

3.0% |

Crude Petroleum

and Natural Gas |

44% |

17% |

-30% |

-68% |

|

U.S. Silica

Holdings Inc. |

SLCA |

7.6% |

4.9% |

Mining, Quarrying

of Nonmetallic Minerals (No Fuels) |

-5% |

-16% |

0% |

47% |

|

World Fuel

Services Corp. |

INT |

7.8% |

3.8% |

Wholesale -

Petroleum and Petroleum Products (No Bulk Stations) |

-25% |

-42% |

-58% |

-47% |

|

Sources: The

Shareholder Forum, FactSet |

You

can click on the tickers for more information about each company,

including news, estimates, ratings, charts and financials.

The

SIC description for U.S. Silica Holdings

SLCA might be a surprise, but

the company is included in the energy sector because its largest

business segment supplies sand to oil producers that use hydraulic

fracturing.

|

|

Philip

van Doorn |

|

Philip van Doorn covers various investment and industry topics.

He has previously worked as a senior analyst at TheStreet.com.

He also has experience in community banking and as a credit

analyst at the Federal Home Loan Bank of New York. |

|

Copyright ©2018 MarketWatch, Inc. |