Money managers are flocking to a $23

trillion investing strategy that Morgan Stanley says is ready to take

off

Joe Ciolli

Jun. 18, 2018, 12:30 PM

|

Getty Images / Chris Hondros |

-

Environmental,

social, and governance investing — also known as ESG — has exploded

in popularity, with roughly $23 trillion being invested with at

least a partial ESG mandate.

-

Morgan Stanley sees

several factors combining to make ESG an even bigger investment

force than it already is.

Sustainable investing is

here to stay, whether money managers like it or not. And if

Morgan Stanley's

prognostications are correct, it's about to start making its influence

felt to an unprecedented degree.

The firm published a

report on the state of environmental, social, and governance investing

— or

ESG, as it's more commonly

called — and found it to be at a tipping point. The strategy is

growing at a time when investor reservations are vanishing, creating

an ideal situation for growth, according to Morgan Stanley.

Money managers already

have almost $23 trillion earmarked with an ESG mandate, which is

roughly 25% of the entire global investment universe. Roughly $8.7

trillion of that is US money, while European investors account for

another $12 trillion, Morgan Stanley data show.

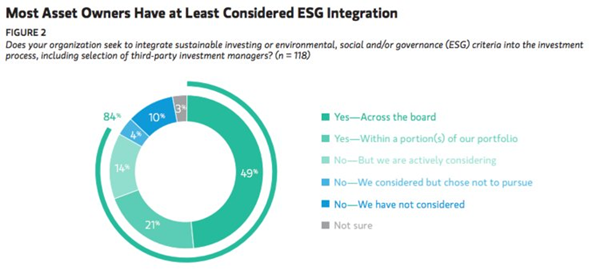

As the chart below

shows, 84% of the 118 assets owners surveyed by the firm are at least

"actively considering" integrating ESG criteria into their investment

decisions, with nearly half saying they're seeking implementation

across the board. For context, the group spans public and corporate

pensions, endowments, foundations, sovereign wealth entities,

insurance companies, and other large asset owners worldwide.

|

Morgan Stanley |

While the high

percentage of desired adoption is a positive sign for ESG, the

strategy must still contend with the perception that, by engaging in

sustainable investing, traders are sacrificing potential returns in

the name of a good cause. Morgan Stanley recently conducted a separate

individual investor survey that found 57% of respondents believing ESG

requires a "financial trade-off."

After all, as the chart

below shows, proof of performance remains the top deciding factor for

investors considering an ESG strategy.

|

Morgan Stanley |

Luckily for ESG

enthusiasts, the firm says this misguided idea seems to be fading.

"It appears that large

institutional asset owners may be replacing this view with a more

sophisticated recognition that ESG factors provide unique insights

into long-term risks and opportunities that might not be captured by

traditional financial factors," Morgan Stanley analysts wrote in a

report.

What's more, the firm

finds that the future looks bright for ESG, considering the investment

behaviors of millennials. Morgan Stanley's 2017 survey of individual

investors found they're more than twice as likely as other generations

to consume products made by companies seen as sustainable.

With all of that

established, it's clear that ESG has a bright future of growth ahead

of it, especially as the notion of a value trade-off evaporates.

"Fueled by a convergence

of long-term performance considerations with trends like mission

alignment, regulations and stakeholder demand, interest in sustainable

investing has both accelerated and evolved," the firm said. "We expect

many more opportunities to open up for those managers who are able to

build the products, relationships and trust that can help investors

generate strong risk-adjusted returns while having a positive impact

on the world."

* Copyright © 2018

Insider Inc. All rights reserved. |