THE

WALL STREET JOURNAL.

Markets

|

DEALS

Activist Investors Gain Clout as Stocks Tumble

A

record of more than 280 companies around the world with market

values of more than $500 million were publicly subjected to

activist demands in 2018

|

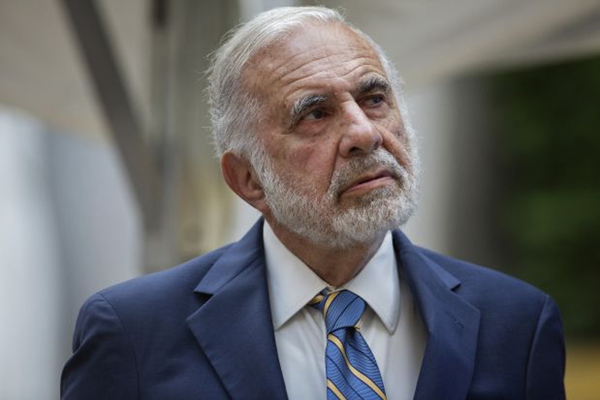

The billionaire activist investor Carl Icahn, seen here in 2015,

publicly targeted nine companies in 2018. PHOTO: VICTOR J.

BLUE/BLOOMBERG NEWS |

By

Cara Lombardo

Dec. 26, 2018 7:00 a.m. ET

Shareholder activists have had their busiest year ever

as market declines make companies more affordable and the investors

and their tactics become more widely accepted.

A record 284 companies around the world with market values of

more than $500 million were publicly subjected to demands from activists between

Jan. 1 and Dec. 21, up from 252 in all of 2017, according to data provider

Activist Insight. Elliott Management Corp., Carl Icahn and Starboard Value LP

were the busiest, with Elliott publicly targeting 24 companies and the other two

taking aim at nine each.

As activism spreads internationally, the number of non-U.S.

companies attracting campaigns rose to 148 from 125, with the largest

year-to-year increase in Asia, the data show.

Activists, who take stakes in companies and push them to make

changes to boost their stock prices, benefited from a market that was beset by

fears of rising interest rates, slowing economic growth and trade tension. For

activists, who tend to make big bets on companies facing challenges, that has

created opportunity.

“The market downturn makes some of our clients feel more

vulnerable,” said Shaun Mathew, a partner at Kirkland & Ellis LLP who advises

companies on how to prepare for and respond to activists. “It’s easier to pick

on companies.”

In all, activists and other investors employing their techniques

have secured a record 194 board seats so far this year, a nearly 42% increase

from 2017, according to Activist Insight. And 64% of those board seats came from

settlements negotiated with companies rather than shareholder votes, its data

show, which allow both sides to avoid expensive proxy fights.

Trying to capitalize on market declines won’t prove wise if the

stocks activists pick keep falling. Activist performance has already been

lackluster, trailing the S&P 500 for most of the year, according to HFR Inc.

That hasn’t deterred activists like Mr. Icahn and Elliott, and

they weren’t the only threats companies faced in 2018. Former executives, fed-up

longtime investors and frustrated heirs showed up at companies including Sharpie

maker Newell

Brands Inc., review

site YelpInc. and Campbell

Soup Co. ,

some with established activists in tow.

Investors of all stripes have been more willing

to pressure companies to bend to their will as money flows into passive

funds and active stock managers seek any edge they can find.

|

Monitors display Dell Technologies signage at the New York Stock

Exchange. Shareholders pressured the company to sweeten its

offer when it returned to the public markets this

year. PHOTO: MICHAEL NAGLE/BLOOMBERG NEWS |

Dell Technologies Inc. received

reams of shareholder feedback after announcing a plan to return to the

public markets via the buyout of a publicly traded affiliate—including

from some investors who have traditionally avoided confrontation. A

public push led by Mr. Icahn and a lawsuit from the billionaire

investor helped

prompt Dell to negotiate a sweetened bid with several of the

shareholders.

Investors are recognizing the benefits of speaking up and doing

so early in campaigns, said Bruce Goldfarb, head of Okapi Partners LLC, a

proxy-solicitation firm that helps activists and companies communicate with

shareholders.

“It’s to their advantage to put their mouth where their money

is,” he said.

Directors have come to realize that even companies largely owned

by friendly shareholders aren’t immune to activist onslaughts, advisers say.

Despite a slumping stock and repeated strategic missteps,

Campbell for years avoided activists, partially because a more than 40% stake

owned by heirs to the soup dynasty acted as a deterrent. But in September,

Daniel Loeb’s Third Point LLC teamed up with one of the heirs to launch a proxy

fight to replace the food maker’s entire board.

|

Daniel Loeb’s Third Point got two board members on Campbell

after it mounted a proxy fight against the soup dynasty. PHOTO: RICHARD

B. LEVINE/ZUMA PRESS

|

|

The two sides engaged in a heated back-and-forth up until a few

days before the shareholder vote, when they struck

a settlement adding two Third Point nominees to the board and giving the

fund input on another new director and on Campbell’s new chief executive.

Activists themselves are evolving, in many cases by toning down

their rhetoric and elevating issues that matter to the shareholders whose

support they increasingly need.

Larger activist funds such as ValueAct Capital Partners LP are

giving more airtime to environmental, social and governance concerns, which

appeal both to their own investors and to index-fund managers who JPMorgan Chase

& Co. says control 26% of the S&P 500.

Elliott, long known as one of the most aggressive activists,

established an in-house stewardship team that has softened

its image and Jana Partners LLC teamed

up with the California State Teachers’ Retirement System to lobby Apple Inc. to

add screen-time controls. Meanwhile, activists and defense advisers have been

competing to hire people with corporate-governance expertise from places like

index-fund giant BlackRock Inc.

“Activism has changed in two significant ways: the convergence of

active managers behaving more aggressively and activists who are behaving

perhaps more benignly,” said Steven Barg, global head of Goldman Sachs Group

Inc.’s activism-defense practice.

Write

to Cara Lombardo at cara.lombardo@wsj.com