Trends in Shareholder Activism

Posted by Josh Black, Activist Insight, on

Wednesday, February 27, 2019

|

Editor’s Note:

Josh Black is Editor-in-chief of Activist Insight. This post is

based on an excerpt from the Activist Insight Monthly Half-Year

Review 2018, published in association with Olshan Frome Wolosky

and authored by Mr. Black, Elana Duré, Iuri Struta, Eleanor

O’Donnell, Husein Bektic and Dan Davis. Related

research from the Program on Corporate Governance includes The

Long-Term Effects of Hedge Fund Activism by

Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); Dancing

with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and

Thomas Keusch (discussed on the Forum here);

and Who

Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on

Hedge Fund Activism and Our Strange Corporate Governance System by

Leo E. Strine, Jr. (discussed on the Forum here). |

The Big Picture

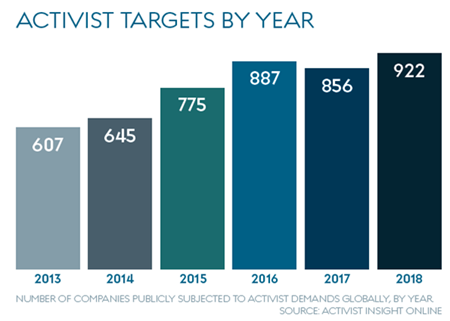

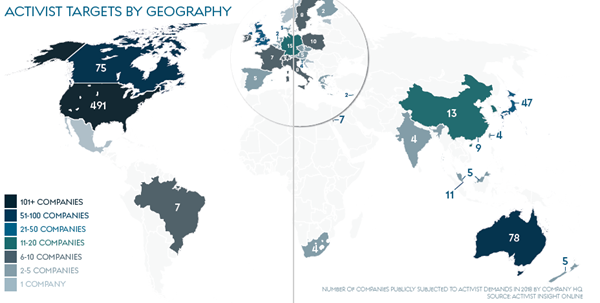

A brief glance at

activism in 2018 shows that, after a brief dip in 2017, things are

back on track. The number of companies publicly targeted hit record

highs in the U.S., Canada, Japan, Australia, and the U.K. Non-U.S.

targets made up a record haul of 47%, passing 400 for the first time.

Prior to the end-of-year volatility, high valuations in U.S. markets

and disruptive forces elsewhere clearly had an impact—as well as

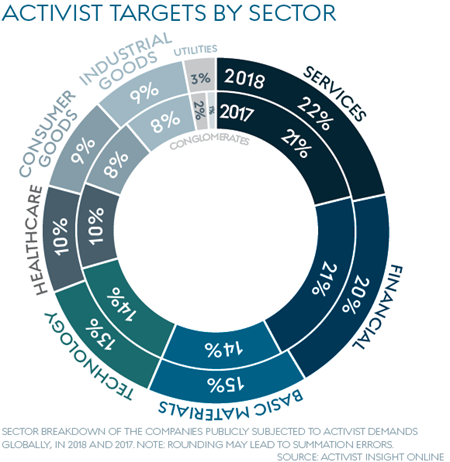

swelling activity in Australian and Canadian basic materials

industries, only 53% of companies targeted in the Brexit-hit U.K. were

targeted by homegrown activists.

M&A activism flourished in a deal-friendly environment:

bumpitrage and Elliott Management’s take-privates captured the most attention

even as the lines between financial and environmental, social, and governance (ESG)

activism continued to blur. Activists piling on top of each other at companies

like Newell Brands, ThyssenKrupp, Whitbread, and United Technologies highlighted

both a limited pool of ideas for well-capitalized funds, and the benefits of

incremental pressure as each moved slowly but inexorably in the directions

demanded of them.

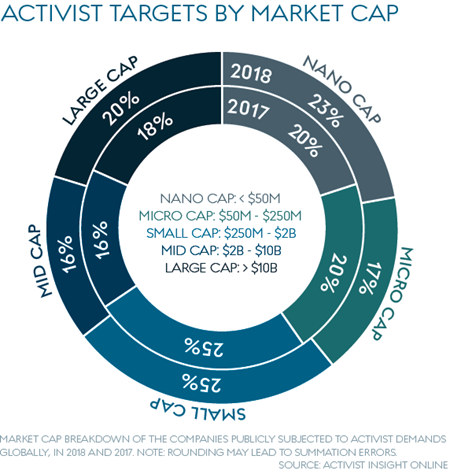

Those tactics meant activists could be effective with smaller

pools of capital: according to Activist Insight Online, only $42 billion

was invested in new positions in the U.S. and Europe during 2018, compared to

$72 billion the previous year, even as the proportion of targeted companies

valued at more than $10 billion increased.

Activists did not lack for ambition. As we point out in the pages

overleaf, they targeted companies with high insider ownership or with no obvious

buyer—or both, in the case of Campbell Soup. Trian Partners began a campaign at

PPG by calling for the ousting of its CEO, perhaps for the first time.

Yet a year without many big proxy contests meant fewer tests of

how institutional investors view activists. Still, activists will have to

address the concerns of major shareholders if they are to get a hearing from

management teams. As Proxy Insight shows in an article for this report, fears of

robo-voting are wide of the mark. Although there has been some talk of

engagement-fatigue over the past year, both index funds and active managers are

looking deeper into companies for potential risks, with human capital management

rising almost to the top of the agenda alongside board diversity.

Activist Insight predicts household name activists will again

struggle to find cause to fight proxy contests, although some campaigns that get

stuck on a CEO change or other fundamental disagreement may go the distance.

Although we were wrong about the need for a correction to drive

activist activity to record highs, the markets will have an impact on whether

the action in 2019 is in the U.S., or overseas. American activists have been

studying markets like the U.K., Germany, and Japan for some time and an uptick

in activity suggests they are now ready to deploy capital if valuations in the

U.S. return to their previous highs. If American markets suffer another rout,

however, activists will likely stay home.

ESG did prove to be a consistent theme in 2018, if at a low

rumble rather than a continuous roar. That will be the case again in 2019

with some funds racing ahead and others trying to keep up. Expect

specialists to be in demand at both activist funds and advisory shops.

Activists may push for transactions at an even more furious pace

as credit markets tighten and the outlook begins to darken. Some advisers

expect activity to mirror 2008, when overall deal volume fell but hostile

takeover attempts boomed. Companies that already have activists on their boards

may be especially vulnerable.

Greater urgency may also be injected into operational

campaigns as the sugar fix of the December 2017 U.S. tax reform wears off.

Expect that to mean CEO tenures and multiyear earnings targets come under

scrutiny, with more pressure for transformational changes along the lines seen

in 2017.

Private equity’s relationship with activism has been an uneasy

one for a long time. Some private equity firms, such as Waterton Global

Resources, are testing out activist strategies and others are partnering with

Elliott Management to acquire companies. Yet others are queasy about being seen

as unfriendly to management. “White squire” deals at Avon Products and Hudson’s

Bay Company are alternative models, though they may not be successful. Whether

private equity firms stay on the fence or start deploying dry powder in 2019 may

influence strategies across the industry.

Withhold campaigns played an outsized role in 2018, especially

for newbie activists that had less experience of advance notice bylaws. Those

bylaws may come under greater scrutiny following a 2018 lawsuit at Xerox,

setting up another litigious proxy season.

The complete publication is available

here.

|

Harvard Law School Forum

on Corporate Governance and Financial Regulation

All copyright and trademarks in content on this site are owned by

their respective owners. Other content © 2019 The President and

Fellows of Harvard College. |