|

Here's why business experts

think Uber's 'profitability' pledge is misleading and meaningless

Troy Wolverton

[February

11, 2020]

|

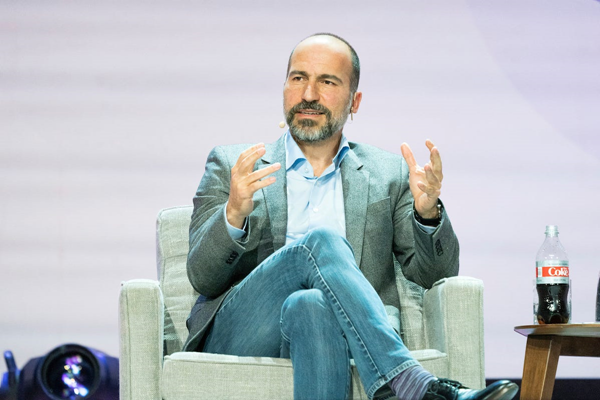

Uber's stock surged last week after CEO Dara

Khosrowshahi announced it plans hit a certain kind of

"profitability" by the end of this year. But Uber's definition

of "profitability" leaves out a whole host of expenses. Photo

by Amy Harris/Invision/AP |

■

Uber excited investors and analysts last week

when it predicted it would hit "profitability" by the end of this

year.

■

But the company's definition of "profitability"

doesn't accord with standard accounting and leaves out a whole mess of

expenses.

■

The company's preferred profitability measure —

adjusted EBITDA — is problematic, because while it is improving, its

outflow of actual cash is actually worsening.

■

It wouldn't be a surprise if

the company hits its "profitability" target, business experts say, but

investors shouldn't consider that a huge achievement.

Uber finally gave

its investors a reason to cheer — the longtime money-losing company

announced last week it

expects to finally hit "profitability" by the end of this year.

But the company's

promise wasn't all that it might have seemed. Uber's executives

weren't actually promising that it would be profitable by the end of

the year, at least not on standard-accounting basis. Nor were they

necessarily promising that it would start generating cash by then.

Instead, they were

promising that the company would be profitable on a basis the company

itself has created and defined.

That basis — which

the company called adjusted earnings before interest, taxes,

depreciation, and amortization, or adjusted EBITDA — leaves out a

whole host of expenses, as its name implies, even more so than EBITDA,

a somewhat standardized term.

It wouldn't be a big

surprise if Uber does post a profit on that basis, business experts

told Business Insider. But because the company itself can define what

expenses it includes and leaves out in adjusted EBITDA, investors

shouldn't be overly impressed if it does become profitable on that

basis.

"I think it's likely

that they will" hit the profitability target, said Phillip Braun a

finance professor at Northwestern's Kellogg School of Management,

said. "But I don't think it's meaningful."

He continued: "I

view it as a vacuous statement."

Uber is under pressure to improve

its bottom line

Like many other

unprofitable tech companies, Uber has been under increasing pressure

from public investors to show that it can be a cash-generating

business. Under standard accounting rules, the company lost $8.5

billion last year on $14.1 billion in revenue. It saw a $4.9 billion

outflow of cash from its operations and investments in property and

equipment.

Thanks in part to

such numbers, the company's stock has fared poorly since it went

public last year, consistently trading below its $45 offering price

and the company's $72 billion peak private valuation.

CEO Dara

Khosrowshahi and his team have been trying to assure investors that

they have the situation in hand. They previously committed to reaching

profitability on their adjusted EBITDA basis by next year. On their

call with investors and analysts following the company's

fourth-quarter report, they pushed that target forward by a quarter.

"While we've already

started demonstrating strong profitability improvements, we view 2020

as a truly transformational year," Nelson Chai, Uber's chief financial

officer, said on the call.

Analysts that cover

the company largely

cheered its report and its profit prediction.

Wedbush analyst Ygal Arounian called the announcement of impending

positive adjusted EBITDA a "shocker" in a research note.

"This was a giant

step forward for Dara and team and shows the business model is

starting to hit another gear," he said in the note.

At least on the

surface, Uber officials already had something to crow about. On its

adjusted EBITDA basis, its loss shrank from $817 million in the fourth

quarter of 2018 to $615 million in the just-completed period.

But those numbers

illustrated the flaws in the company's preferred way of reporting its

bottom line.

Uber's 'profitability' figure

isn't actual profitability

Many tech companies

report or point to their EBITDA numbers. EBITDA is typically thought

of as a proxy for the profitability or cash flow generated by a

company's core operations, since it eliminates certain non-cash

charges and income or expenses that don't come from those operations.

But Uber's adjusted

EBITDA figure goes far beyond typical EBITDA. Because the company

touts numerous non-standard accounting figures and measures, its

earnings releases include a glossary to define just what its bespoke

terms mean.

According to that glossary, adjusted EBITDA excludes not only what's

left out of standard EBITDA, but also earnings or losses from

discontinued operations, earnings or losses that can be assigned to

minority investors in its subsidiaries, and earnings or losses from

companies it has invested in.

But that's not all.

It leaves out stock-based compensation — a big expense at tech

companies including Uber, which saw $243 million of such costs in the

fourth-quarter alone. It excludes restructuring charges, $12 million

of which Uber recorded in the fourth quarter. It omits impairments of

or losses on the sale of assets and any acquisition costs.

On top of all that,

it excludes "other items not indicative of our ongoing operating

performance," a catch-all phrase that Uber could, in theory, use to

leave out just about any expense.

Given all that Uber

already leaves out of the adjusted EBITDA and what it could, it

wouldn't be at all surprising if the company meets its goal of

becoming "profitable" on that basis, the business experts said.

"Do I think that

it's possible they will hit the profitability target as they defined

it?" said Rob Siegel, a lecturer in management at Stanford Graduate

School of Business. "Sure."

Uber's report is reminiscent of

those from the dot-com days

The question is

whether anyone should pay attention to that, he and other business

experts said.

Uber's adjusted

EBITDA and other proprietary financial terms triggered dčjá vu among

some business experts.

Twenty years ago

during the dot-com boom, many startup companies touted their own

custom-created financial and performance metrics instead of

emphasizing how they were doing under standard accounting principles.

Many of those companies touted "pro-forma" profits that were derided

as excluding everything but the kitchen sink. Many of those companies

ended up going out of business or seeing their share prices plunge

when investors and creditors refocused on their actual bottom lines —

expenses and all.

"I think it's very

similar to the dot-com days, when they're kind of pushing out all

these metrics and all of these financial figures for us to try to grab

on to, when the bottom line is they're just not making money," said

Dan Morgan, a senior portfolio manager at Synovus Trust and a longtime

tech investor. Synovus owns 7,450 shares of Uber, a relatively small

position for the firm.

But Uber's focus on

adjusted EBITDA is problematic in another important way, experts said.

While standard EBITDA is supposed to be an indicator of a company's

operating profitability, Uber's adjusted figure looks increasingly out

of sync with its own operating performance. While the company's

adjusted EBIDTA loss shrank in the fourth quarter from the

year-earlier period, it's operating cash outflow actually worsened

considerably and was much worse than its adjusted EBITDA figure would

have suggested.

In the fourth

quarter, Uber's operations burned through nearly $1.8 billion in cash

— or about three times more than its adjusted EBITDA loss. In the

year-ago period, the company's operations consumed $837 million, only

$20 million more than its adjusted EBITDA loss.

"Their cash flow is

a real issue and a real concern," said Stanford's Siegel.

Yet despite their

forecasts of adjusted EBITDA profits, Uber's executives had little to

say about when the company might start generating positive cash flow

or become profitable on a standard accounting basis.

Uber's figure may be more than

just 'noise' — but maybe not

Companies tend to

promote non-standard accounting measures for two main reasons, said

Robert Hendershott, an associate finance professor at Santa Clara

University's Leavey School of Business. In some cases, their

executives truly believe such figures offer investors insights into

their business that investors couldn't get from standard metrics. In

other cases, companies use them to try to distract from their real

performance.

Hendershott is

dubious that the latter strategy works.

When "companies come

out with adjusted numbers that are just creating nonsense and noise,

investors ignore them," Hendershott said.

But some experts are

worried that the heavy promotion of such figures can confuse

investors. Uber's forecast was widely reported as a prediction of

actual profits — not adjusted EBITDA. And even its own executives,

when making the forecast, said they expected the company to post

positive EBIDTA — leaving out the "adjusted" part. A company

representative clarified to Business Insider that they did in fact

mean adjusted EBITDA.

"You really have to

ask whether the company's management actually wants investors to

understand what's going on," said Gary Lutin, a former investment

banker and chairman of The Shareholder Forum, an advocate for investor

rights.

To be sure, Uber's

focus on turning its adjusted EBITDA figure positive isn't necessarily

meaningless, some of the experts said. It's a potentially a sign that

the company is focusing on reducing its costs and improving its actual

bottom line, they said.

"I think it's really

a directional momentum question," said Hendershott. "If they can turn

the ship and they can start improving profitability, given their

business model, whatever they're doing to do that in 2020, they should

be able do more of it."

But many believe

that Uber's claims to an improving bottom line shouldn't be believed

until it can actually show them on a standard accounting basis.

"I'm personally in a

wait-and-see mode," said Synovus' Morgan. "I'm still in the camp that

I'm not quite sure these models are ever going to work."

Got a tip about Uber

or another tech company? Contact

this reporter via email at twolverton@businessinsider.com, message him

on Twitter @troywolv,

or send him a secure message through Signal at 415.515.5594. You can

also contact

Business Insider securely via SecureDrop.

Axel Springer,

Insider Inc.'s parent company, is an investor in Uber.

|