A New Way of Seeing Value

Posted by Witold Henisz (The Wharton

School of the University of Pennsylvania), on Friday, September 24,

2021

Engine

No. 1’s Total Value Framework is a data-driven approach to investing that puts a

tangible value on a company’s environmental, social and governance impacts and

ties those impacts to long-term value creation.

Interest in environmental, social and governance (ESG) has never been greater,

and yet, ESG ratings systems conflict with one another and remain uncorrelated

from financial returns. The inability to tie data to actual outcomes has

supported shareholders divesting rather than holding a company and engaging when

a problem arises.

For the

first time, the Total Value Framework measures, in dollars and cents, the

material negative and positive impacts a company has and demonstrates how a

company’s performance and value can be enhanced by the investments it makes in

its employees, customers, communities, and the environment.

At

Engine No. 1, we believe there is no tradeoff between impact and returns. The

Total Value Framework is an important step forward for CEOs, board members, and

investors to include impact analysis in long-term decision making to drive

better economic results.

Flaws in the

data

The

financial world has been flooded with new ESG-related data in recent years: nine

out of ten companies in the S&P 500 now issue sustainability reports; [1] Bloomberg

terminals provide access to 140 million ESG data points; and dozens of providers

offer investors their own ESG data, ratings, and scores. A recent GSIA report

suggests that the managers of $35 trillion in assets are grappling to integrate

this data into their investing. [2] In

our view, three principal challenges undermine ESG data:

-

Metrics are unstandardized:

There are more than 230 distinct initiatives to bring standards to corporate

sustainability reporting. [3]

Researchers have found that, even for the relatively narrow topic of employee

health and safety, twenty different reporting metrics were recently used among

fifty large companies. [4] Companies

and investors often end up relying on simplified ratings and scores that only

hide this complexity.

-

Ratings are uncorrelated:

A recent study characterized the field of ESG metrics as one of “aggregate

confusion,” in which correlations among providers are worryingly low. [5] The

same companies considered top quartile by one provider are often bottom

quartile for another, rendering these ratings somewhat useless to investors.

-

Analysis is disconnected:

We believe that ESG metrics and analysis remain mostly disconnected from a

company’s financial or operational analysis. We believe that many investors

append their ESG analysis to an investment memo rather than factoring it into

their financial projections, models, or valuations.

Annual

surveys carried out by the Callen Group over the last five years suggest that

many institutional investors still do not consider ESG factors to be material to

financial performance, and that only a minority of respondents incorporate ESG

into their investment decisions. [6] When

they do, they often say the more important factors in ESG investing are

stakeholder pressures, values or impact-based arguments, and potential

correlations with risk. Significantly, the prospect of “higher long-term

returns” is one of the weakest incentives they report.

In the

absence of investment managers who are able to produce superior ESG performance

and financial returns, investors have understandably focused on cost and

convenience. The largest growth segment in the ESG space has been comprised of

low-fee funds that largely mirror passive indexes, modified by the exclusion of

certain stocks with unfavorable ESG ratings and, in some cases, the

overweighting of more highly rated counterparts. [7]

From values to

value

Early

responsible-investing pioneers were focused on moral values, not financial

value. Many of these investors were religious investors who, for centuries,

identified “sin stocks” and removed them from their portfolios. [8] Much

of the ESG investing world is still influenced by that thinking.

An

increasing number of investors are asking more pragmatic questions: “What impact

do my investments have?” and “How will these impacts influence future financial

returns?” To answer these, they must understand how their investing decisions

affect a company’s operations and externalities, and how those operations and

externalities then influence the company’s performance. Through our Total Value

Framework, we are evaluating investment opportunities through a new lens, which

addresses investor’s concerns spanning materiality, impact, and financial

performance over the long-term.

Building a

better way

At

Engine No. 1, we developed our Total Value Framework to address the current

deficiencies in ESG data and help investors generate lasting impact on corporate

behavior and long-term financial returns—not just the warm glow of a “pure”

portfolio.

-

Value for stakeholders:

Through the Total Value Framework, we seek to measure the value that companies

create or destroy for all their stakeholders—their employees, customers, and

communities, and the We seek to quantify, where possible, the impact in

dollars instead of using ESG scores and ranks, the latter of which, in our

view, constitute little more than emojis and are quite difficult to

incorporate into valuation models. Instead, we use independent sources and

estimates to assess the firm-level cost of emissions, resource use, waste,

social practices, and a number of other ESG factors. We then calculate the

societal impact of these estimates in dollars—for instance, the social cost of

carbon—through the use of science-based conversion factors.

-

Value for shareholders:

Armed with these new metrics, we can proceed to focus on how the value

delivered to stakeholders affects the value a company can deliver to

shareholders and the timeline over which that value will be This forces us to

examine drivers like potential regulation, changes in customer or employee

preferences, technological disruption, and other relevant contributors to a

company’s risk or growth.

The

Total Value Framework can show changes in the pattern of value creation or

destruction over time—strongly predicting future shifts in the company’s

financial value, including in revenues, worker productivity, earnings, net

income, market capitalization, and earnings multiples. Our analysis also shows

the association between stakeholder value and these financial outcomes is far

stronger than the correlations observed between traditional ESG metrics and

these same outcomes.

Crucially, and for the first time, the Total Value Framework informs our

decisions as investors, the investments we make, as well as what we do as owners

once we make them. Our approach, rooted in data, connected to value, and

integrated with our investing process, provides the foundation for active

ownership and lasting change.

Our

initial analysis also suggests the Total Value Framework can guide investment

strategy, offering asset managers substantial value by identifying top ESG

performers in each industry—meaning those companies with the smallest negative

ESG impacts. We have preliminarily found that these companies dramatically

outperform their peers in share-price performance, EBITDA, and net income.

We

believe that our Total Value Framework will redefine what financially superior

ESG investing can be. However, this will be an evolving process, where we seek

to continually refine and enrich our framework with new data, methodologies, and

quantification metrics. Even at this nascent stage, we believe we can examine

and evaluate illustrative returns using the Total Value Framework as a proxy for

performance.

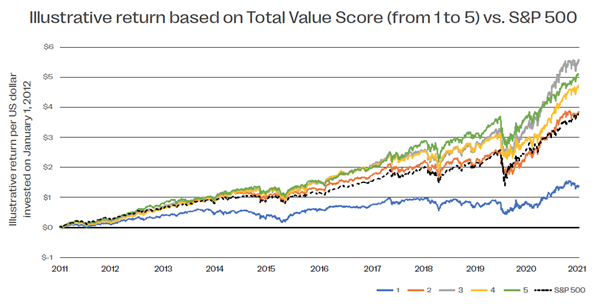

In the

chart below, using the Total Value Framework, we analyzed the performance of 700

S&P 500 firms between December 2, 2011 and August 9, 2021, and separated the

firms into quintiles. Quintile designation on this chart is represented with ‘1’

representing firms with the lowest Total Value Score (or largest negative

impacts) which substantially underperformed the benchmark, and ‘5’ representing

the highest Total Value Score (or smallest negative impacts) which outperformed

the benchmark.

While

this does not account for an evolving data framework and it holds assumptions

over the time period constant, we can still see in the chart that the framework

can be an important and impactful methodology to deploy towards generating

favorable financial returns, while at the same time quantifying the requisite

ESG impact (as opposed to the aforementioned ranking and rating methods).

Subsequent versions of the Total Value Framework will seek to employ a deeper

sector-specific analysis, with better defined weighting schemes and more direct

attribution statistics. We are seeking to bring a new framework to ESG investing

which may carry significant upside potential.

By

embracing the principles outlined above, we believe ESG investing can harness

capital on the scale needed to address systemic challenges. Only then will the

potential of ESG funds translate into the better financial returns and the

corporate, societal, and environmental outcomes they were always meant to

deliver.

Note: Provided for illustrative purposes only. The

chart does not represent the performance results of any existing or proposed

investment vehicle managed by Engine No. 1. The above chart represents the

application of the Total Value Framework to approximately 700 companies included

in the S&P 500 Index from December 2, 2011 – August 9, 2021 to demonstrate the

correlation of performance of companies with lower and higher Total Value

Scores.

The Total Value Framework employs a variety of

ESG-related data factors to quantify and connect the material impact of a

company to financial performance. The framework identifies material and

high-impact actions a company can take, and assigns dollar values to those

actions, highlighting where a business is under or overvalued based on impact.

This process determines each company’s Total Value Score. The companies were

then separated into quintiles, with Band 1 including the companies having the

lowest Total Value Score, and Band 5 having the highest Total Value Score.

Portfolio quintile and S&P index composition adjusted annually.

The chart shows the hypothetical performance of an

investment in December 2, 2011 of $1 USD per each Band as of August 9, 2021 and

assumes that the basket of securities composing each quintile is rebalanced on

January 1 of each year. Hypothetical performance is not actual performance and

has inherent limitations and should not form the basis for an investment

decision. None of the information set forth above constitutes an offer to

purchase or an offer to sell, or a promotion or recommendation of, any security,

financial instrument, product or trading strategy. Past performance is not

indicative or a guarantee of future results.

Endnotes

1

Governance & Accountability Institute (2020) “Trends on the Sustainability

Reporting Practices of the Russell 1000 index companies.” p. 2

(go back)

2

Global Sustainable Investment Alliance. 2021. Global Sustainable Investment

Review 2020. http://www.gsi-alliance.org/wp-content/uploads/2021/07/GSIR-2020.pdf

(go back)

3

Huw Van

Steenis (2019) Defective data is a big problem for sustainable investing

Financial Times January 21, 2019 https://www.ft.com/content/c742edfa-30be-328e-8bd2-a7f8870171e4

(go back)

4

Kotsantonis, S., & Serafeim, G. 2019. Four Things No One Will Tell You About ESG

Data. Journal of Applied Corporate Finance, 31(2).

(go back)

5

Berg, F., Koelbel, J. F., & Rigobon, R. 2019. Aggregate Confusion: The

Divergence of ESG Ratings: MIT Sloan School of Management.

(go back)

6

Callan

Institute (2020; 2019; 2018; 2017; 2016) “ESG Survey” (San Francisco, CA)

(go back)

7

Chuah, Kevin, James McGlinch and Witold Henisz (2021) “Greenwash or Green: What

Attracts Inflows into ESG Equity Funds?” Wharton ESG Analytics Lab Working Paper

(unpublished).

(go back)

8

Eccles, R. G., Lee, L.-E., & Stroehle, J. C. 2020. The Social Origins of ESG: An

Analysis of Innovest and KLD. Organization & Environment, 33(4): 575-596,

Townsend, B. 2020. From SRI to ESG: The Origins of Socially Responsible and

Sustainable Investing. The Journal of Impact and ESG Investing, 1(1): 10-25.

(go back)

|

Harvard Law School Forum

on Corporate Governance

All copyright and trademarks in content on this site are owned by

their respective owners. Other content © 2021 The President and

Fellows of Harvard College. |