Home >

Investing >

Deep Dive

Deep Dive

10 highest-yielding

Dividend Aristocrat stocks for uncertain times as interest rates rise

and economic growth slows.

Last Updated: March 19, 2022 at 12:40 p.m. ET

First Published: March 16, 2022 at 2:23 p.m. ET

—

By

Philip van Doorn

These companies have long records for

raising dividends, providing comfort for investors as rising interest

rates lead to stock-market jitters

|

GETTY IMAGES/ISTOCKPHOTO

|

Now that the Federal Reserve has started to raise interest rates to

counter inflation, this is a good time to take a deep look at the S&P

Dividend Aristocrats and isolate stocks with the highest yields. There

are more aristocrats than you might expect, with three broad U.S.

indexes maintained by S&P Global.

Below is a screen of all three of the indexes to list the 10 U.S.

Dividend Aristocrats with the highest yields.

On March 16, the Federal Open Market Committee released its policy

statement following a two-day meeting and said the target

range for the federal funds rate would increase to 0.25% to 0.50% from

its previous range of zero to 0.25%.

The Federal Reserve Board and FOMC also released a set of economic

projections, which included an estimated gross domestic

product growth rate for 2022 of 2.8%, which was down from the previous

4% estimate in December.

During a press conference following the release of the FOMC statement,

Federal Reserve Chairman Jerome Powell said the committee had “made

progress” on a plan to reduce the central bank’s balance sheet, which

had ballooned during the coronavirus pandemic as the Fed made

extraordinary purchases of government bonds and mortgage-backed

securities, to increase the money supply and support the economy.

Powell said the FOMC would release details of that plan soon.

Shrinking the balance sheet would reduce demand for bonds, possibly

pushing long-term interest rates higher. As bond prices have declined,

the yield on 10-year U.S. Treasury notes TMUBMUSD10Y has

increased to about 2.23% from 1.51% at the end of 2021.

In line with the Fed’s prediction of slower economic growth, Jonathan

Burton interviewed David Rosenberg, who predicts

a recession this summer.

Old reliable — S&P 500 Dividend Aristocrats

Starting with the benchmark S&P 500 SPX Index,

the S&P 500 Dividend Aristocrats Index SP50DIV is

made up of companies that have increased their regular dividends on

common shares for at least 25 consecutive years. That’s the only

criterion for inclusion as an Aristocrat — it makes no differences how

high the dividend yield might be.

The index is equal-weighted, rebalanced quarterly and reconstituted

annually. It is tracked by the $9.6 billion ProShares S&P 500 Dividend

Aristocrats ETF NOBL, which

was established in 2013.

There are 65 S&P 500 Dividend Aristocrats, with dividend yields

ranging from 0.19% to 5.22%, based on closing prices March 15.

The idea of the Aristocrats isn’t that the stocks will necessarily

generate high income for investors. It is that the consistency of

dividend increases might signal a commitment by companies’ management

teams to their shareholders and be an indicator for good performance

over the long term. A commitment to continually raising the dividend

might also provide comfort that a dividend won’t be cut — an action

that is typically brutal for the share price as investors lose

confidence.

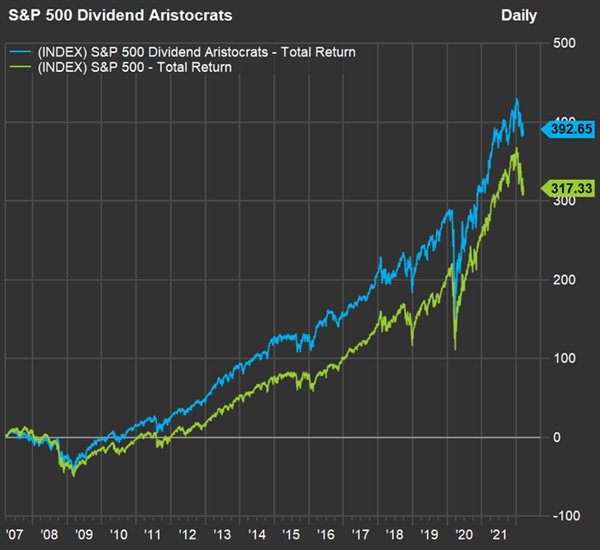

A

15-year chart shows that S&P 500 Dividend Aristocrat have performed

well against the full S&P 500:

|

FACTSET

|

To be sure, the Aristocrats haven’t outperformed for all periods. They

lagged during the long bull market through 2021. Then again, they have

fared better during the decline of 2022. Here’s a look at this year’s

performance and average annual returns for various periods (all

through March 15), with dividends reinvested:

|

Index |

Total

return

2022 |

Avg.

return

3

years |

Avg.

return

5

years |

Avg.

return

10

years |

Avg.

return

15

years |

Avg.

return

20

years |

Avg.

return

30

years |

|

S&P 500 Dividend Aristocrats |

-6.7% |

13.9% |

12.8% |

13.8% |

11.2% |

10.4% |

11.7% |

|

S&P 500 |

-10.3% |

16.7% |

14.4% |

14.0% |

10.0% |

8.8% |

10.3% |

|

Source:

FactSet |

Expanding the pool of Dividend Aristocrats

S&P Global actually maintains a large number of Dividend Aristocrat

indexes and you can see the full list here,

and a shorter list of Aristocrat indexes tracked by exchange-traded

funds (which are also listed) here.

Many of the Aristocrat indexes cover non-U.S. markets. In this article

we are focusing on the three broad U.S. Dividend Aristocrat indexes,

which have varying criteria and some overlap:

-

The S&P 500 Dividend

Aristocrats Index, as described above, is made up of the 65 stocks

in the benchmark S&P 500 that have raised regular dividends on

common shares for at least 25 straight years. It is tracked by NOBL.

-

The S&P 400 Dividend

Aristocrats Index REGL has

48 stocks of companies that have raised dividends for at least 15

consecutive years, drawn from the full S&P Mid Cap 400 Index MID. It

is tracked by the $1.1 billion ProShares S&P MidCap 400 Dividend

Aristocrats ETF REGL.

-

The S&P High Yield

Dividend Aristocrats Index SPHYDA is

made up of the 119 stocks in the S&P Composite 1500 Index SP1500 that

have increased dividends for at least 20 straight years. It is

tracked by the $20.1 billion SPDR S&P Dividend ETF SDY. The

S&P Composite 1500 itself is made up of the S&P 500, the S&P Mid Cap

400 and the S&P 600 Small Cap Index SML So

the S&P High Yield Dividend Aristocrats Index includes all the

stocks in the S&P 500 Dividend Aristocrats Index. However, it

excludes some that are in the S&P 400 Dividend Aristocrats Index.

The name of the High Yield Dividend Aristocrats Index is confusing,

because the yields, again, aren’t necessarily high — they range from

0.19% to 5.22%.

So there are three broad U.S. indexes of Dividend Aristocrats, with

varying criteria. Then again, they are all labeled as Aristocrats, so

we screened the entire group by listing all the component stocks and

removing duplicates, for a pool of 135 companies.

Highest-yielding Dividend Aristocrats

From the full list of 135 companies in the three broad U.S. indexes of

Dividend Aristocrat stocks, here are the 10 with the highest dividend

yields:

|

Company |

Ticker |

Industry |

Dividend yield |

|

International Business Machines Corp. |

IBM |

Information Technology Services |

5.22% |

|

National Retail

Properties Inc. |

NNN |

Real Estate

Investment Trusts |

4.95% |

|

Mercury General Corp. |

MCY |

Property/Casualty Insurance |

4.86% |

|

Leggett & Platt

Inc. |

LEG |

Home Furnishings |

4.63% |

|

Exxon Mobil Corp. |

XOM |

Integrated Oil |

4.56% |

|

Realty Income Corp. |

O |

Real Estate

Investment Trusts |

4.54% |

|

Franklin Resources Inc. |

BEN |

Investment Managers |

4.30% |

|

Amcor PLC |

AMCR |

Containers/Packaging |

4.27% |

|

NorthWestern Corp. |

NWE |

Electric Utilities |

4.24% |

|

OGE Energy Corp. |

OGE |

Electric Utilities |

4.24% |

|

Source:

FactSet |

Click on the tickers for more about each company.

About the Author

|

|

Philip van Doorn

Philip van Doorn writes the Deep Dive investing column for

MarketWatch. |

|

Copyright ©2022 MarketWatch, Inc. |