ESG Incentives and Executives

Posted by Ira T. Kay, Mike Kesner, and

Joadi Oglesby, Pay Governance LLC, on Tuesday, May 24, 2022

Introduction

Early indications are that the inclusion of environmental, social, and

governance (ESG) metrics in corporate incentive plans—primarily annual

incentives currently—is becoming common, with 69% of S&P 500 companies (207 of

301) reporting the inclusion of such metrics in their 2022 proxies. [1] If

this level of inclusion holds for all of 2022, it would represent a significant

increase from 2021 when 52% of the S&P 500 reported ESG metrics. It is apparent

that large corporations and their executives have undertaken a good faith effort

in using incentives to address ESG issues at the company level, with possible

beneficial societal implications.

This unprecedented movement in incentive metric usage—much faster even than the

relative total shareholder return (TSR) transition—is caused by many factors:

from boards’/executives’ desire to help improve the social footprint of their

companies and society to responding to shareholder pressures. This shift is

viewed by most audiences as a positive response from the corporate sector, but

it has its critics and challenges: measuring real impact; interpreting limited

data; navigating the lack of uniform measurement standards; choosing metrics;

setting goals; and balancing shareholder, societal, and employee priorities,

among others. Most, but not all, companies that have added ESG metrics to an

incentive plan have included them in a holistic/qualitative scorecard that may

include a combination of quantifiable and qualitative goals. There are many

valid reasons for this including measurement difficulty, litigation risk, and

motivational challenges. There are several companies that have purely

quantitative goals, and there is governmental, institutional, proxy advisor, and

media pressure to adopt this approach.

Bebchuk/Tallarita (BT), [2] major

critics of the ESG/stakeholder movement, have challenged the suitability and

utility of incorporating these metrics/goals into corporate incentive plans. BT

raised several valid criticisms/questions of the ESG/stakeholder incentive

movement, [3] including

the narrowness of the metrics, the limited use of quantitative metrics, and the possibility

that executives are implementing these metrics to improve their incentive

payouts at the expense of shareholders. Their view is that ESG metrics will

likely not improve the desired corporate and societal goals and might

distract the executives from focusing on shareholder value.

Tom

Gosling, another expert in this field, agrees with the BT view: “One of my big

fears about this sort of stampede towards including ESG targets in executive

pay is that it’s likely just to lead to more pay and not more ESG. ”

[4]

However, despite these criticisms, the ESG incentive metrics movement has

significant, and arguably irreversible, momentum to

address the private and public issues due to substantial pressure on large

corporations to move rapidly into ESG/stakeholder incentive commitments.

Therefore, it is essential that this movement be based upon financial and

economic validity and facts.

One

important criticism from BT remains empirically unresolved: “it is difficult

if not impossible for outside observers to assess whether this use provides

valuable incentives or rather merely lines CEO’s pockets with

performance-insensitive pay.” They worry that these incentives will motivate

executives to increase their pay without benefiting other stakeholders and

“indeed might dilute executives’ incentives to deliver value to shareholders.”

Pay Governance has conducted unique research to try to address this issue. We

find the usage of ESG metrics, thus far, does not appear to have significantly

diluted other incentives or distracted executives from creating shareholder as

well as stakeholder value.

Here are the hypotheses we thought should be tested:

-

Is the ESG

payout multiplier in incentive plans higher than the payout multiplier for

financial metrics?

-

If there is

validity to the criticism that ESG metrics are a distraction and being added

to increase executive pay, there would be some indication that ESG metrics

are in fact diluting attention from creating shareholder value relative to

other stakeholders.

-

It is also

too early in the ESG incentive movement to test whether they have a positive

impact on TSR or other performance metrics.

-

However, we

can test whether the ESG incentive payouts are higher than the payouts for

financial metrics.

-

What

conclusions can be drawn from companies that use a weighted ESG factor versus

a modifier?

-

We note that

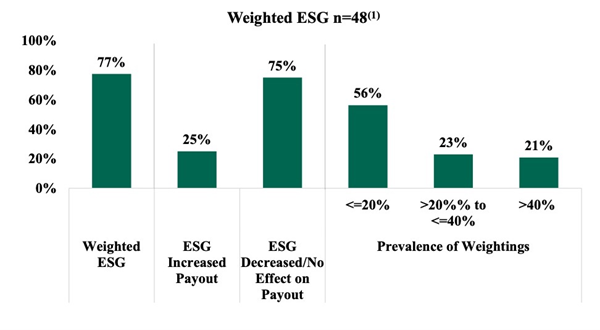

77% of companies with an explicit ESG metric use a “weighted” structure

versus 24% of companies with an unweighted modifier (the total adds to 101%,

as one company uses a weighted metric and modifier).

-

See below for

additional information regarding weighted metrics and modifiers.

-

Are there any

indications that Compensation Committees may be hesitant to provide payouts

above or below target based upon the achievement of ESG metrics if such

metrics are measured based on a combination of quantitative and qualitative

goals and/or when financial and operational goals are not attained?

We

utilized the following methodology to test for the answers:

-

Scanned 100 S&P

500 companies’ proxies using ESGAUGE to identify companies with ESG metrics

that provided clear disclosure of both the financial and ESG metrics

included in their annual incentive plan, even if the ESG metrics were part of

a holistic scorecard of other strategic metrics.

-

Segregated the

data into two different groups based on the method used to include ESG in the

incentive plan: either a weighted ESG factor, which reduces the weight of the

financial metrics, or a modifier that is used to increase or decrease the

financial payout.

-

Collected the

2021 payouts for:

-

Financial/operational metrics

-

ESG metrics

-

Overall

payout after incorporating the ESG impact

We found 62 large companies that met these criteria.

Here are our key findings:

-

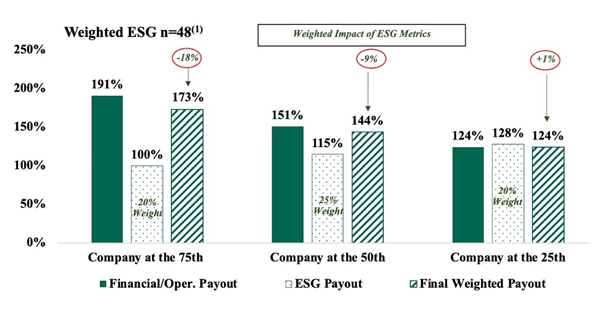

ESG reduced the

overall payout at 75% of the companies using a weighted metric, (Figure 1)

with the median reduction equal to 9%. (Figure

2)

-

Most

ESG-weighted metric companies (56%) used a 20% weighting or less. (Figure 2)

-

In some

cases, the company used a scorecard approach and did not provide sufficient

detail to determine the portion of the weighted metric attributable to ESG;

in those cases, we included the entire weighting.

-

Many of the

companies with a >20% weighting included ESG and other strategic metrics.

-

Of the

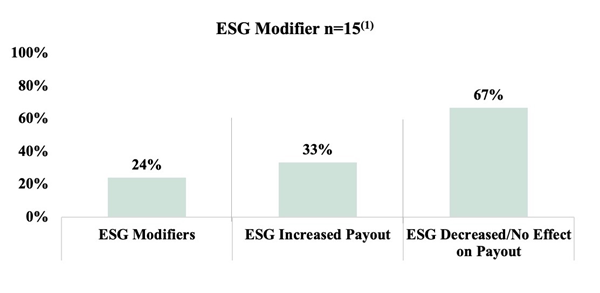

companies that incorporated ESG metrics as part of a modifier, 33% increased

payouts and the remaining 67% had no effect or reduced payouts. (Figure 3)

-

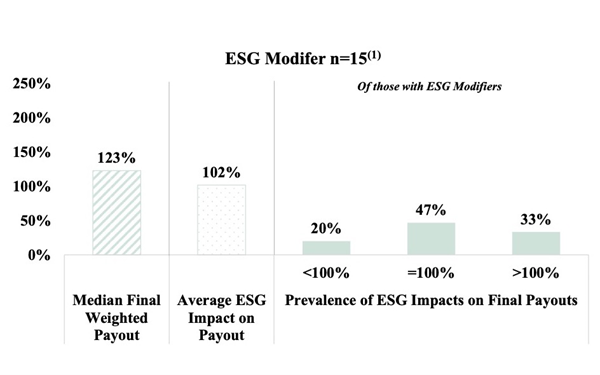

The average

impact on payouts for companies using a modifier on the financial performance

metrics ranged from +35% to -14% and averaged +2%. (Figure 4)

-

These findings

indicate that the compensation committee members are acting conservatively in

setting and scoring ESG goals—thus the narrow band around target for most

companies.

Figure 1.

We

ranked the 48 companies from largest (negative) impact to smallest (positive).

Figure 2.

Figure

3.

Figure

4.

Conclusion

The

ESG movement has made substantial progress in encouraging U.S. companies to

incorporate ESG metrics into their incentive plans. It is early in this process,

and we need to wait for information about the impact of these corporate programs

on companies’ long-term performance and sustainability as well as the effect on

societal problems. However, it does appear that the ESG incentive criticism,

that executives are using these metrics inappropriately to increase their

compensation, is not empirically supported.

Endnotes

1

Data provided by ESGAUGE.

(go back)

2

Lucian A. Bebchuk

and Roberto Tallarita. “The Perils and Questionable Promise of ESG-Based

Compensation.” Journal of Corporation Law. March 4, 2022.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4048003.

(go back)

3

Ira Kay. “The

Perils and Promise of ESG-Based Compensation: A Response to Bebchuk and

Tallarita.” Harvard Law School Forum on Corporate Governance. April 27, 2022.

https://corpgov.law.harvard.edu/2022/04/27/the-perils-and-promise-of-esg-based-compensation-a-response-to-bebchuk-and-tallarita/.

(go back)

4

CJ Clouse. “Does Linking ESG Performance to Executive Pay Actually Make a

Difference?” GreenBiz. February 2, 2022.

https://www.greenbiz.com/article/does-linking-esg-performance-executive-pay-actually-make-difference.

(go back)

|

Harvard Law School Forum

on Corporate Governance

All copyright and trademarks in content on this site are owned by

their respective owners. Other content © 2022 The President and

Fellows of Harvard College. |