|

Buybacks have traditionally been more common in the US stock

market than in the UK or Europe but they are on the rise

worldwide © AFP/Getty Images

|

Arjun Neil Alim,

Emma Dunkley,

George Steer and

Chris Flood

in London and

Nicholas Megaw

and

Madison Darbyshire

in New York MAY 16 2023

Record

levels of

share buybacks

are attracting

complaints from

a growing

number of

prominent investors concerned that the practice is boosting

executive bonuses but providing only limited benefits to shareholders.

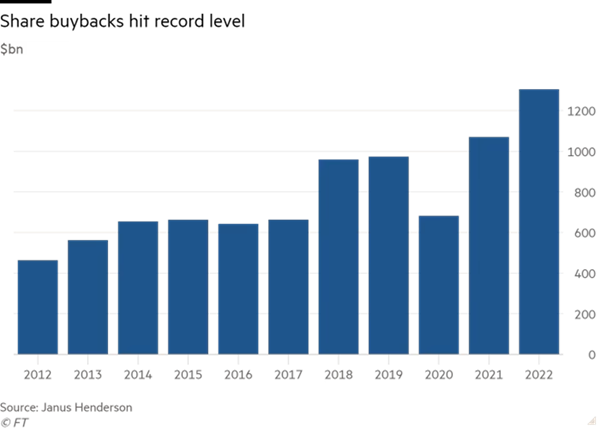

The

world’s 1,200

biggest public

companies

collectively bought

back a

record $1.3tn

of their

own

shares

last year, triple the level of a decade

ago and almost as much as they paid out to shareholders in dividends,

according to research by asset manager Janus Henderson. By contrast,

total dividends have grown by just 54 per cent in the past 10 years.

The

trend has

continued this

year, with

new share

purchases announced

by companies

including

HSBC, Apple, Airbnb and

caterer Compass. Oil was the sector with the largest amount of share

buybacks last

year, according

to Janus

Henderson;

companies repurchased

$135bn of

their stock

—

four times

as much

as

2021.

Buybacks

are

a way

for companies

to return

excess cash

to shareholders,

and can

boost their share

price, but the scale of the activity is increasingly attracting the

interest of regulators.

US

President Joe

Biden introduced

a 1

per cent

tax on

Wall Street

buybacks that

came into

force in January; he has

recently

proposed

to quadruple it.

The

Securities and

Exchange Commission

recently

approved

a

rule that

will require

publicly traded companies to disclose more information on their

buybacks, such as the number purchased and average price paid.

“We

would prefer

buybacks to

be less

prevalent,” said

Euan Munro,

chief executive

of Newton Investment

Management.

Record

levels of

share buybacks

are attracting

complaints from

a growing

number of

prominent investors concerned that the practice is boosting

executive bonuses but providing only limited benefits to shareholders.

The

world’s 1,200

biggest public

companies

collectively bought

back a

record $1.3tn

of their

own

shares

last year, triple the level of a decade

ago and almost as much as they paid out to shareholders in dividends,

according to research by asset manager Janus Henderson. By contrast,

total dividends have grown by just 54 per cent in the past 10 years.

The

trend has

continued this

year, with

new share

purchases announced

by companies

including

HSBC, Apple, Airbnb and

caterer Compass. Oil was the sector with the largest amount of share

buybacks last

year, according

to Janus

Henderson;

companies repurchased

$135bn of

their stock

—

four times

as much

as

2021.

Buybacks

are

a way

for companies

to return

excess cash

to shareholders,

and can

boost their share

price, but the scale of the activity is increasingly attracting the

interest of regulators.

US

President Joe

Biden introduced

a 1

per cent

tax on

Wall Street

buybacks that

came into

force in January; he has

recently

proposed

to quadruple it.

The

Securities and

Exchange Commission

recently

approved

a

rule that

will require

publicly traded companies to disclose more information on their

buybacks, such as the number purchased and average price paid.

“We

would prefer

buybacks to

be less

prevalent,” said

Euan Munro,

chief executive

of Newton Investment

Management.

“Used badly, [buybacks] can be used to

manipulate [earnings per share] numbers upwards to meet

medium-term

management incentive

targets at

the expense

of investments

that might

be important to a company’s long- term health,” he said.

Daniel

Peris, a

fund manager

at Pittsburgh-based

Federated Hermes,

called buybacks

an “environmental hazard”.

“The

dividend is

just the

dividend: grandma

benefits, the

long-term holder

[benefits].

Buybacks benefit traders, hedge funds, senior executives [and]

near-term share prices.”

Leigh Himsworth, a UK equity fund manager

at Fidelity, said: “As a shareholder you feel like you never actually

get the reward” with buybacks. “If the market is nonplussed by it

then, as a shareholder, you are worse than square one, as the company

has typically used up their cash.”Abrie Pretorius, a manager at Ninety

One, said: “Buybacks only create value for remaining shareholders and

strong relative performance when shares are cheap and there are no

better uses of

that cash

which would

generate higher

returns. Most

buybacks help

optical [earnings

per share] growth but destroy value.”

Buybacks

also do

not always

translate into

better share

price performance.

An Invesco

fund that tracks the

price of companies that do large buybacks has underperformed the US

market over the past decade.

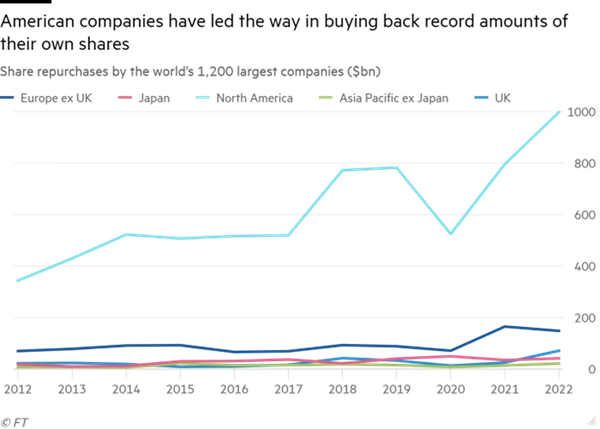

Share

repurchases have

traditionally been

more common

in the

US stock

market than

in the

UK or Europe, but they are on the rise worldwide. Between 2012

and 2022, repurchases by the biggest UK-listed companies more than

tripled from $22bn to $70bn. US-listed companies increased buybacks

from $333bn to $932bn, while in Europe share purchases more than

doubled to $148bn.

“The

approach we

have seen

in the

US to

generally prefer

buybacks could

be problematic

if it takes

root in the

UK,” said

Michael Stiasny,

M&G’s head

of UK

equities. “The

likely outcome would

be that the market ends up yielding permanently less than it could.”

Nevertheless,

some investors prefer buybacks

to dividends,

for instance

because they

may pay lower tax

than on a dividend and can control the timing of when the tax is due.

“I don’t know how we’ve gotten to this

point politically, but the idea that buybacks are a bad thing,

or simply

a way

to manipulate

your stock,

I don’t

think could

be further

from the

truth,” said Jim Tierney, a portfolio manager at

AllianceBernstein who focuses on growth stocks.

Lindsell

Train co-founder

Nick Train

said that

the benefit

of buybacks

depended on

the purchase price, but they could be “a

wonderful way for a board to build enhanced wealth for long-term

shareholders”.

Bernard Ahkong, co-chief investment

officer at UBS Asset Management’s hedge fund unit O’Connor, said: “We

don’t want companies to boost dividends in an unsustainable fashion

only to then

have to

cut them

say one

year later

— and

there would

be less

negative fallout

from doing a one-off

buyback, for example.”

On

Friday, the

US Chamber

of Commerce

sued the

SEC in

an effort

to block

its plan

to require more

buyback disclosure. “Stock

buybacks play

an important role

in the

functioning of healthy and

efficient capital

markets,” said

Neil Bradley,

the chamber’s

vice-president and chief

policy officer.

Some analysts expect the flurry of

activity to taper off. Goldman Sachs forecasts that spending on

buybacks by

US S&P

500 companies

will this

year drop

15 per

cent to

$808bn and

dividends will rise

5 per

cent to

$628bn as

weak earnings

growth constrains

the total

payout to

investors, although next year it expects buybacks to rise

again.

David

Kostin, Goldman’s

chief US

equity strategist, said: “The

slowdown in

US earnings growth, the

increase in policy uncertainty following the recent banking stress,

and high starting valuations at which to repurchase stock all pose

headwinds to buybacks.”

Sharp

declines in

US companies’ cash

holdings have

limited their

ability to

pursue buybacks,

while rising

interest rates

have removed

the incentive

to fund

them with

debt, he

said, adding that

Biden’s buyback tax was unlikely to have a notable effect.

Additional reporting

by Katie

Martin and

Laurence

Fletcher

Copyright The Financial Times

Limited 2023. All rights reserved.