|

Bloomberg

|

Markets

Deals

|

Activist Fights Tick Up, Along With Settlements

|

|

A Salesforce Park sign in San

Francisco, California, US, on Wednesday, Jan. 25, 2023.

Photographer: Marlena Sloss/Bloomberg

|

By

Crystal Tse

July 10, 2023 at 8:30 AM EDT

Updated on July 10, 2023 at 10:30 AM

EDT

The first proxy season after a key US rule change was expected to

rock the shareholder activism world. Instead, the universal

proxy card turned typically public battles into

something more private and discreet, with settlements reached

behind the scenes or very quickly once they become known.

For the first half of the year, the number of new activist

campaigns in the US inched up by 13% to 196 from 173 for the same

period in 2022. Private discussions with companies aren’t captured

in the data.

Here are some of the activism highlights of the year’s first half

and what’s shaping up for the rest of 2023.

Universal Proxy

The US rule change that took effect last year allows shareholders

to vote for individual board nominees instead of picking between

company and activist slates. That’s led to more settlements in

private earlier on when investors show up rather than letting

challenges evolve into public proxy battles, advisers said.

“Some companies and boards are more eager to wrap things up or

make change proactively to avoid the cost and distraction of a

fight, but also because of a perception that with universal proxy,

more cards are stacked against you,” Elizabeth Morgan, a partner

at law firm King

& Spalding said.

That could lead to quicker settlements. Burger chain Shake

Shack Inc. added an independent director to settle a

fight with Engaged

Capital in May, about 48 hours after news of Engaged’s

position was reported.

There’s no lack of public board fights and large companies aren’t

immune. Salesforce

Inc., with a market value of $204 billion, had to deal

with a swarm including Elliott

Investment Management, Starboard

Value LP, Jeff Ubben’s Inclusive

Capital and Third

Point LLC — before taking

steps to avoid a board fight. Salesforce appointed

three new independent directors, including ValueAct

Capital Management Chief Executive Officer Mason

Morfit.

In a contrast showing the effect of the US rule change, Canada saw

a surge in campaigns to 42 from nine. Algonquin

Power & Utilities Corp. and the contested takeover by Ritchie

Bros Holdings Inc. of IAA

Inc. attracted more than half a dozen activists.

One other trend to watch: while campaigns involving companies

valued at $1 billion or more fell by almost 4% globally, those

against smaller companies jumped 47%, the data show.

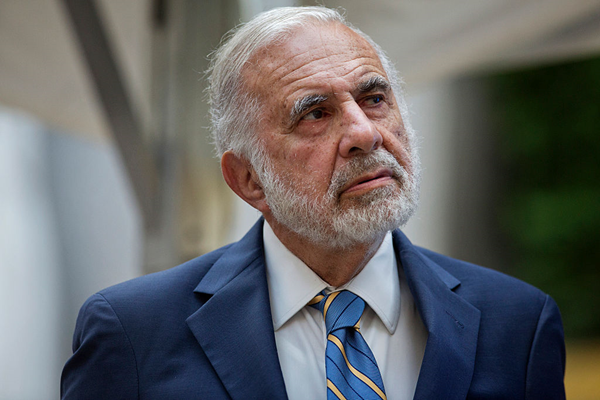

Icahn got Icahn’d

Billionaire Carl Icahn found himself on the receiving end of some

of his own tactics thanks to a report by short seller Hindenburg

Research.

Carl

Icahn Photographer: Bloomberg/Bloomberg

|

The report came out while Icahn sought board seats and called for

the removal of the CEO of Illumina

Inc., a $29 billion company. Icahn

Enterprises LP has lost more than 40% of its value

since May after the short seller blasted Icahn’s

company as being overpriced and for paying outsize dividends to

its namesake majority owner. Icahn Enterprises, in a statement,

has called the Hindenburg report “self-serving.” He’s also amended his

agreements with some of his lenders to lower the chances of a

potential margin call. The new agreement unties Icahn’s loans from

the share price performance of IEP, according to a filing Monday.

At Illumina, one of Icahn’s nominees won a board seat and Francis

deSouza resigned as CEO just weeks after being re-elected to the

board.

Succession

While HBOs Succession series

didn’t get all the details right on the proxy fight by Stewy

Hosseini (the actor Arian Moayed), the family

dynamics depicted by it are playing out in real life

for activists.

Nelson Peltz Photographer: Marco

Bello/Bloomberg

Icahn’s Hindenburg episode led to questions on whether it’s time

for a new generation to step in. Brett Icahn, the son of the

87-year-old billionaire, is a portfolio manager at Icahn

Enterprises and plays a central role in its activism business.

The changing

of the guard is already happening at Trian

Fund Management with co-founder Ed Garden retiring as

chief investment officer after 18 years at the firm. Led by

octogenarian billionaire Nelson Peltz, who is Garden’s

father-in-law, Trian promoted Matt Peltz, Nelson’s son, and Josh

Frank as co-chief investment officers.

Such transitions from a single prominent leader to multiple people

and personalities may make defending against activists trickier,

said Rich

Thomas, managing director at Lazard

Ltd.’s Capital Markets Advisory group.

“You need to know ‘who’ is the ‘who’ behind the activist fund, in

order to really understand what direction the campaign might take

or what tactics the activist may use,” Thomas said.

Biogen, Alkermes

Activist health-care investor Alex Denner resigned from Biogen

Inc.’s board while he was agitating for board seats at Alkermes

Plc. Former Biogen executive Susan

Langer was nominated to replace him on the Biogen

board, without disclosing their live-in romantic relationship

being disclosed.

Alex Denner Photographer: Andrew

Harrer/Bloomberg |

Langer was elected to Biogen’s board but Denner’s hedge fund

Sarissa Capital ending up losing its proxy campaign at Alkermes.

“Activists should be holding themselves to the same standards that

they expect from public companies,” said Lawrence Elbaum, co-head

of the shareholder activism practice at Vinson & Elkins, the

second most active legal adviser for activists on Bloomberg’s

league table.

Rest of the Year

The lead advisers to companies this year have been Goldman

Sachs Group Inc., Sidley Austin and Joele Frank, while

Squarewell Partners, Olshan and Longacre Square Partners won top

spots on the activist advisory side, according to Bloomberg’s

league tables.

Positions taken outside of proxy season are already trickling in.

Elliott is agitating at power producer NRG

Energy Inc. and calling for a strategic review as well

as CEO change. The investor also disclosed a 10% position in

tire-maker Goodyear

Tire & Rubber Co. asking it to appoint new independent

directors and explore a divestment. While Trian had called off its

fight at Walt Disney Co. in February, it’s still a shareholder and

has added to

its stake, Bloomberg News reported in May.

“There are some

big campaigns out there, as well as some campaigns that are under

the radar,” Lazard’s Thomas said.

Companies are now also more familiar with the universal proxy

change after this season so boards will be less rattled by them.

“The big change in the coming year is that people will be less

afraid of universal proxy card,” Thomas said. “People are going to

settle down a little bit more and will be less likely to jump at

the first sign of shareholder trouble.”

(Updates with details of Icahn loan amendment starting in 11th

paragraph)

©2023 Bloomberg L.P. All Rights Reserved

|