FINANCE

|

INVESTING

Wall Street’s ESG Craze Is Fading

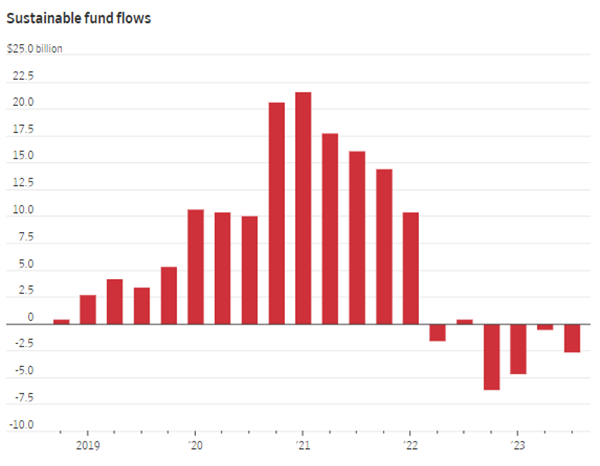

Investors pulled more than $14 billion from sustainable funds this

year

By

Shane Shifflett

Nov. 19, 2023 5:30 am ET

|

Source:

Morningstar Direct Source:

Morningstar Direct

|

Wall Street rushed to embrace sustainable

investing just a few years ago. Now it is quietly closing funds or

scrubbing their names after disappointing returns that have investors

cashing out billions.

The about-face comes after tightened regulatory oversight, higher

interest rates that have slammed

clean-energy stocks and a backlash that has made environmental,

social and corporate-governance investing a

political target.

“This really is the result of too many managers looking to cash in on

increased awareness and demand for ESG investments,” said Tony

Turisch, senior vice president at Calamos Investments.

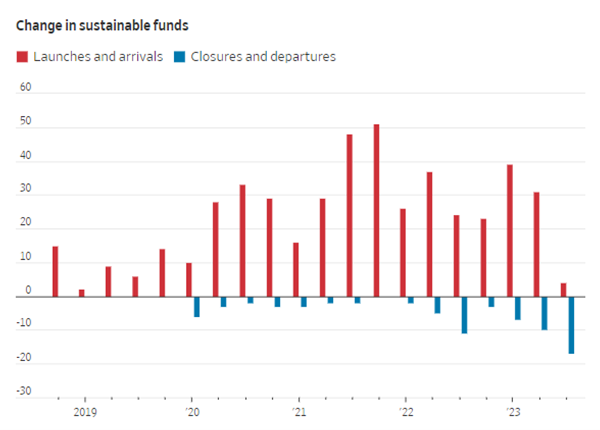

The third quarter was the first time more sustainable funds liquidated

or removed ESG criteria from their investment practices than were

added, according to Morningstar. That is a reversal from not that long

ago, when companies were rebranding

faltering funds to cash in on the billions of dollars flowing into

sustainable investment products.

In 2021, Hartford Funds inserted “sustainable” into the name of its

core bond product and subsequently saw investors pour $100 million

into it. But after missing its own performance targets last year,

Hartford is switching gears again.

Later this month, the bond fund will be known as the Core Fixed Income

Fund and potentially sell some of the holdings that made it

sustainable when it pivots to a conventional investment strategy,

according to company filings. Hartford declined to comment on why it

is rebranding the fund.

|

Source:

Morningstar Direct Source:

Morningstar Direct

|

At least five other funds also announced they would drop their ESG

mandates this year, while another 32 sustainable funds will close,

according to data compiled by Morningstar and The Wall Street Journal.

The retreat comes after investors withdrew more than $14 billion from

sustainable funds this year, leaving them with $299 billion, according

to Morningstar. Conventional funds also lost money, but the pain was

more acute for climate and other thematic products hit by high

interest rates and other factors.

Ron Rice, vice president of marketing at Pacific Financial, said a

legal fight over the Labor Department’s rule letting retirement-fund

managers consider

ESG factors may have weighed on the popularity of his firm’s

sustainable products.

|

|

|

Companies, countries and

organizations are attracting consumers and investors with

promises to be more environmentally friendly. But what happens

when they fall short? Here’s how greenwashing is misleading

consumers about how sustainable products and services are.

|

“We found that the demand for ESG investing, by financial

professionals working with retirement-plan participants, was more

limited than we anticipated,” he said. Earlier this year, Pacific

Financial removed sustainability from the name of three mutual funds

then holding more than $187 million. All three funds subsequently saw

their assets under management jump, Rice said.

Political pressure could be factoring into the changes as well.

Republican presidential candidate Vivek Ramaswamy has been a

vocal ESG critic. Last year, Florida said it was pulling

$2 billion of its assets managed by BlackRock

in part due to the company’s support of ESG.

|

Note: Departures indicate a

sustainable fund that dropped its ESG criteria from its

investment strategy.Arrivals indicate a fund added ESG

strategies to its investment approach.

Source: Morningstar Direct

|

Meanwhile, the Securities and Exchange Commission is stepping up

oversight of the space and recently adopted a rule to prevent

misleading naming conventions. Funds have roughly two to three years

to comply, depending on their size.

Already, the SEC is policing the space more closely. In September, Deutsche

Bank’s investment arm, DWS Investment Management Americas, agreed

to pay $19 million to settle an investigation into alleged

greenwashing by the firm for overstating how the company factored

ESG data into investment decisions.

At the end of the month, DWS will liquidate a mutual fund the company

rebranded as ESG in 2019.

DWS said it addressed the matters with the SEC and that it decided to

liquidate the fund due to its small size.

|

A wind farm in Canada. Investors withdrew billions from

environmental, social and corporate-governance funds this

year. PHOTO: JAMES MACDONALD/BLOOMBERG NEWS

|

Despite the closures, new ESG funds continue to pop up. Last year,

Naperville, Ill.-based Calamos Investments said it would close a $4

million sustainable equities fund that had lagged behind its benchmark

from inception, according to company filings.

Then earlier this year, the firm came up with two new ESG funds. They

have the same strategy as the closed fund, but brandish NBA

superstar Giannis Antetokounmpo’s name.

“While it’s not working currently, we expect that over the long term

it will add value to the strategy,” said Turisch of Calamos.

Write to Shane Shifflett at shane.shifflett@dowjones.com

Appeared in the November 20, 2023, print edition as

'Social-Investment Craze Fades, Hurt By Weak Returns'.