Wall Street Is Worried About Carl

Icahn

The value of the

88-year-old activist investor’s company has fallen by nearly $20

billion. Mr. Icahn said that he was “absolutely not selling.”

|

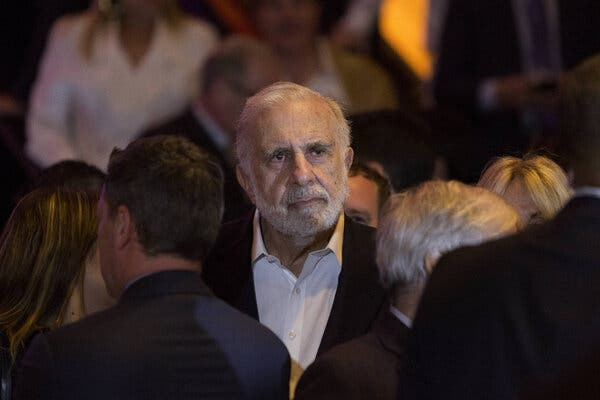

Carl Icahn is under intense scrutiny from Wall Street investors,

who are rapidly selling his company’s stock.

Victor J. Blue/Bloomberg |

Sept. 6, 2024

Chief executives of public companies have long feared Carl C. Icahn.

The 88-year-old investor made a name and billions for himself by

questioning the decisions and strategies of corporate leaders and

agitating for change at companies like Apple, RJR Nabisco and Netflix.

But now Mr. Icahn is under intense scrutiny from Wall Street

investors, who are rapidly selling his company’s stock. In the past

year and a half, shares of Icahn Enterprises, his publicly traded

investment company, have dropped more than 75 percent, losing nearly

$20 billion of value. After dropping more than 30 percent since

mid-August alone, it now trades at $10.53 a share, its lowest level in

more than two decades.

Mr. Icahn owns

roughly 86 percent of the shares, so he has personally lost about $17

billion.

“There’s a confidence game and he’s lost the confidence of investors,”

said Don Bilson, who focuses on activist investing as the head of

event-driven research at Gordon Haskett Research Advisors.

Some Wall Street investors are now worried that the stock’s continuing

fall could threaten the health of the entire company and that it could

be forced to sell companies it holds. Icahn Enterprises holds a mix of

public stocks, real estate and other investments, according to

interviews with Mr. Bilson and several other market watchers.

Investors have been questioning whether Mr. Icahn himself has been

selling his stock. He has taken out personal loans using his stock as

collateral. Banks that offer these loans typically have strict

requirements related to the value of a company. A sharp drop in a

stock price could force a lender to sell shares.

In an interview this week, Mr. Icahn said that he was “absolutely not

selling.” He also said there had not been any so-called margin calls

on personal loans backed by his stock. Margin calls occur when a

lender forces a borrower to sell stock to settle a loan. “I don’t

foresee margin calls,” he said.

Shares in Mr. Icahn’s company started

tumbling in May 2023 when

Hindenburg Research, the short-selling firm run by Nate Anderson,

published a report

questioning Icahn Enterprises’

financials. Among other things, Hindenburg accused Icahn Enterprises

of having a “Ponzi-like economic structure” and paying a dividend it

couldn’t afford. (It has since cut its dividend.) He also questioned

Mr. Icahn’s use of personal loans backed by the stock.

Mr. Anderson said in an interview this week that he expected Icahn

Enterprises’ stock would still fall further. He continues to hold a

short position, betting against the stock. He said Mr. Icahn’s

extensive use of personal loans is still dangerous to the company’s

future. “He’s got too much debt and needs cash. He’s really cornered

himself,” he said. “There’s no safe exit.”

In April 2023, Icahn Enterprises stock traded around $50 to $55 a

share.

But investors became increasingly skeptical of Mr. Icahn after the

Hindenburg report was released, as evidenced by the sharp sell-off.

The move out of the stock intensified after the firm cut its dividend

in August that year.

The pressure mounted even further since

last month, when the Securities and Exchange Commission charged Mr.

Icahn with failing to disclose that he had personally pledged his own

stock as collateral for margin loans worth billions of dollars. The

settlement called for Mr. Icahn to

pay $2 million in fines.

The stock has since continued to drop. Some investors said they are

worried that Icahn may be forced to cut its quarterly dividend again.

Even with its rapid fall in share price, Icahn Enterprises still

trades at a premium to its so-called net asset value, the value of a

public company’s stakes, real estate and private company holdings,

minus debt and liabilities. Many publicly traded investment firms

trade at a discount to net asset value because of a presumption that

certain stakes would lose value if the manager were forced to sell.

At Icahn Enterprises, Mr. Icahn holds the largest stake in certain

public companies, and some have fared poorly. Shares of CVR Energy, a

Texas-based oil refiner, for example, are down more than 30 percent in

the past year, and Icahn Enterprises owns roughly 65 percent of the

stock, one of Mr. Icahn’s largest holdings.

In the interview this week, Mr. Icahn said that Mr. Anderson’s

statements on him and his firm are “what we consider to be compete and

total lies and extremely misleading.”

Maureen Farrell writes

about Wall Street, focusing on private equity, hedge funds and

billionaires and how they influence the world of investing. More

about Maureen Farrell

A version of this article appears in print on Sept. 7, 2024,

Section B, Page 1 of the New York edition with the headline: Icahn

Loses The Trust Of Investors.

© 2024 The

New York Times Company