The Stock Market Is Like a Fashion Show, and Here’s One of Its Hot

Must-Haves

Software companies are touting something called the ‘Rule of 40,’

but some are more flash than substance

By

Jonathan Weil

Jan. 3, 2025 6:00 am ET

|

Whatever

numbers investors want to see, management will supply them. Photo: H.

Armstrong Roberts/ClassicStock/Getty Images

|

Like hemlines and haircuts, stocks go in and out of fashion. So do the

ways companies communicate their performance to investors. Whatever

numbers investors want to see, management will supply them, especially

if they can be easily tailored to look flattering.

For so-called SaaS

companies, selling software as

a service, a favorite metric nowadays is something called the “Rule of

40.” The first thing to know is it isn’t a rule, because there is no

standard definition for what it means. For some companies it has

become a big deal to claim membership in the “Rule of 40 club”

nonetheless.

In general the rule holds that a company’s revenue growth plus its

profit margin should be 40% or greater. So if a company has 20%

revenue growth and a 20% margin, it gets to be in the club. Same for

40% growth and no margin, or 30% growth and a 10% margin.

Brad Feld, a venture-capital investor,

popularized this notion with a blog post back in 2015 called “The

Rule of 40% For a Healthy SaaS Company.”

The term’s first appearance in a company’s Securities and Exchange

Commission filing was in 2017, going by the results of a database

search on the SEC’s website. A

2021 study by McKinsey, the

consulting giant, is credited for helping spread its usage and showed

that the market rewarded companies with higher valuations if they are

at or above the Rule of 40.

|

Brad Feld

in New York in 2011. Photo: Peter Foley/Bloomberg

Photo: Peter Foley/Bloomberg

|

Here is where it starts to fall apart: While revenue has a standard

meaning, there is no consensus on which measure of profit companies

should use to calculate the margin component. Should it be operating

income? Net income? Cash flow? Maybe some nonstandard version of

earnings or cash flow? The numbers that companies are showing lack

comparability because they aren’t apples-to-apples, and the companies

often don’t show their math.

But say everyone could agree on a particular margin metric to use for

the calculation. The traditional one that McKinsey recommended was

free cash flow. This typically is defined as operating cash flow,

which has a standard definition, minus capital expenditures. Even

then, the metric’s usefulness starts to crumble. Done this way, the

rule favors companies that rely heavily on stock-based compensation to

pay their employees, while punishing those that don’t and instead pay

more heavily in cash. That is because free cash flow, like operating

cash flow, excludes stock-based pay, which is a real cost that counts

in companies’ reported profits.

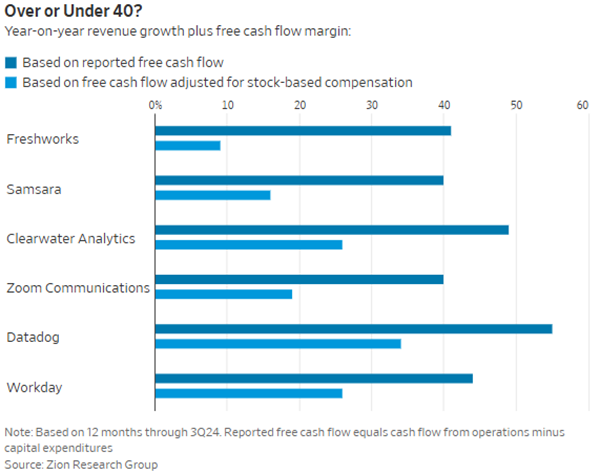

David Zion, founder of Zion Research Group

and a longtime accounting and tax analyst, in a December research

note did his own Rule of 40

calculations for North American application-software companies with

stock-market values of greater than $1 billion. For this exercise, he

took the sum of revenue growth plus free-cash-flow margin using the

last reported four quarters. Of the 98 companies in the group, 33 of

them met or beat the Rule of 40. However, when he adjusted free cash

flow to treat stock-based pay as an expense, only 11 companies still

met or beat the Rule of 40 under both methods. They included Palantir

Technologies and Constellation

Software.

|

|

At Freshworks,

for instance, during the company’s recent earnings call, Chief

Executive Dennis Woodside said, “adding our revenue growth and

free-cash-flow margin for Q3, we exceeded the Rule of 40 in the

quarter.” Indeed, Zion calculated that its Rule of 40 number was 41%,

which put Freshworks at No. 29 on his ranking out of the 98 companies.

Revenue growth was just over 20%, and so was free-cash-flow margin.

But when Zion adjusted Freshworks’ margin figure to treat stock-based

pay as an expense, its Rule of 40 number fell to 9% and its ranking

dropped to No. 76. The reason: Its stock-based pay exceeded its free

cash flow. In other words, if that compensation had been paid in cash

instead of stock, Freshworks’ free cash flow would have been negative,

and its free-cash-flow margin would have been negative 11%.

Similarly, Workday’s chief

executive, Carl Eschenbach, at an investor conference in May said

“we’re a Rule of 40 company.” Using free-cash-flow margin for the

calculation, Zion showed its Rule of 40 number was 44% for the past

four quarters, but it was 26% if stock-based compensation was treated

as an expense.

Write to Jonathan Weil at jonathan.weil@wsj.com