|

Editor’s Note:

Ray Garcia is

a Leader, Matt

DiGuiseppe is a Managing Director, and Ariel

Smilowitz is a Director at the PricewaterhouseCoopers

(PwC) Governance Insights Center. This post is based on their PwC

memorandum. |

The flurry of activity coming out of the Trump Administration is

ushering in a new paradigm for investment stewardship of

environmental, social and governance (ESG) considerations. Over the

course of a few weeks in February 2025, the SEC issued significant new

guidance on topics ranging from shareholder proposals to investor

engagement and communication. In some ways, this shift in approach

raises questions about how business priorities and voting outcomes

will be impacted during this year’s proxy season, while in other ways

it may provide additional clarity.

As the market responds in real time, we anticipate that investors’

engagement and proxy voting strategies will evolve to address

potential legal and regulatory risks. We foresee the return of “quiet

diplomacy,” in which investors take less public credit for the impact

of their stewardship activities and surreptitiously articulate their

positions on governance issues related to specific companies. That

said, investors will also seek to understand how boards are overseeing

relevant business risks if company policies, practices or disclosures

are modified. Here, we outline how these developments may unfold,

along with steps boards and management teams can take to successfully

navigate through proxy season.

Companies may experience a shift in investor engagement

As we head into the 2025 proxy season, we expect to see a marked

change in how institutional investors communicate and engage with

portfolio companies. In particular, investors may be less forthcoming

and transparent in discussions with boards and management about their

views on board composition, executive compensation and shareholder

rights, among other issues.

Passive investors confront engagement limitations

One factor that may impact shareholder

engagement is the SEC’s new guidance on

who can be considered a large passive investor versus an active

investor. Before this guidance, large active investors were generally

understood to be those that took a position greater than 5% of a

company’s shares with the intention of influencing its management or

operations, like a hedge fund. However, the SEC expanded its

interpretation of an active investor to include an investor who —

through engagement — uses his or her vote to exert pressure on the

company to change its governance, environmental, social, compensation

or other practices. The new interpretation means that the largest

investors, many of whom follow an index and have sizeable equity

stakes in thousands of companies, will potentially need to change the

way they engage with companies or stop doing so all together to avoid

the cost and complexity associated with the reporting requirements for

active investors.

Proxy voting policies become less prescriptive

Institutional investors are also softening the language they use in

their voting guidelines, particularly about board diversity

expectations. For example, several large investors have updated their

voting guidelines to remove the mention of aspirational board

diversity targets and broaden the definition of diversity beyond

personal or demographic factors. Additionally, proxy advisor

Institutional Shareholder Services (ISS) announced that it has halted

the consideration of diversity factors when making voting

recommendations for directors. Proxy advisor Glass Lewis also

announced it will provide clients with research to help them consider

multiple voting outcomes on board diversity.

What this means for companies

As institutional investors alter their

voting policies and engagement practices, the onus will fall on

companies to have line of sight into investors’ voting intentions.

Investors have never been required to publicly disclose the rationale

underpinning vote decisions, especially as they pertain to individual

directors. And in some cases, there are several factors that come

together, including insights from engagement discussions, that can’t

be easily unwound. Ultimately, companies will need to analyze

investors’ stewardship programs to understand what they are

prioritizing and develop targeted

communications strategies. Part

of that analysis includes proactively identifying where governance

practices do not align with shareholder expectations, so that the

mismatch can be addressed in disclosures or engagement meetings

without the investor raising it via the engagement. Otherwise,

companies might miss out on opportunities to tend to the concerns of

their top shareholders.

Shareholder proposals may fluctuate in quantity, scope and

purpose

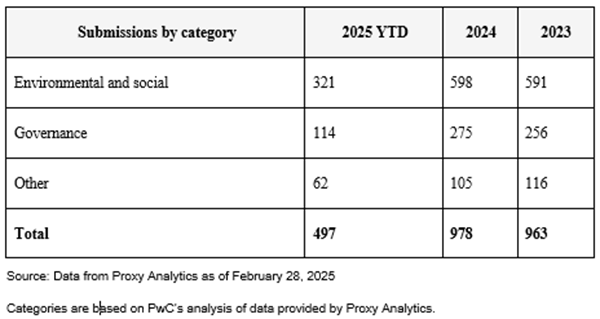

We expect shareholder proposals will continue to polarize investors,

resulting in varying levels of support. Even so, we anticipate

investors will focus on assessing proposals through a company-specific

risk lens. Multiple factors are contributing to this trend.

Shareholder proposals face new restrictions

In February, the SEC rescinded prior

guidance on shareholder proposals, making it easier for companies to

exclude proposals that are not economically relevant, seek to

micromanage or are too broad in nature rather than unique to the

company’s circumstances.

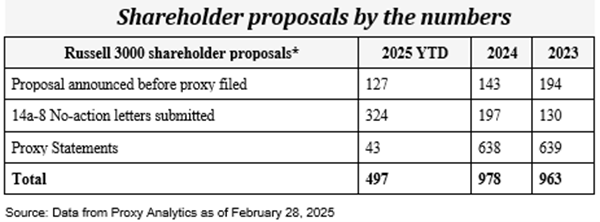

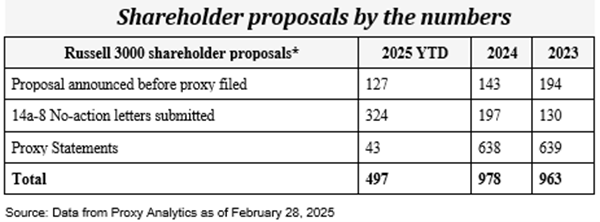

Early data shows that the number of SEC no-action requests increased

by 35% year-over-year before the SEC weighed in, indicating that the

SEC’s action was largely anticipated. But the new guidance essentially

places a higher burden on the proponent to demonstrate how the

proposal is material to the company’s business. It remains to be seen

how the SEC will apply this guidance to the no-action requests

reviewed after the change, especially given how rarely the SEC has

relied on the economic impact threshold in past decisions. However,

some companies have already successfully eliminated shareholder

proposals on topics that were permissible in the past, like corporate

political activities.

|

*Before proxy statements are filed, we can gain preliminary insights

into which proposals may be included on the corporate ballot through

the tracking of 14a-8 no-action requests to the SEC and voluntary

disclosures made by shareholder proponents. Some of the proposals

tracked will be withdrawn based on engagement activities before the

annual meeting. The rest will appear in proxy statements. There are

several shareholders that do not announce where they have filed

proposals ahead of time, so we will not know the final makeup until

after proxy season.

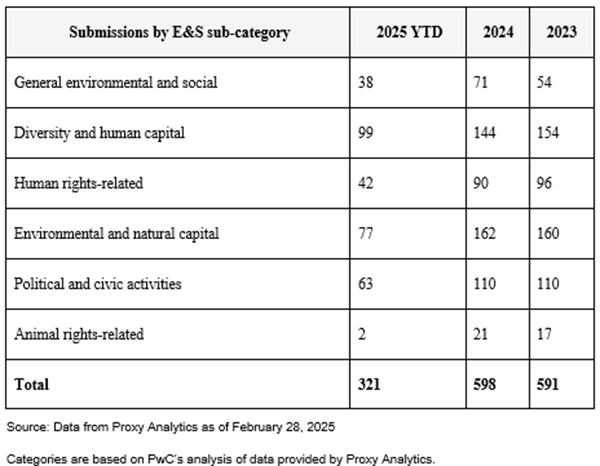

Investors expected to gravitate towards ESG topics that impact company

performance

Last year, investors generally did not use their votes to support

shareholder proposals asking companies to curtail their ESG

activities. In other words, there was no signal from investors that

companies should back off from these efforts. This year, we expect a

rise in both the number of shareholder proposals and proponents asking

companies to reverse course on these topics. However, we do not expect

to see significant changes in how investors vote on these “anti-ESG”

proposals and anticipate they will continue to not support them.

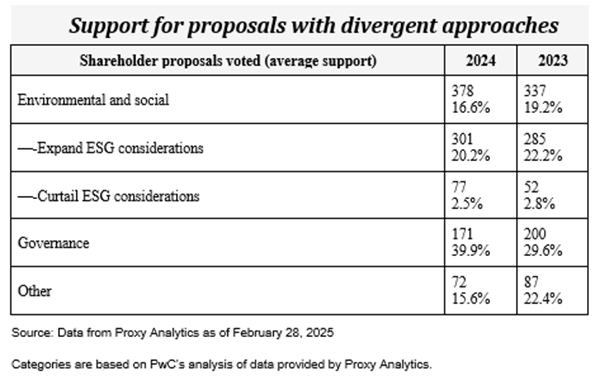

The shareholder proposal “resolved clause” takes center stage

Although proponents with divergent

political views are filing shareholder proposals, investors are

demonstrating that they are more interested in the risks posed by the

topic addressed in each proposal and the ask of the company — the

resolved clause — than the proponent’s public postering on the issue.

One example is the area of artificial intelligence (AI) oversight.

Our recent

survey of US investor priorities

for 2025 affirms that investors representing a range of investment

approaches are rallying around the opportunities presented by AI,

which in turn invites greater scrutiny of companies’ practices. Last

year, technology companies faced a swell of AI-related shareholder

proposals asking for enhanced guardrails and more transparency about

how boards are overseeing risks that may arise when this technology is

deployed. Some of these proposals were filed by proponents across the

political spectrum yet still received significant support from

shareholders. For this year’s proxy season, Glass Lewis also developed

a new approach to assessing AI risk oversight that may result in an

increased number of adverse vote recommendations on directors and

elevation of this topic during engagement meetings.

What this means for companies

Companies may find fewer shareholder

proposals on the proxy statement this year. But when one does appear,

it’s important to understand that the company-specific risks and

actions requested in the shareholder proposal — not the proponent’s

intent, reputation or political views — ultimately drive how investors

will vote. According to our Stewardship

investor survey, the resolved

clause in the shareholder proposal is one of the most important

factors in making a voting decision. On the other hand, the

proponent’s perceived political leaning and public statements are some

of the least important factors. Consequently, a company should focus

on disclosing how it is managing the risks raised by a shareholder

proposal in a manner aligned with value creation rather than simply

arguing against the proponent’s position.

Shareholder activists may consider new strategies to signal

concerns

As SEC reforms spur potential changes to the shareholder engagement

and shareholder proposal landscape, shareholder activists may

increasingly turn to other tactics such as vote “no” campaigns and

proxy contests.

Activists encounter communication-related barriers

That said, the SEC recently introduced new

limitations on how shareholder proponents can use the SEC’s electronic

filing platform to communicate with other shareholders. With this in

mind, activists may look for alternative ways to promote their

messages.

One strategy is using a company’s advance notice bylaws to introduce

shareholder proposals. Under this process, companies cannot exclude

proposals from appearing on the ballot, and shareholders can put forth

as many proposals as they choose without minimum shareholding

requirements. But the notice process is more costly and cumbersome as

companies have different information requirements and submission

deadlines.

Another strategy is harnessing social media and other digital

platforms to reach new audiences. Even traditional hedge fund

activists are broadening their aperture as campaigns surge to greater

levels.

What this means for companies

As shareholder activism continues to

evolve, it is important for companies to understand how activists

pursue their goals so they can prepare and respond accordingly. In

2024, over 70% of board members in our Annual

Corporate Directors Survey said

their boards had taken action in response to shareholder activism,

including engaging a third party to advise the board and tracking

ownership changes. As companies dedicate more time to activist

preparedness, they should consider the potential for new activist

scenarios.

|

Harvard Law School Forum on

Corporate Governance

All copyright and trademarks in

content on this site are owned by their respective owners. Other

content © 2025 The President and Fellows of Harvard College.

Privacy

Policy |