|

THE WALL STREET JOURNAL.

CFO

Journal.

December 2, 2014, 3:02 AM

ET

Pricey Stocks Curb LBO Hunger

By John Kester

Reporter

Record

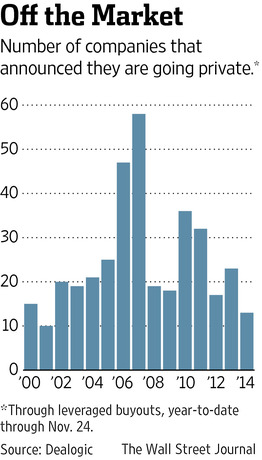

stock prices have curbed the number of companies that leveraged-buyout

firms want to take private. Just 13 firms have announced they would go

private so far this year. That is the fewest since 2001, when just 10

public companies announced, according to data provider Dealogic.

With

stock prices up, “bargains are more difficult to find,” said Richard

Peterson, an analyst at S&P Capital IQ. Take-private LBOs totaled

$11.6 billion, down 83% from 2013’s year-to-date total of $68.9

billion.

Instead,

private-equity firms are increasingly buying specialized divisions

rather than their larger parent companies, Mr. Peterson said. Carlyle

Investment Management LLC announced it would buy Johnson

& Johnson‘s ortho-clinical diagnostics division for $4.15 billion

in January.

Low

interest rates and high stock prices, Mr. Peterson said, mean

investors are “waiting for the pullback that, you know, never happens

until something cataclysmic happens and then everything gets swept

down.”

Some

companies are willing to sell only low-performing divisions, he said,

mentioning Procter

& Gamble Co.’s agreement last month to sell Duracell to Berkshire

Hathaway for $4.7 billion. A Procter & Gamble spokesman countered

that the deal shows a “vote of confidence” in Duracell.

Tibco Software Inc.

was the largest company to announce its public departure this year, at

$4.3 billion. Telecommunications-equipment company Riverbed

Technology Inc. and software firm Compuware Corp. will

do the same in deals valued at $3.4 billion and $2.4 billion,

respectively.

But those

deals are dwarfed by last year’s largest. H.J. Heinz Co. went private

in a $27.5 billion leveraged buyout, and Dell went off the market for

$24.4 billion.

|