|

For copies of the Form 8-K report and exhibits filed with the SEC relating to the agreements announced in the press release below, see Note: The agreements reported in this press release were modified a week later. For the announcement of the revisions and links to new agreements, see |

JP Morgan Chase & Co., March 16, 2008 press release and investor presentation (as filed in exhibits to a March 18, 2008 Form 8-K report)

| EX-99.1

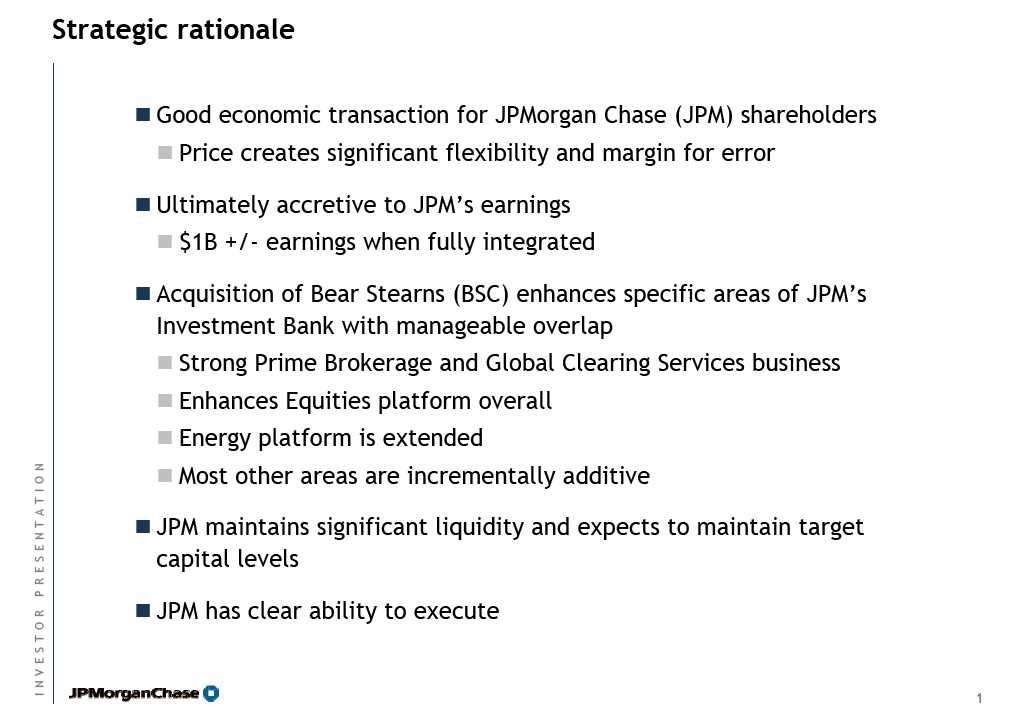

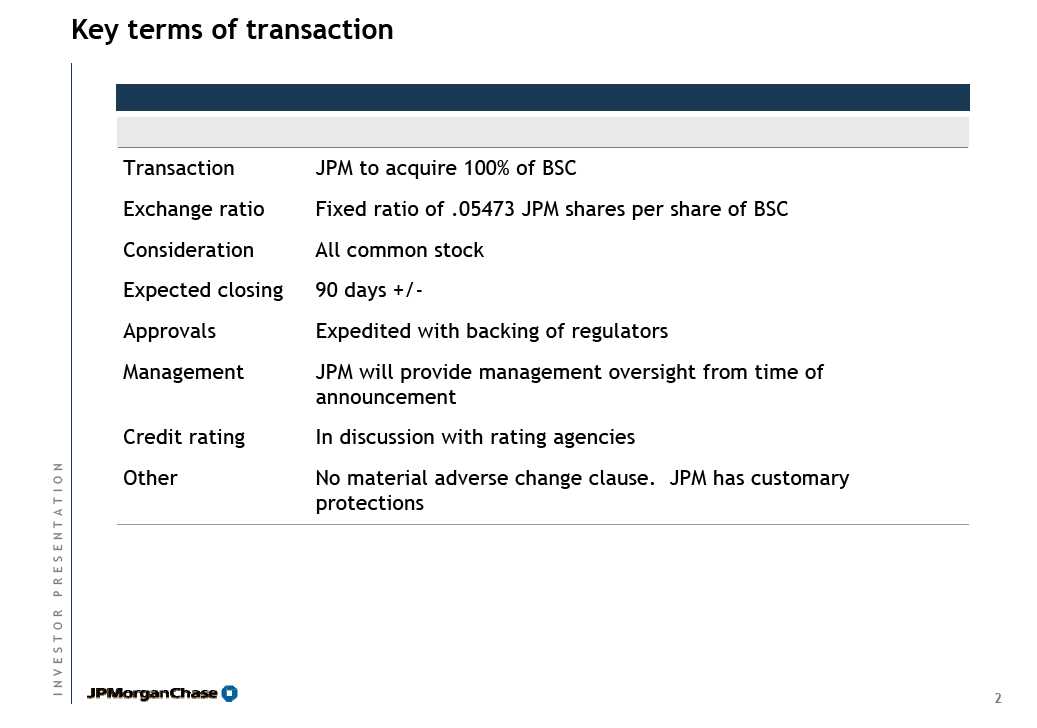

JPMorgan Chase To Acquire Bear Stearns New York, March 16, 2008 -- JPMorgan Chase & Co. (NYSE: JPM) announced it is acquiring The Bear Stearns Companies Inc. (NYSE: BSC). The Boards of Directors of both companies have unanimously approved the transaction. The transaction will be a stock-for-stock exchange. JPMorgan Chase will exchange 0.05473 shares of JPMorgan Chase common stock per one share of Bear Stearns stock. Based on the closing price of March 15, 2008, the transaction would have a value of approximately $2 per share. Effective immediately, JPMorgan Chase is guaranteeing the trading obligations of Bear Stearns and its subsidiaries and is providing management oversight for its operations. Other than shareholder approval, the closing is not subject to any material conditions. The transaction is expected to have an expedited close by the end of the calendar second quarter 2008. The Federal Reserve, the Office of the Comptroller of the Currency (OCC) and other federal agencies have given all necessary approvals. In addition to the financing the Federal Reserve ordinarily provides through its Discount Window, the Fed will provide special financing in connection with this transaction. The Fed has agreed to fund up to $30 billion of Bear Stearns’ less liquid assets. “JPMorgan Chase stands behind Bear Stearns,” said Jamie Dimon, Chairman and Chief Executive Officer of JPMorgan Chase. “Bear Stearns’ clients and counterparties should feel secure that JPMorgan is guaranteeing Bear Stearns’ counterparty risk. We welcome their clients, counterparties and employees to our firm, and we are glad to be their partner.” Dimon added, “This transaction will provide good long-term value for JPMorgan Chase shareholders. This acquisition meets our key criteria: we are taking reasonable risk, we have built in an appropriate margin for error, it strengthens our business, and we have a clear ability to execute.” “The past week has been an incredibly difficult time for Bear Stearns. This transaction represents the best outcome for all of our constituencies based upon the current circumstances,” said Alan

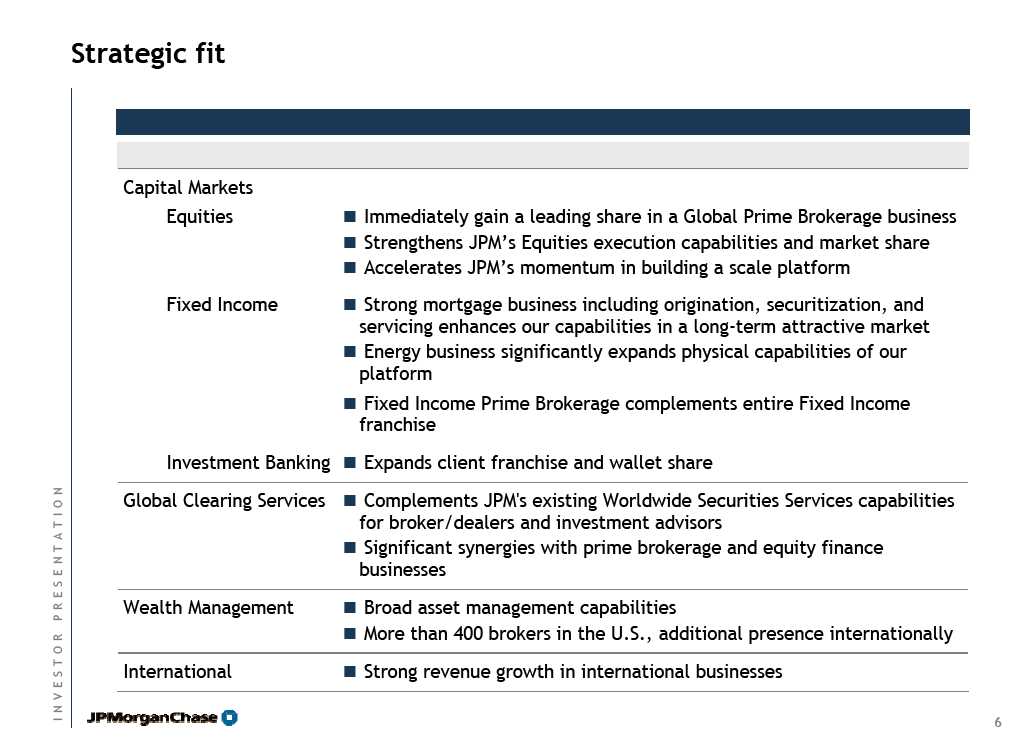

Schwartz, President and Chief Executive officer of Bear Stearns. “I am incredibly proud of our employees and believe they will continue to add tremendous value to the new enterprise.” The transaction is expected to be ultimately accretive to JPMorgan Chase’s annual earnings. “This transaction helps us fill out some of the gaps in our franchise with manageable overlap,” said Steve Black, co-CEO of JPMorgan Investment Bank. “We know the Bear Stearns leadership team well and look forward to working with them to bring our two companies together.” “Acquiring Bear Stearns enables us to obtain an attractive set of businesses,” said Bill Winters, co-CEO of JPMorgan Investment Bank. “After conducting due diligence, we’re comfortable with the quality of Bear Stearns’ business, and are pleased to have them as part of our firm.” “JPMorgan Chase’s management team has a strong track record of effective merger integration,” said Heidi Miller, CEO of JPMorgan Treasury & Securities Services business. “We will work closely in the coming weeks with Bear Stearns’ clients and management to execute the transaction quickly.” JPMorgan Chase will host a conference call today, Sunday, March 16, 2008, at 8:00 p.m. (Eastern Time) to review the acquisition of Bear Stearns. Investors can call (800) 214-0745 (domestic) / (719) 457-0700 (international), with the access code 614424, or listen via live audio webcast. The live audio webcast and presentation slides will be available on http://investor.shareholder.com/jpmorganchase/presentations.cfm under Investor Relations, Investor Presentations. A replay of the conference call will be available beginning at 11:00 p.m. (Eastern Time) on March 16, 2008, through midnight, Monday, March 31, 2008 (Eastern Time), at (888) 348-4629 (domestic) or (719) 884-8882 (international) with the access code 614424. The replay also will be available on www.jpmorganchase.com. JPMorgan Chase & Co. (NYSE: JPM) is a leading global financial services firm with assets of $1.6 trillion and operations in more than 60 countries. The firm is a leader in investment banking, financial services for consumers, small business and commercial banking, financial transaction processing, asset management, and private equity. A component of the Dow Jones Industrial Average, JPMorgan Chase serves millions of consumers in the United States and many of the world's most prominent corporate, institutional and government clients under its JPMorgan and Chase brands. Information about the firm is available at www.jpmorganchase.com. The Bear Stearns Companies Inc. (NYSE: BSC) serves governments, corporations, institutions and individuals worldwide. The company’s core business lines include institutional equities, fixed income, investment banking, global clearing services, asset management, and private client services. For additional information about Bear Stearns, please visit the firm's website at www.bearstearns.com.

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the benefits of the merger between J.P. Morgan Chase & Co. and The Bear Stearns Companies Inc., including future financial and operating results, the combined company’s plans, objectives, expectations and intentions and other statements that are not historical facts. Such statements are based upon the current beliefs and expectations of J.P. Morgan Chase’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: the ability to obtain governmental and self-regulatory organization approvals of the merger on the proposed terms and schedule, and any changes to regulatory agencies’ outlook on, responses to and actions and commitments taken in connection with the merger and the agreements and arrangements related thereto; the extent and duration of continued economic and market disruptions; adverse developments in the business and operations of Bear Stearns, including the loss of client, employee, counterparty and other business relationships; the failure of Bear Stearns stockholders to approve the merger; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the merger may not be fully realized or may take longer to realize than expected; disruption from the merger making it more difficult to maintain business and operational relationships; increased competition and its effect on pricing, spending, third-party relationships and revenues; the risk of new and changing regulation in the U.S. and internationally and the exposure to litigation and/or regulatory actions. Additional factors that could cause JPMorgan Chase’s results to differ materially from those described in the forward-looking statements can be found in the firm’s Annual Report on Form 10-K for the year ended December 31, 2007 (as amended), filed with the Securities and Exchange Commission and available at the Securities and Exchange Commission’s Internet site (http://www.sec.gov). Additional Information

In connection with the proposed merger, JPMorgan Chase & Co. will file with the SEC a Registration Statement on Form S-4 that will include a proxy statement of Bear Stearns that also constitutes a prospectus of JPMorgan Chase & Co.. Bear Stearns will mail the proxy statement/prospectus to its stockholders. JPMorgan Chase & Co. and Bear Stearns urge investors and security holders to read the proxy statement/prospectus regarding the proposed merger when it becomes available because it will contain important information. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from JPMorgan Chase & Co.’s website (www.jpmorganchase.com) under the tab “Investor Relations” and then under the heading “Financial Information” then under the item “SEC Filings”. You may also obtain these documents, free of charge, from Bear Stearns’s website (www.bearstearns.com) under the heading “Investor Relations” and then under the tab “SEC Filings.” JPMorgan Chase, Bear Stearns and their respective directors, executive officers and certain other members of management and employees may be soliciting proxies from Bear Stearns stockholders in favor of the merger. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the Bear Stearns stockholders in connection with the proposed merger will be set forth in the proxy statement/prospectus when it is filed with the SEC. You can find information about JPMorgan Chase’s executive officers and directors in its definitive proxy statement filed with the SEC on March 30, 2007. You can find information about Bear Stearns’s executive officers and directors in definitive proxy statement filed with the SEC on March 27, 2007. You can obtain free copies of these documents from JPMorgan Chase and Bear Stearns using the contact information above. # # #

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

EX-99.2

|