|

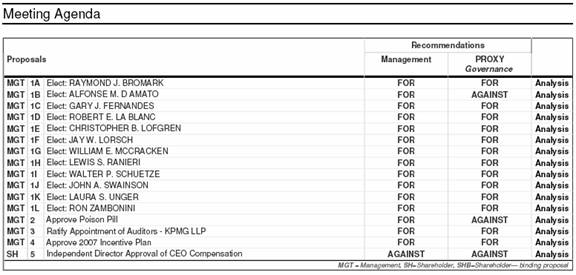

Proposal:

To elect

the following 12 nominees to the board for a one-year term: R. Bromark, A.

D'Amato, G. Fernandes, R. La Blanc, C. Lofgren, J.

Lorsch,

W. McCracken, L. Ranieri, W. Schuetze, J. Swainson, L. Unger, and R.

Zambonini.

Analysis:

§

Board size: 12

§

New directors since last year: 1

§

Independent directors: 11

§

Non-Independent directors: 1

Non-Independent directors: CEO/President J. Swainson

Withhold Vote:

At last

year's annual meeting, shareholders cast a relatively high percentage of

withhold votes for former N.Y. Senator A. D'Amato (25.9%). When directors

receive a high percentage of withhold votes in the preceding year, we

believe that the proxy statement should address that subject, since the

company presumably knows what issue or issues led to the withhold vote, and

should discuss what, if any, action was taken on that issue. D'Amato became

a director in 1999 (at this point, he is the only holdover director from

that era). He currently serves on the Corporate Governance Committee, and

has served on the Audit and Compliance Committee since 2000. Shareholders

appear to have been voicing displeasure after court filings disclosed that

D'Amato, while serving on the CA board in 2000, played an important role in

brokering a deal for former CEO Sanjay Kumar to buy the New York Islanders

hockey team. Such a deal was possible only because the CA board had, just a

few days earlier, eased restrictions on the sale or transfer of Kumar's

stock, which allowed him to use the stock as collateral for a $51 million

loan used to fund the acquisition. Only a few days after Kumar secured the

loan, the company announced that it would miss financial projections, which

resulted in a 43% decline in the company's stock and erased $13 billion of

the company's market value.

The

entire history surrounding the ensuing “35-day month” scandal is tawdry, and

it has led to derivative actions and shareholder litigation that have

continued to the present. The report of the company’s Special Litigation

Committee, issued in April 2007, effectively says that the then current

directors, which included D’Amato, were asleep at the switch (“The CA Board,

at various points in time, too often accepted the explanations and

assurances of CA management and its advisors without applying a high degree

of skepticism or fully understanding the details of what was being done.

Such skepticism and careful probing of management and advisors might have

led the directors to take further action in situations where, although

action was not required to satisfy their fiduciary duties under Delaware

law, it nonetheless might have benefited the Company and saved it from

further harm.”) We recognize that the company has taken pains to portray

D'Amato as having been part of the solution to its problems and not part of

the problem. However, notwithstanding that the Special Litigation Committee

was of the opinion that D'Amato should not be held legally liable to the

company, that does not mean, particularly in view of the understated but

still devastatingly critical language of the committee's report, that

shareholders should vote to continue his presence on the board. We believe

that the company, which has spent the last several years striving to put its

past behind it, would be better served if the sole remaining director from

that era departed from the board. We therefore recommend that shareholders

withhold votes for D'Amato.

Recent Developments:

In 2002,

the U.S. Attorney’s office and the SEC began an investigation into the

company’s past accounting practices that centered on the company’s

recognition of revenue for periods prior to October 2000, and resulting

misstatements of financial information in filings for that period and

afterward. The company restated its financial results for fiscal years 2000

and 2001. The investigation eventually led to the resignations of several

executives and the criminal convictions of former CEO Kumar, former CFO Ira

Zar, former head of Worldwide Sales Stephen Richards, former General Counsel

Steven Woghin and several others. Pursuant to an April 2007 settlement

agreement with the government, Kumar was ordered to pay restitution of

nearly $800 million.

The

Special Litigation Committee (noted above) determined in April 2007 to

pursue additional claims against former Chairman/CEO Charles Wang and

several other former executives, but not against any current executives or

directors of the company. While the report was critical of the board’s

unquestioning acceptance of management, it stated that directors had

satisfied their fiduciary duties to shareholders. However, dissident

shareholder Sam Wyly has criticized the report as a "whitewash," noting that

one member of the committee (L. Unger) formerly worked for director D'Amato

while he was in the U.S. Senate. It should be noted, however, that Ms. Unger

was only on the committee in its very early stages and for a very short

time.

As the

scandal had begun to subside, shareholders were hit with further revelations

in 2006 that the company would again restate earnings, this time for the

period from 2002 to 2006, primarily to account for additional stock

compensation expense of $342 million related to improper reporting of stock

option grant dates for the years 1996 to 2002. In addition, management

identified several material weaknesses in its internal control over

financial reporting, most significantly that monitoring of stock option

grants had not been effective to ensure that their valuations were correctly

reported. The company states that it has implemented procedures to ensure

that option grants are properly communicated to employees, recorded and

reported. We note that although almost no directors or executive management

remain from that era, the lone remaining director, D'Amato, served on the

Stock Option and Compensation Committee during fiscal years 2000 and 2001.

Performance:

According

to PROXY

Governance's

performance analysis, the company has

underperformed

peers

over the past five years; the company ranks at the 41st percentile relative

to the S&P 1500 compared to peers at the 51st percentile, and is

declining

relative

to peers at a rate of 2 percentile points per year. The company

significantly trails peers with regard to return on equity (at the 11th

percentile relative to the S&P 1500, compared to peers at the 41st

percentile) and revenue/expense ratio (at the 35th percentile compared to

peers at the 60th percentile).

On June

20, 2007 the company announced it had repurchased approximately 16.9 million

common shares, or 3% of its outstanding common shares, at a cost of

approximately $435 million. The repurchase was done under an accelerated

share repurchase agreement and was funded with existing cash. Most recently,

the company has reported sharply higher net profits. For the quarter ended

June 30, earnings of $129 million (on $1 billion in revenue) were more than

3.5x the previous year’s quarter.

Compensation:

The

average three-year compensation paid to CEO Swainson is 8% above the median

paid to CEOs at peer companies and the average three-year compensation paid

to the other named executives is 29% below the median paid to executives at

peer companies. We note that the company's average compensation numbers are

slightly inflated due to the company's double reporting of 2006 LTIP awards

in the form of restricted stock grants. The grants, which were valued at

approximately $1.0 million for CEO Swainson and from $300,000 to $590,000

for the other named executives, were disclosed in both the company's 2006

and 2007 proxy statements.

The

company's executive compensation appears

reasonable

given its

financial performance relative to peers.

Rationale/Conclusion:

PROXY

Governance

generally

believes that the current board is properly discharging its oversight role

and adequately policing itself. However, we recommend withholding votes from

D'Amato given his role in brokering a major business deal involving Kumar in

2000, which appears to be a clear conflict of interest, and the fact that he

is the sole remaining director that served on the board during the period

when the company's initial accounting scandal was occurring.

|