|

For the original report of survey responses, see Note: The independent survey of Dover Motorsports shareholders reported below was conducted by the Shareholder Forum according to its established policies assuring the privacy of respondents. |

Updated Results of Shareholder Survey Since there had been postal service delays in the delivery of many of the letters mailed on October 30, 2009 inviting Dover Motorsports shareholders to participate in the Forum survey of their value realization objectives, we kept the questionnaire web site open after the announced completion date so that all investor responses could be considered.

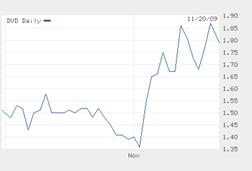

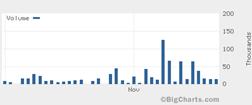

The accompanying graphs compare the analysis of responses in the November 9, 2009 Forum Report, for the originally scheduled survey period from Tuesday, November 2, until Sunday, November 8, 2009, with the updated results that includes responses from another 24% who participated in the survey after November 8. As shown, the general pattern of responses remained consistent, but there was a noticeable increase in the level of pricing objectives among later responses.* The new proportion of shareholders who thought pricing at $2.50 per share or less was reasonable for an all-cash offer to buy the company dropped to 42% of the total, compared with 47% of those who had responded during the original period. A majority still considered $3.00 per share acceptable, but that proportion also dropped, to 55% of the new total from 59% of those who had responded during the first week before the market pricing increase. There was no apparent difference in the range of views expressed by the later shareholder participants regarding pricing preferences of merger partners for a potential exchange of shares. Comments offered by the later shareholder participants were also generally consistent with the range of initial views, including these examples: “With the continued growing interest in racing, management team should be looked at carefully to ensure they are maximizing returns.” – an investor who wrote in the alternative strategy of “New management” with a price objective at $3.00 per share, reporting ownership of up to 1,000 shares “I hope this [merger to combine with another operation] can happen so that I can still own part of this fine company.” – an investor who supported suspending efforts to sell the company until the economy improves, setting a price objective of $4.00 or more per share for a cash sale but only $2.00 in exchange for shares of other operators, reporting ownership of between 1,000 and 10,000 shares “Get rid of management. They appear to be not up to the job.” – an investor supporting selling the company now at $4.00 or more per share, reporting ownership of between 10,000 and 100,000 shares “Considering the price that New Hampshire Speedway sold for last year, and adjusting for the poor economy, a price greater than $4 should still be obtainable. …Given that management has been a continuous destroyer of shareholder value, it's best to sell today before the value declines even more.” – an investor supporting selling the company now at $4.00 per share or more, reporting ownership of between 100,000 and 500,000 shares The Forum will of course continue to invite shareholder views now that the survey is concluded, either anonymously or for identified attribution according to standard Forum policies. As previously reported, the Forum has invited the management of Dover Motorsports to offer comments on the survey. Anything they provide for investors will of course be presented to Forum participants. GL – November 23, 2009 Gary Lutin, Forum chairman c/o Lutin & Company 575 Madison Avenue, 10th Floor New York, New York 10022 Tel: 212-605-0335 Email: gl@shareholderforum.com * The chart below shows the market pricing of Dover Motorsports common stock that might have been considered by shareholders responding to the Forum survey after November 3, 2009, when invitations were first delivered. For a chronological listing of public reports that could have influenced market pricing, see the Forum’s “DVD Reference” page.

|