With Backdrop of Glamour, Wal-Mart Stresses Global Growth

|

|

|

April L. Brown/Associated Press Enrique Iglesias, who performed at the shareholders’ meeting.

|

By STEPHANIE CLIFFORD and STEPHANIE ROSENBLOOM

Published: June 4, 2010

FAYETTEVILLE, Ark. — Wal-Mart’s past was as a humble five-and-dime store in nearby Bentonville, but at its shareholders’ meeting here Friday, the retailer said its future would be in distant lands.

April L. Brown/Associated PressMaria Carey performed at the Wal-Mart shareholders’ meeting on Friday.

|

April L. Brown/Associated PressThe Walton siblings, Jim, Alice and Rob, also spoke to the company’s shareholders.

|

|

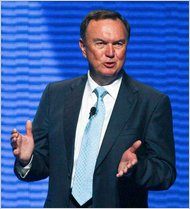

Sarah Conard/ReutersMichael T. Duke, Wal-Mart’s chief, said the chain was committed to being “truly global.”

|

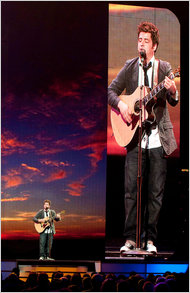

April L. Brown/Associated PressLee DeWyze.

|

I want all of you to be able to say that at this moment Wal-Mart committed to being a truly global company,” Michael T. Duke, Wal-Mart’s chief executive, told about 16,000 employees, shareholders and onlookers at the Bud Walton arena here, “and began building the next generation Wal-Mart.”

Last year, Wal-Mart International’s sales surpassed $100 billion for the first time, providing about one-fourth of the company’s $405 billion in revenue.

Just under half of its 8,300 stores are outside of the United States, and more than 60 percent of the new square footage Wal-Mart built last quarter was in its international division.

Doug McMillon, the head of Wal-Mart’s international operations, told audience members that they could count on Wal-Mart International to drive growth, though the company has waved off questions about when or whether it expects international sales to outpace United States sales.

As Mr. McMillon introduced employee delegations from Brazil, Mexico, China, Japan, Argentina, India, Britain and other countries, the groups roared, honked horns, rattled cowbells, whistled and waved their countries’ flags. The company said it would add 500,000 jobs worldwide over the next five years.

Wal-Mart is emphasizing international growth as it tries to offset sluggish spending domestically. Its core customer in the United States continues to budget carefully and cut down on trips to stores because of unemployment and high gas prices. And Wal-Mart’s chief financial officer acknowledged in the chain’s most recent reporting period that the company might have lost some of the wealthier customers it gained during the recession as those customers returned to higher-price stores.

For the three months that ended April 30, sales at United States stores open at least a year, a measure of retail health known as same-store sales, declined 1.4 percent from a year ago.

Wal-Mart said it was taking steps in the United States to offset those declines, like offering some of the most aggressive price cuts in its history and leveraging its buying power to offer low prices. The chain known for its sprawling stores also said it planned to build smaller stores in all kinds of markets around the world, including the United States.

“We think the combination is the best,” Mr. Duke said in a question-and-answer session with reporters. “We’ll build large stores for one-stop shopping and then we’ll build small stores for the convenience and the fill-in.”

Bill Dreher, senior research analyst with Deutsche Bank Securities who attended the shareholder meeting, said the shift toward international operations reflected the company’s near build-out of its so-called supercenters in the United States.

Mr. Dreher predicted that the profitability of Wal-Mart’s international sales would surpass that of its domestic sales.

“We expect Wal-Mart will eventually be as big in China as they are in the U.S. now, and grow double- digit annual sales increases in Latin America,” he said in a written response to questions.

Domestically, the company is also working on mending its struggling apparel business. Wal-Mart said that in the future it would focus on selling everyday basics like T-shirts, socks and jeans instead of name brands.

Along the way, the company plans to compete in the global marketplace by improving its technology. “Some of our competitors are ahead of us here,” Mr. Duke said of Wal-Mart’s e-commerce and mobile-phone offerings. “We need an even deeper understanding of the role of mobile technology throughout the world, including developing countries.”

“Building the best Web site,” he said, “will be just as important as getting our store formats right.” Currently, outside of the United States, only Britain, Brazil and Japan have e-commerce sites.

Executives will emphasize mobile shopping, as well. Mr. Duke said Wal-Mart was well positioned to compete as retailing enters “an era of price transparency,” assuming it improves its technology.

Eduardo Castro-Wright, who leads the company’s United States business, said that Wal-Mart could also “use mobile as a productivity tool, where customers can shop in our stores and make their shopping experience easier,” he said, such as with applications that help them find products. That was one reason the company acquired the online video service Vudu early this year, he said.

The annual meetings here always mix business and pleasure. The entertainment lineup included Jamie Foxx, Mariah Carey, Mary J. Blige, the “American Idol” winner Lee DeWyze, Josh Groban and Enrique Iglesias.

When Mr. Iglesias jumped offstage to walk in the crowd, looking women in the eyes as he sang his love song “Hero,” he seemed to have some trouble disentangling himself from an adoring Wal-Mart employee. Afterward, the Wal-Mart chairman Rob Walton said, “Man, he was hot.”

Wal-Mart is a powerful sales outlet for the celebrities, who seemed duty-bound to pay homage to the retailer. That led to some strange moments, like Mr. Foxx, in character as Ray Charles, exhorting the group to “Make some noise right now, shareholders!”

The ubiquity of Wal-Mart was underscored at every turn. In a clip shown before he appeared onstage, Mr. Foxx was seen joking around in a Wal-Mart’s makeup aisle alongside a blown-up photograph of the Revlon spokeswoman Halle Berry. “You broke up with your man?” he said to her image. “Holler at me; I’ll be at Wal-Mart.”