|

For direct source information about the Broadridge chief executive officer's speech referenced below, see

Forum participants, including Broadridge, are invited to offer comments on the issues raised by the article. [The Forum subsequently submitted its responsive comments to the SEC.] Note: Broadridge was one of the companies that provided invited leadership support of the Shareholder Forum's public interest program to develop standards for electronic communications relating to shareholder meetings. |

IR Web Report, December 2, 2010 article

With Investor Network failing, Broadridge lobbies SEC for mandatory forumsFOR THE past two years, Broadridge Financial Solutions Inc. (NYSE:BR) CEO Richard Daly has been talking to analysts about the promise of his pet project – the company’s proprietary Investor Network shareholder forum that has failed to gain market acceptance. Now he is ratcheting up the rhetoric and angling to have the U.S. Securities and Exchange Commission (SEC) issue a mandate that all companies be required to offer a shareholder forum, for which his company would conveniently be the only service provider, at fees ranging between $20,000 and $50,000 per company per year. In an unusually direct and strongly worded news release yesterday, the Broadridge CEO “called on the SEC to give public companies the right to social media technology to communicate with their shareholders.” That apparent right for public companies is little more than spin for giving investors a universal right to shareholder forums — and giving Broadridge the exclusive role of gatekeeper and the ability to print money due to its monopoly access to brokerage client records. SEC has already approved shareholder forums, networks

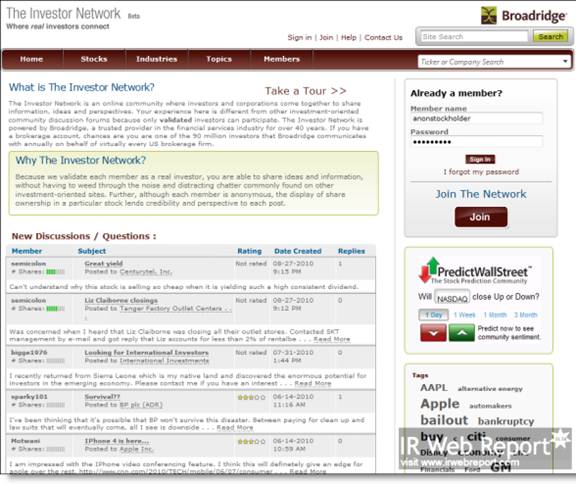

As things stand, nothing prevents companies from sponsoring a shareholder forum or using Broadridge’s Investor Network. They already have the “right” because on January 18, 2008, the SEC adopted new Rule 14a-17 and an amendment to Rule 14a-2 under the Securities Exchange Act of 1934 to “facilitate the use of electronic shareholder forums by public companies and their shareholders.” In fact, it was following the adoption of that rule that Broadridge developed its proprietary Investor Network, using expensive software from white label social networking provider Telligent Systems in Dallas, Texas. However, the Investor Network has never taken off. Only a handful of companies have used the shareholder forum feature as part of their full or hybrid virtual annual meetings. And investors have never taken to the service in any meaningful way. In fact, as I write this, there has only been one comment on the public Investor Network site in the past 3 months. The Investor Network’s failure to gain organic adoption is most likely because it is created to serve Broadridge’s proprietary interests, which run counter to the fundamental principles of a successful social network. Mandate strategy discussed in 2008 call with analystsNow Broadridge’s Daly is acting on a strategy he first discussed more than two years ago in a conference call on August 14, 2008. In the call, he made it clear that if the Investor Network did not take off via an “opt-in” process, then an SEC mandate would be his other option. To quote from a transcript of that conference call (emphasis added): “The activity here is really going to be driven by, is the SEC going to deem that this is something that shareholders need to have the right to. And if that was the case, then I can’t imagine it getting done any other way than through the plumbing we have in place, and again that’s a chasm between us and any one else, no one else is close to connecting every investor to every public company.” Note the difference in emphasis between yesterday and two years ago. While Daly was yesterday talking about companies having a right, what he was telling investors two years ago is that the SEC would need to give shareholders the right — and if they did so, Broadridge would have the market almost to itself. “Had conversations with every Commissioner, and, of course, Mary”In the release and a speech yesterday at a conference held by Hofstra University’s Frank Zarb School of Business, Daly made it clear that he want’s the SEC to mandate shareholder forums. “Some believe we can wait and see. They believe these developments, if they have merit, will take hold by themselves,” he told a crowd of business people. “But the truth is that changing the paradigm rapidly for all investors will require regulatory support. ” Previously, the Broadridge CEO has let it be known that he has been talking about this at the highest levels of the SEC. Last month in an earnings call with analysts, he said: “I have actually had conversations directly… I am relatively certain with every commissioner and, of course, Mary, the chair, Mary Shapiro.” It would be a big mistake for the SEC to mandate a forum anything like Broadridge’s Investor Forum. The success of any social network or forum is driven by market dynamics. It cannot be created by regulators, no matter how good their intentions. Anonymity on Investor Network undermines accountabilityWhat is clear is that without a regulatory mandate from the SEC, Broadridge’s Investor Network will never be successful because it fails to recognize fundamental social media principles. Broadridge has built its system around anonymous participation. Using its monopoly access to Street Name shareholder records, Broadridge validates that individuals are indeed shareholders, but it permits them to be nameless by default. This reliance on anonymity, which helps to protect Broadridge’s exclusive access to the shareholders’ information, is a fundamental flaw in their approach to social networking.

Anonymity is widely recognized as the root cause of what causes traditional chat message boards to be so unreliable and unruly. Anonymity undermines accountability, trust and confidence. When someone attends an annual meeting, they cannot be totally anonymous. That lack of anonymity is what gives the proceedings legitimacy. The only aspect of an annual meeting that requires anonymity is the actual voting process. Discussion, questions and conversation cannot be conducted with any legitimacy in an anonymous forum. The reason social networks like Facebook and Twitter work is because they promote personal accountability by creating disincentives for people to be anonymous. Indeed, Facebook does not permit users to be anonymous. And while people can be anonymous on Twitter, such accounts rarely gain much influence. Investor Network is not a neutral venueIn an anonymous forum, especially one paid for by companies and controlled by their agent Broadridge, opportunities for abuse are real. Company employees can influence the forum without shareholders having any idea who they are. As things stand, Broadridge’s shareholder forums are typically held in private and are not accessible to the public at large, even as observers. This further undermines their legitimacy and leaves them vulnerable to abuse. Another fundamental flaw is that Broadridge’s system classifies participants based on the size of their ownership stake. This exacerbates retail shareholders’ perceptions that their participation in the annual meeting process is meaningless because they have little economic or voting influence. Real social networks are level playing fields, where identifiable participants have a reasonably equal say and are judged by the substance and coherence of their arguments, not by the size of their bank accounts. Yet, Broadridge’s Daly wants regulators, investors and company executives to believe that his Investor Network is the answer to dwindling retail participation in the annual meeting process. It’s a hollow argument. The fact is, nothing prevents companies and their directors from directly engaging with shareholders and other stakeholders in neutral venues like Facebook or Twitter if they are willing to abide by the SEC’s rules and the community’s expectations. The only time Broadridge needs to validate a shareowner is when it comes time for them to cast their ballots. Based on recent problems at the company’s own annual meeting, that’s where Daly and Broadridge’s board should focus their attention.

|