|

ValueYahoo.com – the latest in a

number of activist campaign sites – marks a step up in quality from the

usual fare

Fortunately for embattled web company Yahoo!,

ValueYahoo.com

does not show up in the first page of search results. The site is the latest

move by Daniel Loeb, manager of hedge fund Third Point, in is proxy campaign

against the company, and it shows what’s possible when an activist investor

wants to take his or her message online.

Setting up a site is nothing new – several such campaigns already exist –

although their effectiveness has yet to be determined. What makes Loeb’s

endeavor powerful, however, is the effort that has gone into it.

Is this an escalation in online tactics for rallying shareholders? Most

campaign websites appear to have been slapped together with little effort or

expense. A little commitment, though, can go a long way. Here we review five

activist campaign sites.

1. Enhance ITEX

A group of activists led by David Polonitza, chief operating officer of AB

Value Management, looked to unseat two of ITEX Corp’s directors last year.

They set up

Enhance ITEX

to support their cause.

While the message is clear, Enhance ITEX does not have the production values

you find at ValueYahoo.com. The design is sparse, lacking any visual appeal.

It offers information about Polonitza’s nominees for the board, access to

past press releases and SEC filings, and a contact email. But there’s little

inducement to take action.

Enhance ITEX's basic homepage

2. Enhance Cracker Barrel

Enhance Cracker Barrel,

an activist website created by Biglari Holdings, resembles Enhance ITEX in

more than just the name. Biglari, Cracker Barrel’s largest shareholder when

the website was set up last year, hoped to take a seat on the board.

The most important feature on Enhance Cracker Barrel isn’t technological.

Rather, it’s the content. Biglari strikes an authentic tone, indicating –

even emphasizing – the limited objectives of his campaign.

While the design is weak, the website provides easy access to both letters

to management and letters to shareholders. Using what look like ads on the

website, Biglari offers access to online voting and a Glass Lewis proxy

report.

Enhance Cracker Barrel makes a personal appeal

3. CP Rising

Where Enhance ITEX and Enhance Cracker Barrel fall short,

CP Rising

succeeds. Launched by Pershing Square, this hedge fund campaign website

clearly tries to make a case to Canadian Pacific Railway’s investors with

positive messages. Pershing Square is looking to put six people on the board

of directors, only two of whom are affiliated with the hedge fund.

CP Rising also differentiates itself with its strong design and rich media.

The fund has posted a two-hour webcast to the campaign site, along with a

presentation outlining Pershing Square’s objectives.

CP Rising utilizes positive messages

4. Shareholders for Baja

Mount Kellett Capital Management used

Shareholders for Baja

to push its campaign online against the Canadian miner. The website provides

a wealth of information about what Mount Kellett perceives as the company’s

‘web of conflicts’ of interest, even using a chart to illustrate them for

website visitors. The campaign’s goals included adding two new independent

directors to the board.

Like Enhance Cracker Barrel, Shareholders for Baja uses what resembles an

online ad to make it easy for shareholders to vote online. The news section

is much richer than most of the other activist sites, with both news

coverage and press releases available.

Although the design falls short of professional standards, the visual impact

of the ‘web of conflicts’ chart, along with the incendiary page title,

demonstrates the approach necessary for catching a visitor’s attention.

Shareholders for Baja has a rich news section

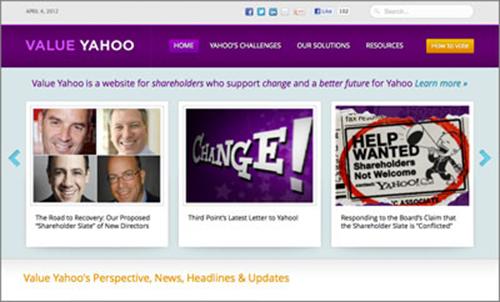

5. Value Yahoo

The travails of Yahoo!’s board of directors have been well documented. The

board is in rough shape, and the struggle with investors has been both

profound and public. Third Point is leading the charge. It has a 5.8 percent

stake in Yahoo! and offers a plan for change, claiming the company has a

‘tremendous opportunity’ to improve its core business, not to mention

valuable Asian assets.

Value Yahoo

certainly represents an escalation in the use of online tactics – the

campaign even has its own Facebook page. On the core website, there is

plenty of content, including analyses of Yahoo!’s business and even

info-graphics that make it easy for visitors to visualize Third Point’s

message. The design is elegant and easy to navigate. In short, Value Yahoo

is an online shareholder activist campaign for an online world.

Value Yahoo looks good and is easy to navigate

Activist campaign websites may have been nothing more than online billboards

in the past, amplifying a message traditionally communicated through press

releases and proxy statements, but times are changing.

With Value Yahoo, the full potential of taking a proxy battle online has

been revealed. While this approach does take investment of both capital and

time, the potential for impact is far higher.

|

© Copyright Cross Border Ltd. 1995–2012. |

|