Annual General Meetings & COVID-19

Posted by Michael Laff, Institutional

Shareholder Services, Inc., on Thursday, April 9, 2020

|

Editor’s Note:

Michael Laff is a Senior

Associate at Institutional Shareholder Services, Inc. This post is

based on his ISS memorandum. |

In

response to the COVID-19 pandemic, securities regulators in several countries

have published guidance that affords publicly listed companies greater

flexibility regarding the type of annual general meeting (AGM) they can hold as

well as when it can be held.

As of March

31, the total number of meetings postponed or cancelled globally

because of COVID-19 was approximately 557 while the number of meetings

that will be virtual-only or proxy-only stood at 560. By comparison,

that number stood at 286 for all of calendar 2019. These figures, as

tracked by ISS and as illustrated below, are changing by the day as

the pandemic is pushing into the traditional AGM season for many

markets in the northern hemisphere.

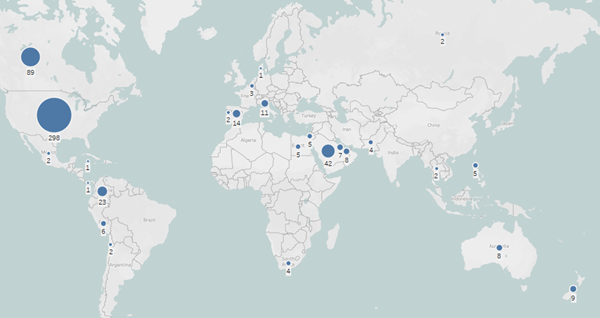

Figure 1:

Count of Virtual Meetings by Market as a Result of the Pandemic

Source:

Institutional Shareholder Services; as of March 31, 2020; data is

compiled based on alerts issued due to COVID-19 as disclosed by

companies after the meetings had entered the ISS Global Meeting

Services queue.; includes extraordinary and non-equity meetings. Does

not necessarily include all meetings that have been announced as

virtual in a market.

Similarly,

regulatory agencies across varied jurisdictions are providing frequent

updates to their policies on meetings and public reporting. Given the

rapid pace of change, there is considerable disruption to the typical

corporate reporting period and the AGM calendar.

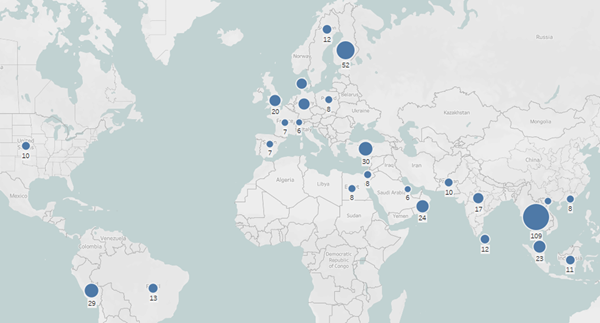

Figure 2:

Count of Adjourned/Cancelled Meetings by Market as a Result of the

Pandemic

Source:

Institutional Shareholder Services; as of March 31, 2020; data is

compiled based on alerts issued due to COVID-19 as disclosed by

companies after the meetings had entered the ISS Global Meeting

Services queue.; includes extraordinary and non-equity meetings. Does

not necessarily include all meetings that have been announced as

postponed in a market.

This is a

fast-changing area with new regulatory and other guidance coming out

frequently at present regarding the hosting of AGMs and public

reporting requirements. In most U.S. states, companies are generally

able to hold either hybrid or virtual-only meetings without seeking

shareholder approval. The SEC issued guidance on

March 13, providing regulatory flexibility to companies that wish to

change the date or location of their shareholder meeting or switch

from an in-person meeting to a virtual meeting because of COVID-19.

Some

companies may choose to take measures such as postponing their AGM,

changing the format from a physical (in person) to a virtual meeting,

or simply changing to another physical location to minimize public

health concerns. Many companies shifted to online-only meetings

after the SEC offered exemptions following

a shareholder request.

The SEC staff

is also encouraging companies to allow shareholder proponents or their

representatives to present their proposals by telephone and not insist

that they attend in person.

Companies

that seek to make the change after their proxy materials have already

been filed and mailed will not be required to amend their proxy

statement or mail additional material to shareholders, provided that

such companies issue a press release announcing the change, file it on

EDGAR, and “take all reasonable steps necessary to inform other

intermediaries in the proxy process and other relevant market

participants of such change.”

Separately,

the SEC has also provided publicly traded companies with a 45-day extension to

file certain disclosure documents, including annual and quarterly

reports. Such reports would otherwise have been due between March 1

and July 1, 2020. Companies must, among other conditions, explain

through a current filing why the relief is needed in their particular

circumstances.

Additionally,

publicly traded companies may be exempt from providing hard copies of

proxy statements and annual reports if the shareholder has a mailing

address located in an area where mail delivery has been suspended as a

result of COVID-19.

On March 23

the SEC announced temporary

flexibility for registered funds affected by recent market events to

borrow funds from certain affiliates and to enter into certain other

lending arrangements. The relief is designed to provide funds with

additional tools to manage their portfolios for the benefit of all

shareholders as investors may seek to rebalance their investments.

The SEC also

issued orders that

would provide certain investment funds and investment advisers with

additional time with respect to holding in-person board meetings and

meeting particular filing and delivery requirements, as applicable.

Access an

overview of regulatory updates in select countries regarding the

hosting of AGMs and public reporting requirements as of March 31,

2020, here.

|

Harvard Law School Forum

on Corporate Governance

All copyright and trademarks in content on this site are owned by

their respective owners. Other content © 2020 The President and

Fellows of Harvard College. |