Your Money

How Many Mutual

Funds Routinely Rout the Market? Zero

MARCH

14, 2015

|

Minh Uong/The New York Times

|

The bull market in stocks turned six last Monday, and despite some

rocky stretches — like last week, when the market fell — it has

generally been a very pleasant time for money managers, who have often

posted good numbers.

Look

more closely at those gaudy returns, however, and you may see

something startling. The truth is that very few professional investors

have actually managed to outperform the rising market consistently

over those years.

In

fact, based on the updated findings and definitions of a particular

study, it appears that no

mutual fund managers have.

I

wrote about the initial findings of that study

last summer. It is called “Does

Past Performance Matter? The Persistence Scorecard,” and it is

conducted by S.&P. Dow Jones Indices twice a year. The edition of the

study that I focused on began in March 2009, the start of the bull

market.

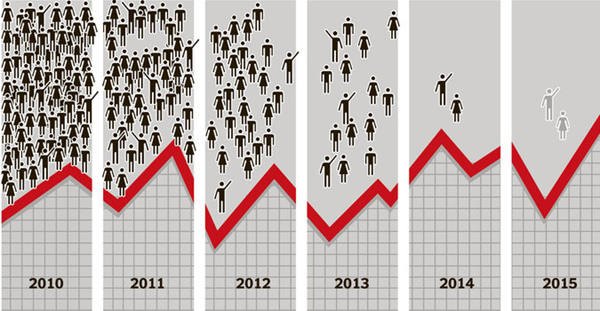

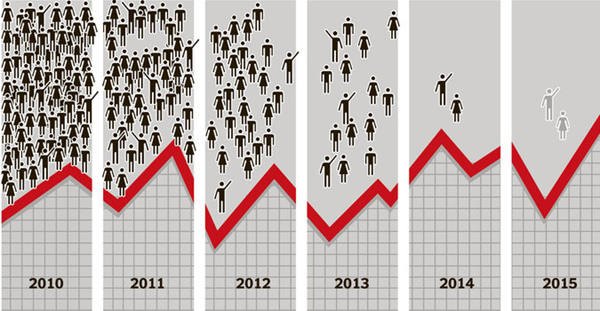

It

included 2,862 broad, actively managed domestic stock mutual funds

that were in operation for the 12 months through 2010. The S.&P. Dow

Jones team winnowed the funds based on performance. It selected the 25

percent of funds with the best returns over those 12 months — and then

asked how many of those funds actually remained in the top quarter in

each of the four succeeding 12-month periods through March 2014.

The

answer was remarkably low: two.

Just

two funds — the Hodges Small Cap fund and the AMG SouthernSun Small

Cap fund — managed to hold on to their berths in the top quarter every

year for five years running. And for the 2,862 funds as a whole, that

record is even a little worse than you would have expected from random

chance alone.

In

other words, if all of the managers of the 2,862 funds hadn’t bothered

to try to pick stocks at all — if they had merely flipped coins — they

would, as a group, probably have produced better numbers. Instead of

two funds at the end of five years, basic probability theory tells us

there should have been three. (If you’re curious, I explained how the

math works in a

subsequent column, “Heads or

Tails? Either Way, You Might Beat a Stock Picker.”)

The study seemed to support the considerable body of evidence

suggesting that most people shouldn’t even try to beat the market:

Just pick low-cost index funds, assemble a balanced and appropriate

portfolio for your specific needs, and give up on active fund

management.

The

data in the study didn’t prove that the mutual fund managers lacked

talent or that you couldn’t beat the market. But, as Keith Loggie, the

senior director of global research and design at S.&P. Dow Jones

Indices, said in an interview last week, the evidence certainly didn’t

bolster the case for investing with active fund managers.

“Looking at the numbers, you can’t tell whether there is skill

involved in what they do or whether their performance is just a matter

of luck,” Mr. Loggie said. “I believe that many of them do have skill.

But even if they do have it, based on how they’ve done in the past you

really can’t predict how they will perform in the future.”

Still,

those two funds did manage to perform splendidly in that study. Their

stubborn persistence at the top of the heap over that five-year period

suggested that there was some hope for active fund managers. If they

could do it, after all, others could, too.

But

we’re now about two weeks away from the completion of another 12

months since the end of that study, and it’s been a mediocre stretch,

at best, for those two mutual funds. When the month is over, to borrow

from Agatha Christie, it looks as though we’ll be saying: And then

there were none.

Here

are the dismal statistics: The SouthernSun Small Cap fund has actually

lost money for investors over the 12 months through Thursday. It was

down 3.2 percent, according to Morningstar, and for the nine months

through December, it was in the bottom quartile of funds in the S.&P.

Dow Jones study. The Hodges Small Cap fund has done better, gaining

almost 6 percent through Thursday. S.&.P. Dow Jones Indices says that

put it in the third quartile — or second-to-worst one — through

December. While it’s mathematically possible, it is highly unlikely

that either will climb to the top quartile in the next few weeks, Mr.

Loggie said.

Michael W. Cook, the lead manager of the

SouthernSun Small Cap fund and

the founder of the firm that runs it, was traveling last week and was

unavailable to comment for this column. Craig Hodges, manager of the

family-run

Hodges Small Cap fund in Dallas,

spoke to me on the telephone and told me that he wasn’t surprised that

his fund had stumbled. “We’re not that good,” he said. “It was going

to happen sooner or later. We’ve never expected to outperform all of

the time.” And despite disappointing recent returns, both funds are

still beating the market handily over the last five years.

Late

last year, Mr. Hodges said, his fund was hurt by falling energy

prices, which pulled down the returns of several of its holdings.

“That kind of thing will happen,” he said. “You can expect that.” Last

summer, he told me that over the long run — which he said is probably

50 years or more — he expects that his fund will do better than

average. And he reiterated that view last week. “We’ll come out all

right in the end,” he said. “I think if you pick a good manager,

someone you believe in and you think you can trust, you’ve got to

stick with him for a long time, and if he’s good, he’ll perform for

you.”

Mr.

Loggie and his crew are continuing their regular monitoring of mutual

fund performance. Right on schedule, they did another winnowing of

mutual funds through the five years that ended in September — and they

will do another one for the five years ending this month.

The

September performance derby produced more funds that ended up

consistently in the top quartile — nine of them, Mr. Loggie said.

“That’s not surprising,” he said. “Some periods you have more funds,

some periods you have less.”

But

what you never have, he said, is any indication that past performance

predicts future returns. “It’s possible that any one of these funds

will beat the market over the long term,” he said. “Some of them will

do that. But the problem is that we don’t know which of them will do

that in advance.” And that, in a nutshell, is the kernel of the

argument for buying index funds.

A version of this article appears in print on March 15, 2015, on page

BU4 of the New York edition with the headline: How Many Mutual Funds

Routinely Rout the Market? Zero.

© 2015 The

New York Times Company