|

How to make money in the coming economic ‘ice age’

Published: Sept 3, 2015

5:33 p.m. ET

Analysts have a plan for investors to prosper during a sustained period of

deflation in the U.S.

|

Bloomberg News/Landov

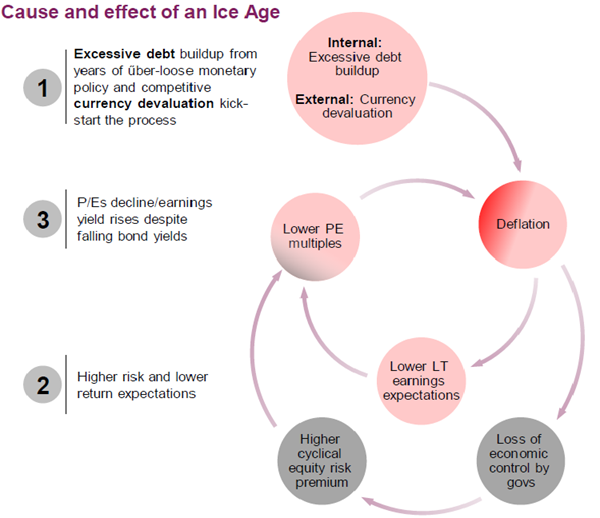

A huge increase in overall

debt, combined with currency devaluation in emerging markets, is

likely to lead to a Japan-like period of deflation in the U.S. and

weak returns for most stocks, according to Société Générale

analysts. |

Every day

there are headlines about slowing economic growth in China, and the

country’s

currency devaluation last month

was a catalyst for painful volatility and declines of stocks worldwide.

But these events may point to a longer-term problem that U.S. investors

have to consider.

Overall debt in the United States has continued to grow and is now at

an all-time high, and debt has also shot up in Europe, Japan and now

China. “Combined with adverse demographics, an excessive debt burden

erodes disposable income of people who have to finance the debt,”

according to Société Générale analyst Robbert van Batenburg.

Meanwhile, “devaluation of many currencies in emerging markets

particularly has been driving deflationary trends in developed

markets,” van Batenburg said during an interview on Wednesday.

It

makes plenty of sense for exporters of manufactured goods, worried

about their own economies, to go through competitive rounds of

devaluation in order to boost their exports to developed countries.

The

good news for people in developed countries is the continued flow of

cheaper goods. But there’s a price.

|

Société Générale |

“While

investors have already talked about the eurozone looking similar to

Japan, a deflationary recession also beckons for the U.S.,” Société

Générale strategist Albert Edwards said in a report on July 30.

Building on this thesis, analysts from the bank said last week that

this economic “ice age” will lead to higher risk and lower returns for

stocks.

“We’ve

had this deflationary environment in Japan three times, in 1994 to

1996, 1999 to 2007 and 2012 to 2014. We have seen an overall market in

Japan that has led to bonds outperforming stocks,” van Batenburg said.

This

chart illustrates just how terribly Japan’s Nikkei 225 Index

NIK, -0.05% has performed, on

a price basis, against the S&P 500 Index

SPX, +0.12% since the end of

1989:

FactSet

Since 1989, the Nikkei 225

index is down 53% on a price basis, while the S&P 500 is up 451%. |

The

aging of the U.S. population will place a further drag on the economy,

with an increasing percentage of people “relying on government support

and entitlement programs, which in turn will push up overall debt,”

van Batenburg said. “The result of all this is a relentless

compression of growth and eventually declining earnings expectations,”

he added.

What to do about it

Considering van Batenburg’s comment about government bonds

outperforming equities in Japan, investors fearing a long-term weak

trend for the U.S. stock market might want to consider an income

strategy. During last week’s market turmoil we discussed various

aspects of

income investing and ways to

limit volatility risk.

Of

course, long-term institutional investors will still be holding stock.

If you still want to go for long-term growth during an economic ice

age, Société Générale has recommended focusing on quality stocks, that

meet these criteria, outlined by van Batenburg:

•

Stable and sustainable profits

•

Strong balance sheet

• Low

debt

•

Ability to fund operations internally

• In a

market with high barriers to entry

•

Strong competitive position

Société Générale incorporated the Piotroski Score, which is a model

developed by Stanford University Associate Professor Joseph Piotroski.

The

ice-age basket of equities recommended by Société Générale includes 43

companies, most of which are headquartered in the United States.

We

can’t include the entire list, but here are the three largest ice-age

basket companies recommended by Société Générale by market

capitalization in each sector, or fewer if there are less than three

in that sector.

We

included five-year average returns on equity as a relative measure of

performance, although it is not very useful to compare ROE across

industries. We also included five-year total returns, even though they

have no bearing on future performance.

Consumer discretionary

|

Company

|

Ticker

|

Industry

|

Average return on equity - past five

fiscal years

|

Total return - 5 years

|

|

Walt Disney Co. |

DIS,

+0.10%

|

Media conglomerates |

13.9% |

223% |

|

Nike Inc. Class B |

NKE,

+0.39%

|

Apparel/ footwear |

23.8% |

223% |

|

Target Corp. |

TGT,

+0.52%

|

Discount stores |

16.9% |

66% |

|

Sources: Société Générale, FactSet |

Consumer staples

|

Company

|

Ticker

|

Industry

|

Average return on equity - past five

fiscal years

|

Total return - 5 years

|

|

Procter & Gamble Co. |

PG, +0.17%

|

Household/ personal care |

16.0% |

36% |

|

PepsiCo Inc. |

PEP, +0.53%

|

Beverages: Non-alcoholic |

30.6% |

63% |

|

Altria

Group Inc. |

MO, +0.87%

|

Tobacco |

109.6% |

203% |

|

Sources: Société Générale, FactSet |

Financials

|

Company

|

Ticker

|

Industry

|

Average return on equity - past five

fiscal years

|

Total return - 5 years

|

|

Loews Corp. |

L, +1.16%

|

Property/ casualty insurance |

4.8% |

3% |

|

Sources: Société Générale, FactSet |

Health care

|

Company

|

Ticker

|

Industry

|

Average return on equity - past five

fiscal years

|

Total return - 5 years

|

|

Johnson & Johnson |

JNJ,

-0.76%

|

Pharmaceuticals |

20.5% |

87% |

|

Pfizer Inc. |

PFE,

-0.25%

|

Pharmaceuticals |

11.6% |

134% |

|

Gilead Sciences Inc. |

GILD, -2.26%

|

Biotechnology |

48.9% |

531% |

|

Sources: Société Générale, FactSet |

Information technology

|

Company

|

Ticker

|

Industry

|

Average return on equity - past five

fiscal years

|

Total return - 5 years

|

|

Google Inc. Class A |

GOOGL,

-1.22%

|

Internet software/ services |

17.2% |

178% |

|

SAP SE Sponsored ADR |

SAP, +0.67%

|

Packaged software |

22.6% |

55% |

|

Total System Services Inc. |

TSS,

+0.86%

|

Data processing services |

16.8% |

240% |

|

Sources: Société Générale, FactSet |

Telecommunications

|

Company

|

Ticker

|

Industry

|

Average return on equity - past five

fiscal years

|

Total return - 5 years

|

|

AT&T Inc. |

T, +0.67%

|

Telecommunications |

11.2% |

57% |

|

Verizon

Communications Inc. |

VZ,

+0.82%

|

Telecommunications |

17.0% |

91% |

|

Sources: Société Générale, FactSet |

|

Copyright

©2015 MarketWatch, Inc. |

|