|

Your Money

Simpler, Less Expensive 401(k) Options Emerge for Small Businesses

SEPT.

11, 2015

|

Jon Stein at Betterment's office in

Manhattan. The investment firm has 106,000 customers and $2.6

billion in assets.

Credit Danny Ghitis for The New York Times |

The

way Jon Stein sees it, receiving financial advice for

retirement should be a

fundamental right.

Betterment, the investment firm

Mr. Stein created just five years ago, is now one of the

higher-profile

robo-advisers — companies that

automatically build and manage customized portfolios of low-cost

investments for people who can’t afford the type of

financial adviser who sits behind

a mahogany desk.

He

argues that all workers who save using a

401(k) should be entitled to

personalized help and investment management services: When an employer

offers a retirement plan without any recommendations, Mr. Stein

reasons, it’s akin to providing a

health insurance plan that lists

medications without any doctors.

Given

that philosophy, perhaps it was only a matter of time before his firm

— with 106,000 customers and $2.6 billion in assets — would plunge

into the 401(k) business. Starting in the first quarter of next year,

the firm will begin offering the plans to employers, with a focus on

smaller businesses (though it’s essentially equipped to handle larger

ones, too).

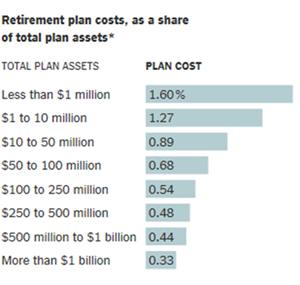

Economies of Scale

The costs of running an employer-sponsored 401(k) plan are often

higher, relative to total plan assets, for small companies than

for larger ones. Big plans tend to have a greater portion of

their money invested in index funds, which often have lower

expenses than other investments. Moreover, there are some fixed

costs in running a plan — and as plans grow in size, those costs

can be spread across more employees and a larger asset base.

|

|

|

|

|

*Among plans with audited

401(k) filings in the BrightScope database (2012)

Source: BrightScope and

Investment Company Institute

By The New York Times

|

|

Small

businesses, which

employ nearly half of all private

sector workers, could surely use the help.

Only

14 percent of employers with fewer than 100 employees offer a 401(k)

plan, according to a

report from the Government

Accountability Office. Even when these workers have access to a

401(k), they often pay three times as much as workers at larger

companies, if not more. And if the business owner bought the 401(k)

plan from a broker, the investment lineup might be rife with conflicts

of interest and high-cost, actively managed

mutual funds. As for financial

advice, it’s not always an option.

But

the landscape is rapidly evolving. In addition to Betterment, several

other

technology-driven providers have

started offering 401(k) plans in recent years, with a focus on

reducing costs and the complex administrative burdens for small

employers.

Vanguard started catering to

smaller businesses about four years ago and has already signed up more

than 4,000 employers covering 162,000 participants.

Mr.

Stein said he hoped to elevate 401(k) plans to the next level,

bringing the kind of holistic service that personal finance nerds

could only dream of. You know, things like automatic management and

rebalancing, taking into account your rollover Individual Retirement

Account, a spouse’s plans and future

Social Security benefits.

By

looking at the entire picture, it can tell you how much you need to

save and in which accounts — say a 401(k) versus a Roth or taxable

account.

“That

is like fundamental stuff that everyone should have a right to if we

are going to put the responsibility of saving for retirement on

individuals, which is what we’ve done in this country,” said

Mr. Stein from Betterment’s

offices, a loft space that was formerly a dojo, or martial arts

studio, in the Chelsea neighborhood of Manhattan.

Since

all of this advice is driven by algorithms, not humans, it helps

contain costs: 401(k) plans with less than $1 million in assets had an

average cost of 1.6 percent of the plan’s total assets in 2012. That

compares with 0.54 percent for plans with $100 million to $250

million, according to a

research report by BrightScope

and the Investment Company Institute in 2014.

The

fees for small plans also tend to vary greatly. The vast majority of

401(k)’s with less than $1 million in total assets had costs that

ranged somewhere from 0.68 percent to a scandalous 2.66 percent.

Part

of the reason is economics. Small plans have less money to manage, so

they generate less in fees and have less negotiating power. But

another driving factor is the way the industry is structured.

“It

has tended to attract the high-cost providers in part because of the

economics, but in part because in this area of the market, the plans

are sold, not bought,” said

Mike Alfred, co-founder and chief

executive of BrightScope, which tracks and rates retirement plans. “So

there is an adviser or rep going into that company and convincing the

chief executive officer, human resources or the chief financial

officer to set up a plan,” he added. “And usually the high-cost

providers are the ones that have the economics to pay the adviser to

support that effort.”

In

case you haven’t already heard, paying all those fees can seriously

affect your nest egg: Paying just 1 percentage point more annually

could reduce savings by nearly 30 percent over an individual’s working

career, according to Labor Department calculations.

Imagine an employee who saved $25,000 in a 401(k); she doesn’t make

any new contributions and earns 7 percent over the next 35 years. If

she paid 0.5 percent in total fees, the account would grow to

$227,000. But paying fees totaling 1.5 percent would leave her with

$163,000 — that’s 28 percent less.

For

the tiniest companies, Betterment will charge .60 percent of plan

assets, plus the cost of the actual investments, which tend to be

another .1 percent, on average. There is also a $1,500 setup fee for

new plans. The fees decline as the company’s assets grow.

Those

expenses are all inclusive, wrapping in the customized, automatically

managed portfolio and all of the administrative work that a 401(k)

plan demands, a task that is often handled by a third-party

administrator or record-keeping firm. (Vanguard, for instance, works

with Ascensus.)

But

Mr. Stein said Betterment built its own system from scratch, which

means the managed investment accounts can talk directly to its

record-keeping arm. That, he says, has enabled the company to simplify

many administrative tasks and regulatory compliance, making life

easier for employers sponsoring the plans.

His

team learned a lot when they were shopping around for their own

401(k), back in early 2014 when they had about 50 employees. “We found

this process to be super difficult for us, and we are pretty

sophisticated,” said Mr. Stein, who ultimately chose Vanguard. Though

Vanguard charges a flat fee per participant, he said it cost them the

equivalent of 0.82 percent of total assets.

Even

though the Department of Labor, which oversees retirement plans, now

requires plan providers to itemize their costs of services —

separating investment costs from administrative ones — comparing plan

prices can still be mind-boggling, particularly for a time-constrained

entrepreneur.

The

Labor Department is now trying to take its oversight a step further,

and has

proposed a rule that would

require more brokers to act in the best interest of their small

business customers when selling retirement plans and suggesting

investments, a rule that is now easily bypassed. (Brokers must meet a

five-part test before they are deemed a fiduciary, which means they

must put their customers interest before their own.) Depending on how

the

final rule is written, it could

force even more transparency.

The

financial services industry has argued that such a rule would make it

too costly to work with smaller investors and plans, but there are

plenty of providers, including Betterment, lining up to take their

place, at least in the 401(k) space.

Kevin

Busque, a co-founder of TaskRabbit, the online marketplace that

connects individuals with people willing to complete small jobs, is

gearing up to introduce a 401(k)

plan to small employers through his new start-up,

Guideline.

Another company,

Dream Forward Financial, goes

beyond lowering costs and providing a modernized interface. Its 401(k)

service will attempt to address the reasons people don’t save for

retirement, like buying a home or sending a child to college.

ForUsAll and

America’s Best 401(k) are two

other newer players, while

Employee Fiduciary, Capital One’s

ShareBuilder 401(k) and

Ubiquity (formerly the Online

401(k)) have each offered lower-cost plans for at least a decade.

“They

are using low-cost funds and exchange-traded funds, so it is a lot

cleaner and cheaper for everyone,” said

William Trout, a senior analyst

at Celent who tracks technology-focused financial firms.

Given

the rising number of options, there hasn’t been a better time for

workers in small businesses to make a case to their employer for a new

or improved 401(k) plan.

“This

is something of a national scandal,” Mr. Trout said. “We lionize small

business in this country. But the fact of the matter is that part of

working for a small business means paying a lot more — and in many

cases, twice as much more — for their 401(k) plans than big corporate

employees.”

Make the

most of your money. Every Monday get articles about retirement, saving

for college, investing, new online financial services and much more.

A version

of this article appears in print on September 12, 2015, on page B1 of

the New York edition with the headline: More 401(k) Options for Small

Business.

© 2015 The

New York Times Company |