NextCapital takes on competing retirement robos with

401(k) account aggregation

With such automated functionality, advisers can pull data from various

sources to create a comprehensive financial plan

Sep 22, 2015 @ 12:01 pm

By

Alessandra Malito

(nextcapital.com)

|

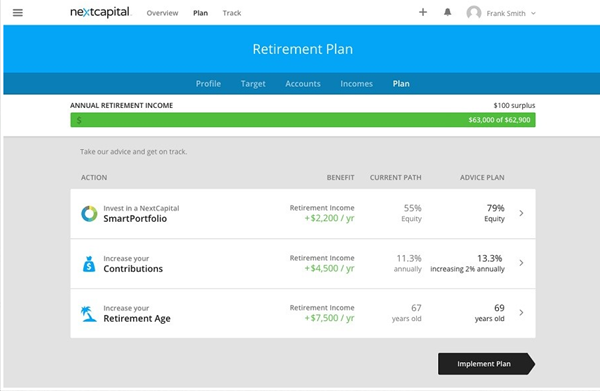

NextCapital, a robo-adviser that focuses on retirement, is implementing

automated 401(k) account aggregation, touting it will help advisers to peer into

a client's retirement assets to get a fuller financial picture.

Through its 401(k) Digital Advice Platform, advisers will be able to create a

retirement savings plan and portfolio construction recommendations, while taking

into consideration what clients already have in their defined-contribution

accounts.

The goal is for advisers to center an entire financial plan around the

work-sponsored retirement plan.

"It's really about aggregating everything else into the 401(k)," said Rob

Foregger, co-founder of NextCapital. "The 401(k) is the primary place for

Americans to save for and manage retirement."

The company will be pulling the data from technology created in-house, as

opposed to some other robo-advisers who partner with data-aggregation and

analytics services such as Quovo and Yodlee.

Other platforms that offer account aggregation include retirement robo-adviser

Financial Engines and Morningstar.

Mr. Foregger said that it is more crucial now than ever before to do something

like this, especially with the Labor Department and White House

pushing for a fiduciary standard for retirement

plans, which would mandate that all financial professionals

advise clients with their best interests top-of-mind.

"There is a push from consumer-protection groups, so scalable personal advice

will become more mainstream," he said.

It has the potential to do so for advisers' practices as well.

Kristi Sullivan, adviser and owner of Sullivan Financial Planning, said that

automated account aggregation for 401(k)s would facilitate more detailed,

tailored conversations with clients about their retirement accounts. It would

help advisers to alleviate any issues that clients may not even know they have.

Ms. Sullivan said what she sees most often is clients who are invested in

multiple target date funds. She then spends the time to explain what these funds

are and how they're meant to be used.

As defined-benefit plans go the way of the dodo bird and more people are anxious

about relying on Social Security,

401(k)s have become an integral

part of the conversation between advisers and clients.

"For a lot of people, a 401(k) is the biggest account [they have] and certainly

the one that grows the fastest," Ms. Sullivan said. "If invested poorly or

inefficiently, it's definitely a conversation advisers should have with their

clients."

Account aggregation will help

advisers to make such communication even more relevant and customized, said

Yoav Zurel, the chief executive

of FeeX, a technology provider that looks to reduce retirement plan fees.

"Because we have more access to data, we get more transparency," Mr. Zurel said,

noting that advisers and investors should look closely at the exact fees that

these 401(k) plans — and the funds on their investment menus — charge.

"If I am advising on household portfolios, I should take the 401(k) assets into

account as a significant part of an entire diversification strategy," Mr. Zurel

said. "I can provide value on the entire wallet of a user."

More insight: Quovo CEO Lowell Putnam on the hottest trends in data aggregation: