|

THE

WALL STREET JOURNAL.

Markets

Are You Ready to Buy Stocks at Your Grocery Store?

Kmart, Office Depot, Safeway and other retailers roll out gift

cards that give recipients shares in top companies

|

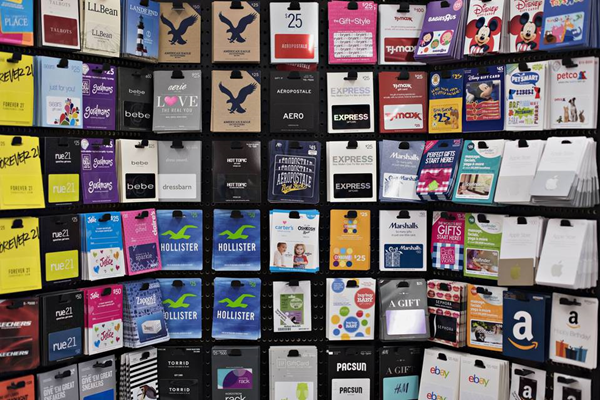

Gift cards for sale at a Kroger Co. store in Peoria, Ill., on

June 16. The gift-card business has boomed in recent years, and

shoppers can now use them to purchase stock. PHOTO: DANIEL

ACKER/BLOOMBERG NEWS |

By

Robin Sidel

Updated Oct. 13, 2015 7:40

p.m. ET

Now selling at the checkout counter: breath mints, hand sanitizer

and…$25 of

Berkshire Hathaway

stock?

In a new twist on the bustling gift-card business, retailers such as

Kmart and

Office Depot this week are

starting to roll out cards that give the recipients small amounts of

stock in some of the country’s best-known companies. The cards will be

available ahead of the holiday shopping season at other retailers,

including Safeway Inc., Toys “R” Us and

Lowe’s

Cos.

The idea that shoppers might want to pick up some Apple Inc. along

with their apples is the brainchild of Stockpile Inc., a Palo Alto,

Calif.-based startup. Avi Lele, a former patent attorney and founder

of the company, said he came up with the idea when he wanted to give a

Christmas gift of stock to his nieces and nephews, and found the need

to first gather personal information such as their Social Security

numbers too burdensome.

“It is taking something complicated and expensive and making it

accessible to everyone,” said Mr. Lele, who also is Stockpile’s chief

executive officer.

The cards work like traditional gift cards but recipients receive

stock instead of merchandise when they cash them in. If they want,

customers can swap the shares they have received for other stock.

Stockpile is licensed as a broker-dealer, and the Securities and

Exchange Commission and other regulators have blessed the cards’

rollout. Americans could be harder to win over.

Only 13.8% of American families own stock directly, down from nearly

18% before the financial crisis, according to a study released by the

Federal Reserve last year. Most Americans prefer to invest through

mutual funds and retirement accounts.

Gift cards are a different story. That product has exploded, with

$93.9 billion loaded on to retail gift cards last year, nearly double

the $51.8 billion in 2005, according to Mercator Advisory Group, a

consulting firm that specializes in the payments industry.

Gift cards are already one of the top-selling products at Giant Eagle

supermarkets, which will start stocking the Stockpile cards next

month, said Tina Flowers, vice president for specialty merchandising

and in-store banking at the regional chain.

“We believe it creates a whole new category for us in gift cards,” she

said. The supermarket chain plans to install a separate rack of the

cards at the front of the store and is training employees to answer

questions about them.

The Stockpile cards cost $4.95 for a $25 card and will be sold in

carousels, kiosks and racks alongside the dozens of traditional gift

cards distributed by Blackhawk Network Inc., which has more than

180,000 retail locations. The cards say “stock” across the top with

the logo of the company so that shoppers won’t confuse a gift card for

Nike Inc.

shares with a card for Nike shoes.

The first group of Stockpile cards to hit the racks will offer shares

of 20 companies, including

Coca-Cola Co.,

Facebook Inc.,

Apple Inc. and Berkshire Hathaway Inc., as well as

products that follow the S&P 500 index and precious metals such as

gold and silver. Buyers can also choose a more general card that gives

the recipient a choice of stock.

The cards will be available in denominations of $25, $50 and $100,

meaning the purchase will often be a fractional share of the stock. A

$25 purchase of Berkshire Hathaway’s “B” shares, for example, would be

less than 20% of one share at Monday’s closing price of $133.40.

Consumers already can buy fractional shares when they place orders

with brokers or reinvest dividend payouts.

The gift-card recipient activates the card by registering it on the

Stockpile website. There is no activation fee or monthly fee, but

aspiring hedge-fund managers beware: any buy or sell transaction costs

99 cents.

Shirley Motyka regularly buys gift cards for

Barnes & Noble Inc.,

and thinks the idea of buying stock the same way is a

good one.

“I have always wanted to get into the stock market business, but I

honestly don’t have the time to explore what’s going on in the market

trends of the day,” said the 37-year-old biology teacher, who lives in

New Milford, Pa.

Her pick of Stockpile’s new offerings:

Tesla Motors Inc.,

which she calls a “pretty cool” company in which to own

shares.

Stockpile’s investors include venture-capital firm Mayfield Fund,

which put up $9 million in the latest $15 million fundraising round,

Sequoia Capital and actor Ashton Kutcher, who has backed companies

like Skype and social network Foursquare.

Quincy Krosby, a market strategist at Prudential Financial, likened

the gift card to the old-fashioned savings bonds that generations of

children received as gifts. Those bonds have gone out of fashion in

recent years.

While it is too early to tell if Mr. Lele’s product will change the

investing landscape, he hopes Stockpile will become a new consumer

staple. “Your grocery list,” he said, “will be bread, milk, eggs,

Apple stock and gold.”

Write to

Robin Sidel at

robin.sidel@wsj.com

|