|

Forum Report:

Requested new program and

workshop for “metrics”

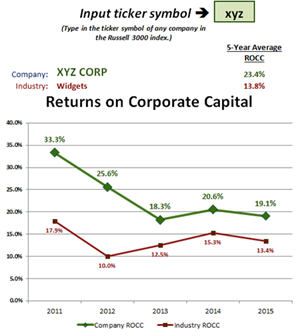

Defining a

Simple Measure of “Returns on Corporate Capital”

Your views

will be appreciated to guide the final development of a standard “Returns

on Corporate Capital” (“ROCC”) measurement. Initiated a month ago as a

subordinate task in our workshop project to define metrics for analyzing

stock buybacks,[1]

the effort to make it simple proved to be surprisingly complicated.

What we

propose is a calculation based purely on GAAP-defined numbers, as reported

by companies in their SEC filings:

net

income plus interest expense and income taxes,

divided

by

the prior

year’s ending balance of total assets

less

current liabilities other than short-term debt

|

To use the workshop test graph online,

click

here.

|

The use

of standardized, GAAP-defined terms is important to allow collection

of consistent data from all SEC-registered U.S. companies, so that they

can be meaningfully compared over time and with each other, and with

industry or other groupings of companies. This also allows anyone to

obtain the same source data from publicly accessible SEC records, as well

as from research services, so that they can independently perform or

confirm a ROCC analysis.

This ROCC

definition is of course similar to many definitions of “ROIC” (return on

invested capital), but avoids both the confusion and debates resulting

from all the GAAP and non-GAAP variations of ROIC calculations among

research services, analysts and companies that present their own “right”

way.[2]

Please use

the test version of a ROCC graphing tool, illustrated here and now

embedded on a

website

established for our “metrics” workshop,

to review the measurement and consider its applications to whatever

analyses you may want to perform. The currently posted online tool is of

course designed only for workshop development use, as you’ll see from its

slow responses and limited universe of companies. We will be trying to

establish specifications for a final public version during the next couple

of weeks, so will welcome any advice you can offer to guide our refinement

of the graphing tool as well as the ROCC analysis.[3]

These are

some of the questions we are currently considering:

1.

Should

the calculation of ROCC be further refined?

2.

Should

the universe of companies include all SEC-registered U.S. companies, or

only a subset such as the Russell 3000 or S&P 1500?

3.

Should

calculations of industry comparisons exclude the subject company, as

currently specified, or include the subject company in the total?

4.

Should

industry classifications be based on the Global Industry Classification

Standard (GICS) codes assigned by the Standard & Poor’s staff, which are

used by many financial professionals, or on the Standard Industrial

Classification (SIC) codes identified by companies themselves in their SEC

filings, which are more broadly established?

It will also

be very helpful to know how you would like to be able to use ROCC

analyses. For example, while our interest in it was stimulated by the need

for rational evaluations of stock buyback proposals, some of our workshop

participants are primarily interested in applying ROCC analyses to

executive compensation policies. We want the analysis, and the tools for

its use, to be readily applicable to any kind of corporate performance

analysis.

Our

objective is to focus on a practical measure of profits generated from

using corporate capital in the competitive production of goods and

services. That, as the Forum has emphasized, is the only real foundation

of corporate value, and of economic prosperity.

GL – June

16, 2016

Gary Lutin

Chairman,

The Shareholder Forum

575 Madison

Avenue, New York, New York 10022

Tel:

212-605-0335

Email:

gl@shareholderforum.com

|