Short Ideas | Tech

HC2 Holdings, Inc.: Asset Rich But Cash Poor

Sep. 22, 2020 5:55 PM ET | About: HC2

Holdings, Inc. (HCHC)

Summary

-

HC2

Holdings 11.5% First Lien Notes is going current end of 2020 and

will likely need to tap high yield market to refinance the bond.

-

While HCHC made progress reducing the amounts on the 11.5% notes,

there is still a sizable ~$342.4 million outstanding, plus $55

million of convertible bonds outstanding.

-

Most

of HCHC's subsidiaries are not generating meaningful cash flow, and

the couple that are cash flow positive don't have enough debt

capacity to absorb the holdco debt.

-

The

proceeds of the recently announced rights issuance are to fund

general corporate expenses, which won't be used to delever the

balance sheet.

-

I

think HCHC will have a tough time refinancing the remaining balance

of the 11.5% notes.

Situation Overview

HC2

Holdings (HCHC)

is an investment holding company previously managed by Philip

Falcone who has since left

the company after a proxy

fight. HC2 holds a diverse array of operating subsidiaries

including DBM

Global, ANG, Continental

LTC Insurance, and HC2

Broadcasting. HC2 also has a portfolio of early-stage life

science investments.

HC2

has been on a journey to delever its balance sheet ever since it ran

into trouble refinancing the previous version of the 11.5% notes where

Mr. Falcone confidently said that he could refinance the debt the next

day in the 7.5%

to 7.75% range, but ended up refinancing the bond at 11.5%

with an additional $55 million 7.5% convertible that drove down the

price of the stock.

To

HC2's credit, it sold Global

Marine, one of its three main cash flow positive operating

subsidiaries, for a total $390 million total value. The net proceeds

to HC2 were ~$175 million after adjusting for subsidiary debt and

pension obligations, as well as the 73% ownership interest. However,

the net proceeds were only sufficient to redeem ~$128 million face

value of the 11.5% notes as the redemption price was set at 104.5% of

the face value under the indenture.

Ever

since the end of the proxy fight, the focus of the board has been on

the refinancing of the 11.5% notes with (hopefully) a lower cost of

capital. The board has essentially put every operating subsidiary

under strategic review. Most recently, HC2 has announced a $65 million

rights offering with the Chairman of the board agree to backstop

$35 million. Two other top shareholders (Michael Gorzynski,

the investor who launched the proxy fight, and Jefferies Group) have

informed the company that they intend to purchase at least their pro

rata portion of the rights offering. HC2 expects to use the proceeds

from the rights offering for general corporate purposes. Obviously,

one of these purposes is to pay the coupon on the 11.5% notes and the

7.5% convert, together cost HC2 $43.5 million a year in interest

payment.

Leaning on DBM Global

In the

absence of a large equity check that delevers the balance sheet, which

is massively dilutive to the existing shareholders, HC2 can only rely

on its remaining two cash flow positive subsidiaries: DBM Global and

Continental LTC Insurance. One strategy would be an outright sale, and

the other one would be a dividend recapitalization of the operating

subsidiary and simultaneously upstream the cash to pay down

corporate-level debt.

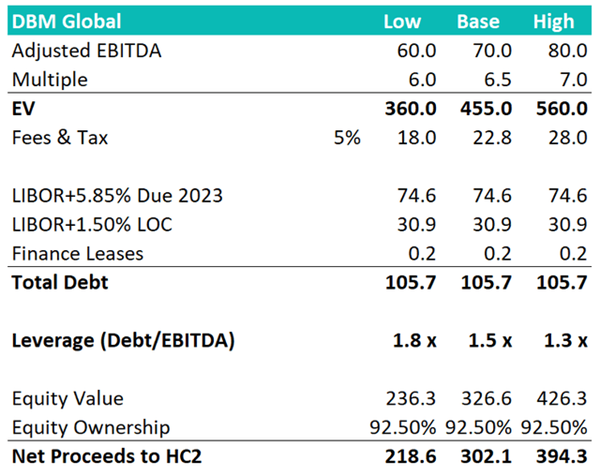

Depending on the M&A cycle, I believe DBM Global can be sold for a

total enterprise value of $360 million to $560 million, and net

proceeds to HC2 from ~$220 to $395 million. Some clients of DBM Global

are delaying maintenance capex in 2020 but using 2019 as a "COVID-free"

guidepost, DBM Global can generate $70-$80 million adjusted EBITDA,

and 6.0-7.0x is a reasonable range for a construction business.

Source: Management Guidance, Author's Estimates |

The

main issue with selling DBM Global outright is that the net proceeds

must be sufficient to turn HC2 into a debt-free business (at the

corporate level) because ex-DBM Global HC2 doesn't have much (if any)

debt capacity at the corporate level. This means that HC2 must achieve

the best-case scenario, or it's not worth pursuing this strategy - a

tall order in this environment.

As for

the dividend recapitalization of DBM Global, I agree that DBM Global

has remaining debt capacity but I'm not sure if it's going to be

enough. As shown above, DBM Global is already 1.5x levered. For a

business that's driven by backlog and the revenue can be quite

volatile on a QoQ basis, I think DBM Global can add 1.0x additional

debt at most. That's $60-80 million upstreamed cash vs. close to $400

million of corporate debt ($342.4 million 11.5% notes and $55 million

7.5% convert).

Selling Continental LTC Insurance

HC2

was in exclusive talks with a buyer of the Continental LTC Insurance

but after the proxy fight, the board decided to head for a different

direction by letting the exclusivity period lapse. HC2 hasn't provided

any details on the rationale but I suspect that the bid wasn't high

enough is at least a part of it.

It's

always difficult to value a life insurance business. HC2 paid

$15 million for the first major block of this business in

2015. The second block was purchased from Humana where Humana

contributed $195 million, essentially to transfer the long-term care

liability to HC2's insurance subsidiary.

HC2

has been upstreaming cash flow from Continental via management fee.

Effectively, HC2 is acting as the asset manager of Continental's AUMs,

and Continental pays a quarterly management fee to HC2. Initially, HC2

was targeting $15

million annual management fee, and the potential to

dividend out excess capital. However, on the Q4-2019

earnings call, HC2 indicated that "both the management fee

and dividend possibilities would not meet" their long-term

expectations and objectives going forward. In fact, in FY2019 HC2 only

received $11.5 million management fee and $9.5 million was on a LTM

basis as of Q2-2020.

Continental doesn't deserve a high multiple of its management fee

because the big insurance companies have been a net

seller of long-term care insurance businesses. Moreover,

the insurance book is essentially in run-off mode, so it can't

generate organic growth. As long-term interest rate is going to stay

lower for longer, the risk of assets running out before the

liabilities has also decreased (although HC2 has repeatedly said that

their regulatory-based capital position is strong). Let's assume that

an $8 million base management fee can be achieved, and assume an 8.0x

multiple. At most, this hypothetical divestiture brings in $64 million

before taxes and transaction fees. It simply doesn't move the needle

for the deleveraging target.

Selling HC2 Broadcasting

Selling HC2 Broadcasting is almost a non-starter. To my knowledge, HC2

is the only low-power TV station consolidator, so the number of

potential bidders is limited. Also, it seems like asset sale proceeds

must be applied to subsidiary debt first reading from the press

release. This means HC2 won't receive a dime until the

$81.2 million subsidiary notes are paid off first. Finally, it sounds

like even the refreshed board wants to grow this business instead of

divesting it. Either the prospect is just too attractive to let it

pass, or there are limited buyers so HC2 is forced to grow this

business.

One-Two-Three-Punch Approach

Perhaps a multi-step maneuver is needed here. HC2 could (1) sell

Continental for $64 million, (2) dividend recap DBM Global to upstream

~$70 million cash, (3) negotiate with the 7.5% convert holders to

extend the maturity, and finally (4) tap the high yield market for a

more manageable $200 million issuance.

Shareholders of HC2 should realize that any of the steps above is

negative for the equity value of HC2, to different degrees. Selling a

major cash flow contributor, unless the price paid is very dear,

lowers HC2's financial flexibility. Dividend recap DBM is going to

reduce its ability to upstream dividends in the future to service any

debt remaining and paying for the holdco SG&A expenses. Extending

maturity of the 7.5% convert will inevitably come with lowering the

conversion price, that's followed by a wave of short selling by the

convert holders to hedge their delta. Most importantly, even if steps

1 to 3 are achieved, I'm not sure if the $200 million deal will come

at a significantly reduced coupon as HC2 still relies on subsidiary to

upstream dividend to service the holdco bonds.

Conclusion

HC2

has assembled a portfolio of businesses over the years but

unfortunately, there's a major mismatch between characteristics of the

assets and the funding sources (i.e. holdco-level debt). Although the

refreshed board is focused on changing this, I believe the HC2 will

once again run into difficulties refinancing the 11.5% notes - unless

the anchor equity holders are willing to write a much bigger check

than the recently announced $65 million rights offering.

** ** **

Disclosure: I/we

have no positions in any stocks mentioned, and no plans to initiate

any positions within the next 72 hours. I wrote this article myself,

and it expresses my own opinions. I am not receiving compensation for

it (other than from Seeking Alpha). I have no business relationship

with any company whose stock is mentioned in this article.

© 2020 Seeking Alpha |