Tibco Software

Agrees to Sell Itself to a Private Equity Firm for $4.3 Billion

By

David Gelles

September

29, 2014 7:39 am

|

A Robert F. Smith, the founder and

chief executive of Vista Equity Partners. The firm is buying

Tibco Software for $4.3 billion.

Credit Chester Higgins Jr./The New York Times. |

Tibco

Software, an enterprise software company based in Silicon Valley, has

agreed to sell itself to Vista Equity Partners for $4.3 billion in the

largest buyout in the technology industry this year.

The

sale comes after a difficult year for Tibco, which has faced declining

profits and pressure from an activist investor to sell.

In the

most recent quarter, Tibco said profit fell to $1.5 million from more

than $8.8 million in the period a year earlier. Tibco’s stock has

fallen 23 percent in the last year

“As a

private company, Tibco will have added flexibility to serve our

customers and execute on our long-term strategy,” Vivek Ranadivé, the

chief executive of Tibco, said in a statement. “We are excited to work

with our new partners at Vista and enter our next chapter of growth

and industry leadership.”

|

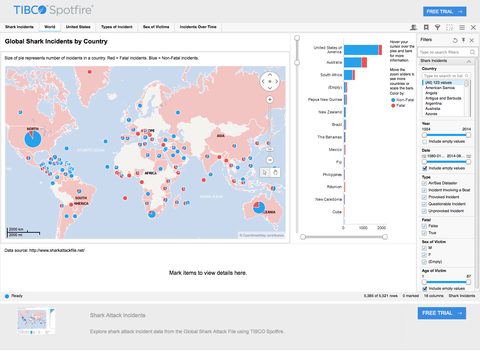

An example of Tibco Software used

to track global shark attacks.

Credit Tibco Software. |

Nonetheless, Vista Equity Partners, an

unusual private equity firm led

by Robert F. Smith, its founder, deemed that the company was worth the

price.

Vista

will pay $24 a share, 23 percent above Tibco’s closing price of $19.51

on Friday. Vista beat out a number of bidders, including strategic

buyers and other buyout firms that were interested in Tibco.

Vista

specializes in buying and turning around enterprise software

companies. The firm has more than $13 billion in assets under

management, and has generated some of the best returns of any private

equity firm in recent years, despite its relative obscurity.

“We

look forward to working with the talented management team and

employees to accelerate Tibco’s growth and strengthen its leadership

as a complete fast data platform,” Mr. Smith said. “We worked hard to

make this deal happen because we understand the tremendous value that

Tiibco can bring to its customers and the marketplace as a private

company. We are incredibly excited to help Tibco reach its full

potential.”

The

deal will still have to be approved by Tibco shareholders. Its stock

was trading above $30 a share as recently as 2012.

Goldman Sachs advised Tibco, and Wilson Sonsini Goodrich & Rosati

provided legal advice. Bank of America Merrill Lynch, Deutsche Bank,

Jefferies, JPMorgan Chase and Union Square Advisors advised Vista, and

Kirkland & Ellis provided legal advice.

Correction: September 29, 2014

An earlier version of this article misstated the premium that Vista

Equity Partners would pay with its offer to buy Tibco Software. It is

23 percent above Tibco's closing stock price on Friday, not 26.

Copyright 2014

The New York Times Company |